Stock overview

| Ticker | SUZLON |

| Sector | Renewable Energy (Wind) |

| Market Cap | ₹ 71,700 Cr |

| CMP (Current Market Price) | ₹ 54 |

| 52-Week High/Low | ₹ 86 / 38 |

| P/E Ratio | 61x |

| Beta | 1.1 (Moderate volatility) |

About Suzlon

Founded in 1995, Suzlon Energy is one of India’s largest and oldest wind turbine manufacturers. Over the last few years, the company has undergone a major restructuring and deleveraging exercise that has set the foundation for a sustainable future.

- Core Business: Manufacturing, installing, and maintaining wind turbines.

- Installed Base: Over 19.5 GW capacity across India and international markets.

- Turnkey Solutions: Provides end-to-end services including project development, erection, commissioning, and O&M (operations and maintenance).

- Geographic Presence: Primarily India, with select projects in the US, South Africa, and Europe.

Primary growth factors for Suzlon

1. Policy push for renewable energy

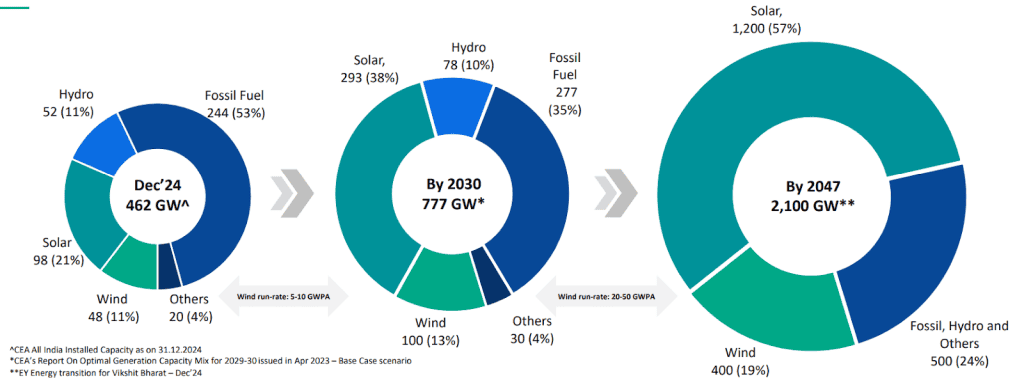

- India aims to add 140 GW of wind capacity by 2030 (currently ~46 GW).

- Government PLI schemes, green corridor investments, and relaxed grid connectivity rules are boosting project viability.

- Below is a breakdown of how India plans to expand its energy transition to wind and solar installations :

2. Revival of the wind sector

- After being overshadowed by solar, wind power is seeing renewed interest due to improved turbine technology, higher PLFs (~35%), and hybrid projects.

- Wind-solar hybrid policies gaining traction in states like Gujarat, Karnataka, and Tamil Nadu.

