Stock overview

| Ticker | TATAELXSI |

| Sector | Technology / Engineering R&D Services |

| Market Cap | ₹ 31,490 Cr |

| CMP (Current Market Price) | ₹ 4,762 |

| 52-Week High/Low | ₹ 9,083 / 5,004 |

| P/E Ratio | 39x |

| Beta | 1.1 (Moderate volatility) |

About Tata Elxsi

Tata Elxsi is a global design and technology services company specialising in:

- Automotive Electronics & Software Development

- Media & Broadcasting Solutions

- Healthcare & Medical Device Engineering

- Industrial Design & Visualisation (IDV)

Its strength lies in blending engineering with user-centric design, making it a preferred partner for global OEMs and tech firms.

Primary growth factors for Tata Elxsi

1. EV & ADAS tailwinds in automotive

- Partnering with global OEMs on electric vehicle platforms, software-defined vehicles, and autonomous driving systems.

- 55% of Tata Elxsi’s revenues come from the automotive vertical.

2. Expansion in medical devices & healthcare

- Creating smart, connected medical devices.

- Compliant with global regulatory standards like FDA and EU MDR.

- 12% of Tata Elxsi’s revenues come from the Healthcare and Life Sciences vertical.

3. OTT, Broadcast & 5G enablement

- Helping global content providers and telecoms transition to 5G and streaming-first platforms.

- 32% of Tata Elxsi’s revenues come from the Media and communications vertical.

4. Design thinking edge

- The Industrial Design vertical adds a unique moat, combining UX/UI, industrial product design, and visualisation under one roof.

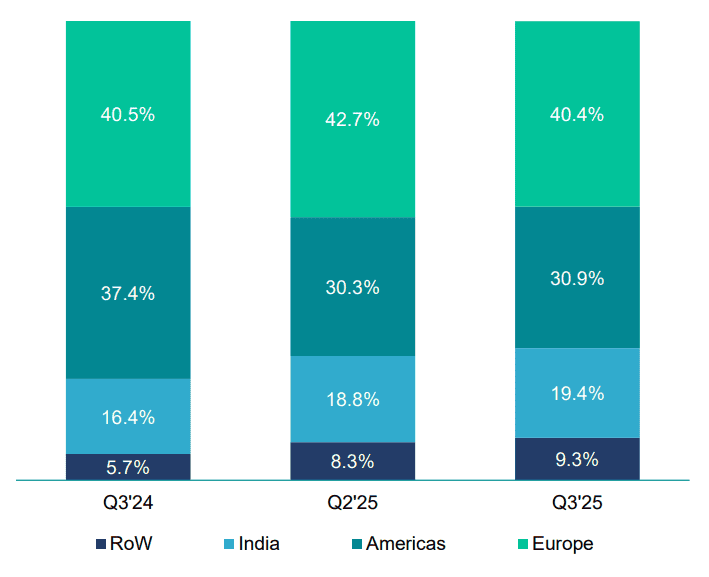

5. Geographical diversification

- 80%+ revenue comes from global clients, especially in Europe, North America, and Japan.

- Below is the geographical split of the revenue that Tata Elxsi makes

Q3 FY25 Financial Performance

- Transportation grew by 0.5% QoQ in CC terms, amidst longer deal closure cycles being witnessed in the automotive industry.

- Media and Communications revenue grew by 0.4% QoQ in CC terms in a quarter that is traditionally soft and impacted by furloughs.

- Healthcare grew by 1.1% QoQ in CC terms with new customer wins and traction from digital and Gen AI powered offerings.

Detailed competition analysis for Tata Elxsi

| Company | Market Cap | Revenue | P/E Multiple | RoCE |

| Tata Elxsi | 31,490 Cr | ₹ 939 cr | 39x | 43% |

| PB Fintech | 69.081 Cr | ₹ 1,291 cr | 332x | 2% |

| OFSS | 65,334 cr | ₹ 1,715 cr | 28x | 40% |

| Hexaware | 39,837 cr | ₹ 3,154 cr | 34x | 29% |

- Tata Elxsi leads in margins and returns, but trades at a premium valuation

- Tata Elxsi needs to deliver strong financial performance in the upcoming quarters to justify the high valuation. This is going to be challenging as the stock price is under pressure and is near its 52-week low.

Company valuation insights: Tata Elxsi

As per the Discounted Cash Flow analysis:

It estimates the intrinsic value of Tata Elxsi shares based on expected future cash flows:

- Intrinsic Value Estimate: ₹5500 per share

- Upside Potential: 15%

- WACC: 9.2%

- Terminal Growth Rate: 4.2%

Despite rich valuations, Tata Elxsi remains attractive due to its consistent execution, high client retention, and digital-first approach..

Major risk factors affecting Tata Elxsi

- Valuation concerns: Trading at over 38x earnings in a rising interest rate scenario may pressure multiples.

- Automotive dependency: Heavy reliance on auto clients could hurt if global auto spending slows.

- Talent attrition & Margin pressure: Intense competition for tech talent could inflate costs.

- Forex volatility: Global revenue exposure makes it sensitive to INR fluctuations.

- Tech disruption: Rapid evolution in AI/ML, design tools, and platforms could disrupt existing service models.

Technical analysis of Tata Elxsi

- Resistance: ₹5250

- Support: ₹4,750

- Momentum: Neutral, Bullish

- RSI (Relative Strength Index): 47 (Neutral)

- 50-Day Moving Average: ₹5300

- 200-Day Moving Average: ₹5600

Tata Elxsi is currently in a corrective phase, but approaching strong support. A bounce may be likely if ₹5,000 holds.

Tata Elxsi stock recommendation by Ketan Mittal

Outlook: Constructive with caution

Investment View: Long-term story intact, but near-term consolidation likely

Target Price: ₹5500 (12-month horizon)

Strategy: Accumulate on dips near support levels (₹4,800–₹5,000)

Rationale

Niche player in the Indian IT space, focusing on embedded product design and digital engineering for high-growth sectors like automotive, healthcare, media, and telecom.

The company's differentiated capabilities in EV software, autonomous driving systems, and OTT platforms have earned it long-term partnerships with global OEMs and tech majors.If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

Tata Elxsi is a solid long-term play for investors looking to ride the digital product engineering and embedded systems wave. While near-term volatility in IT services spending might keep the stock range-bound, the company’s strong fundamentals, domain specialisation, and consistent earnings track record make it a ‘Hold’ or ‘Buy on dips’ candidate.