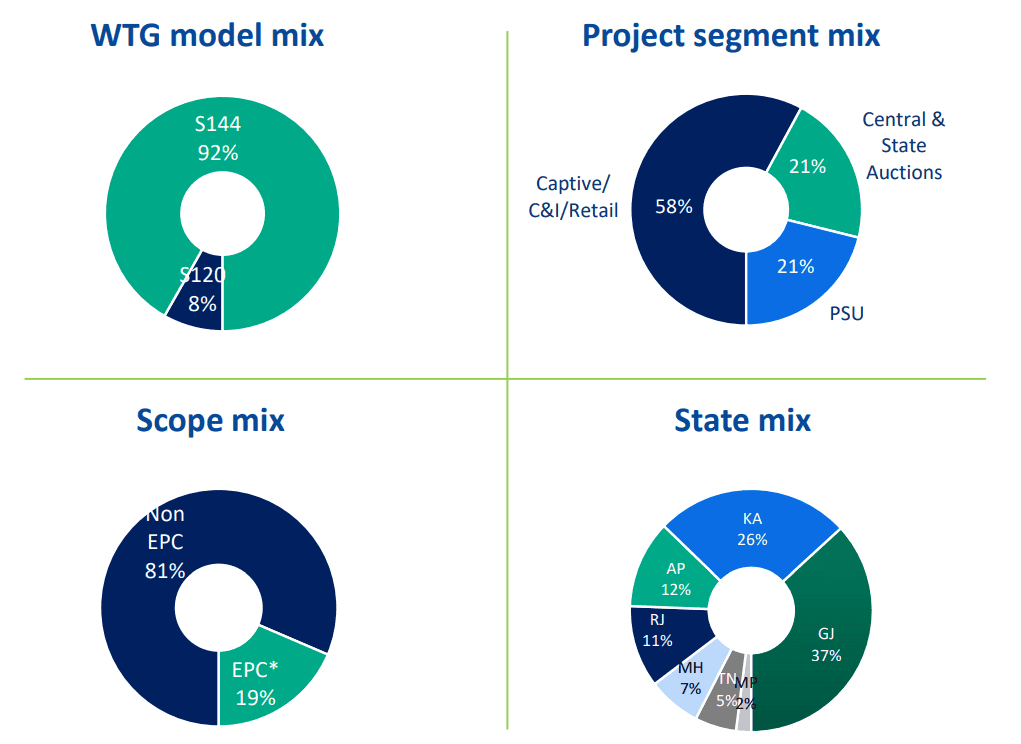

3. Well-diversified portfolio

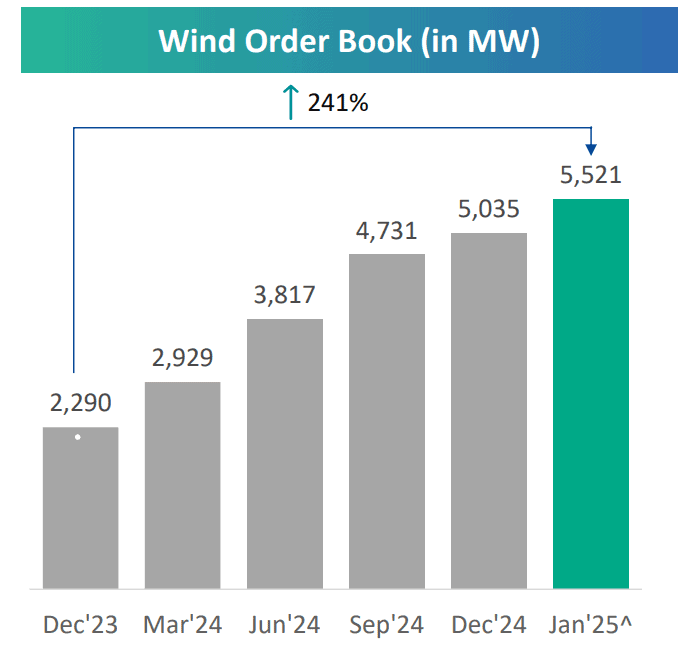

- Suzlon boasts of a healthy order book with a well diversified portfolio across project segments, scope, and revenue mix from states.

- Below is an illustration of the same :

4. Turnaround Execution

- Post-restructuring, Suzlon has improved manufacturing efficiency, optimised manpower, and reduced cost of servicing turbines.

- Strong cash flow generation in FY24, marking a reversal from years of operating losses.

5. Strategic focus on India

- Reduced global exposure and focused on high-growth domestic markets.

- Entered strategic partnerships with PSUs and large IPPs for turnkey wind projects.

6. O&M as a Cash Cow

- O&M business (~₹1,400 crore annually) provides annuity-like cash flows with strong EBITDA margins.

- Over 13 GW under maintenance contracts.

Q3 FY25 Financial Performance

| Metric | Q3 FY 25 | YoY Growth | QoQ Growth |

| Net Volumes (MW) | 447 MW | 163% | 75% |

| Net Revenue | 2,969 cr | 91% | 42% |

| Contribution Margin | 33.6% | -2.8% pt | -1.5% pt |

| PAT | 388 cr | 42% | 43% |

- Suzlon has been able to stage a remarkable turnaround from a business that was once reeling from high debt and negative revenue growth.

- Their growth is reflected in terms of higher-order books, higher volumes and growth in overall profitability.

Detailed competition analysis for Suzlon

| Company | Market Cap | Revenue | P/E Multiple | RoCE |

| Suzlon | 71,700 Cr | ₹ 2.969 cr | 61x | 25% |

| ABB | 1,08,990 cr | ₹ 3,364 cr | 58x | 38% |

| Siemens | 97,100 cr | ₹ 3,587 cr | 42x | 23% |

| CG Power & Ind | 87,512 cr | ₹ 2,515 cr | 93x | 46% |

- Suzlon is trading at a reasonable valuation relative to peers while maintaining higher margins.

- Suzlon leads the wind-only listed pack and has higher execution scale and O&M depth.

Company valuation insights: Suzlon

As per the Discounted Cash Flow analysis:

It estimates the intrinsic value of Suzlon shares based on expected future cash flows:

- Intrinsic Value Estimate: ₹63 per share

- Upside Potential: 20%

- WACC: 10.2%

- Terminal Growth Rate: 5.2%

Suzlon remains attractive due to its business turnaround and a very healthy order book at this stage. However, investors should be cautious before investing in this stock as it could see profit booking from higher levels.

Major risk factors affecting Suzlon

- Project execution delays

- Delay in land acquisition or grid connectivity can lead to revenue slippage.

2. Regulatory uncertainty

- Changes in wind auction policies or tariffs may impact margins.

3. Component price volatility

- Dependence on steel, copper, and rare-earth metals could hurt margins during inflationary cycles.

4. Competition from global giants

- Entry of foreign OEMs (like Siemens Gamesa, Vestas) may intensify price-based competition.

5. Promoter history & Governance concerns

- Legacy concerns around financial mismanagement still linger, although improving with better transparency.

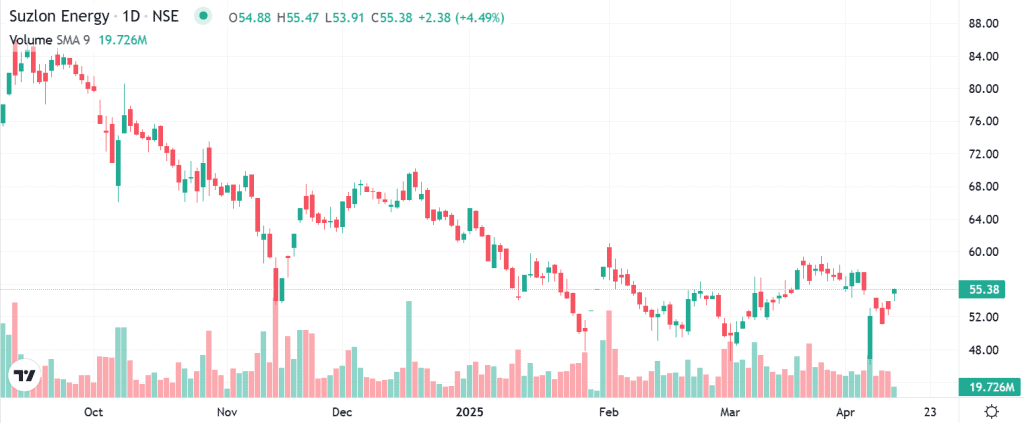

Technical analysis of Suzlon

- Resistance: ₹56

- Support: ₹47

- Momentum: Neutral, Bullish

- RSI (Relative Strength Index): 49 (Neutral)

- 50-Day Moving Average: ₹48

- 200-Day Moving Average: ₹34

The stock has seen a breakout on high volume and is likely to consolidate before the next leg up. Any dip toward ₹48–₹50 zone may offer a buying opportunity.

Suzlon stock recommendation by Ketan Mittal

Recommendation: Buy on dips / Long-term accumulate

Target Price: ₹63 (12-month horizon)

Investment Horizon: 2–4 years for multibagger potential

Rationale

Suzlon is undergoing a transformation from a debt-laden has-been to a lean, growth-ready green energy player. India’s policy shift and execution-focused energy transition significantly favour Suzlon’s core competencies. The company’s improving balance sheet, strong order book, and consistent profitability reinforce the turnaround story.

Given its low base, sectoral tailwinds, and scarcity of pure-play wind stocks, Suzlon offers a compelling risk-reward profile for long-term investorsIf you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

Suzlon Energy is no longer just a story of survival — it is now a story of revival and growth. The shift in India’s energy mix, along with company-specific execution improvements, places Suzlon in a position of strength. While near-term volatility may persist due to macro or regulatory noise, the structural growth potential remains intact.