Stock overview

| Ticker | TRENT |

| Sector | Retail |

| Market Cap | ₹ 1,89,060 Cr |

| CMP (Current Market Price) | ₹ 4,760 |

| 52-Week High/Low | ₹ 8,346/ ₹ 3,801 |

| P/E Ratio | 127x |

| Beta | 1.2 (Moderate to High volatility) |

About Trent

A part of the Tata Group, Trent Ltd. operates some of India’s most successful retail chains, including:

- Westside: A leading apparel and fashion retail chain with 200+ stores.

- Zudio: A fast-growing budget fashion brand targeting young consumers.

- Star Bazaar: Trent’s supermarket chain catering to groceries and essentials.

- Landmark: A books and stationery retail chain.

With its aggressive store expansion strategy, focus on private-label brands, and growing consumer base, Trent is at the forefront of India’s retail revolution.

Trent Ltd. has emerged as a dominant force in India’s retail sector, capitalising on India’s growing middle-class consumption and strong brand positioning. This report provides an exhaustive analysis of the company’s Q3 FY25 performance, growth trajectory, competitive landscape, risks, and technical trends to help investors make informed decisions.

Primary growth factors for Trent

1. Aggressive store expansion

- Opened 50+ new stores in Q3 FY25 across Westside, Zudio and Star Bazaar.

- Plans to reach 1,000+ Zudio stores by FY27, making it India’s largest value fashion chain.

2. Dominance in fashion retail

- Westside & Zudio contribute ~85% of revenues with strong brand loyalty.

- Private-label brands ensure high margins (better than competitors like Reliance Trends).

3. Strong E-Commerce & Omnichannel presence

- Westside Online & Tata Neu integration drive online sales growth of 40% YoY.

- Hybrid strategy combining offline & digital retail boosts Trent’s positioning.

4. Rising consumer spending in India

- India’s retail market is expected to grow at 12-15% CAGR.

- Urbanisation, rising middle class, and preference for branded apparel boost demand.

5. Synergies with Tata Group

- Cross-selling via the Tata Neu super app strengthens customer acquisition.

- Leveraging Tata’s financial strength for aggressive expansion.

Q3 FY25 Financial Performance

| Metric (values in ₹. Cr ) | Q3 FY 25 | YoY Growth | QoQ Growth |

| Revenue | 4,535 cr | 37% | 12% |

| Operational EBIT | 586 cr | 35% | 32% |

| Profit before Tax | 618 cr | 38% | 46% |

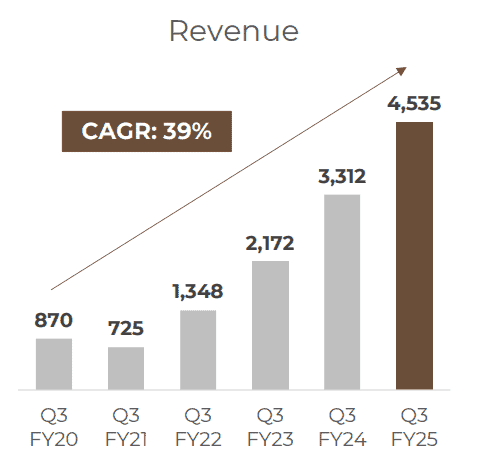

- Trent reported a revenue of ₹4,535 Cr at an impressive 37% growth vs Last Year.

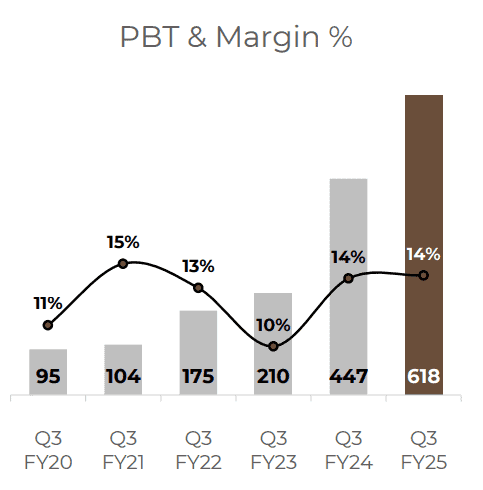

- The business reported a 35% growth in operational EBIT and a 38% growth in PBT vs Q3 FY 24

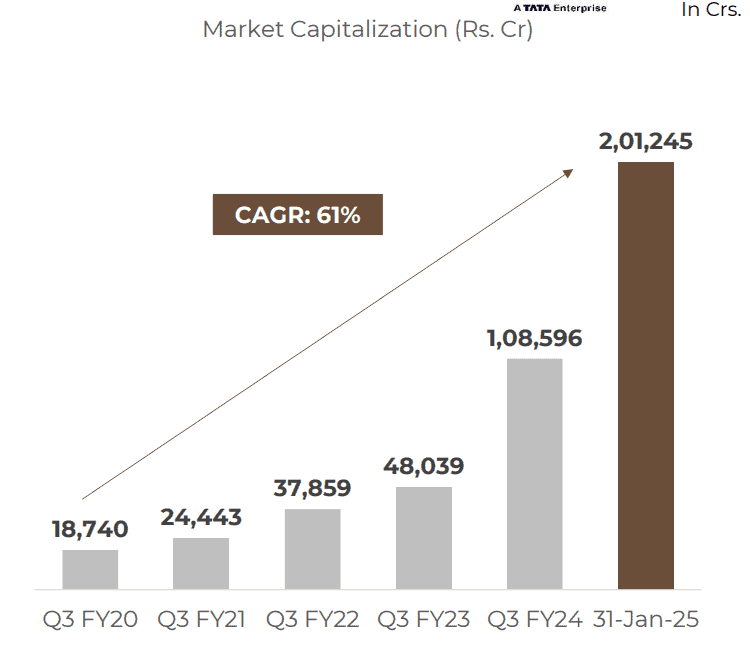

Here are some numbers that truly reflect the growth story of Trent

- 39% CAGR of Revenue over the past 6 years

- Double-digit PBT Margin over the past 6 years

- 61% CAGR in market capitalisation in the last 6 years

Detailed competition analysis for Trent

| Company | Market Cap | Revenue | P/E Multiple | RoCE |

| Trent | 1,89,060 Cr | ₹ 4,535 cr | 127x | 24% |

| Avenue Supermart | 2,56,336 Cr | ₹ 15,972 cr | 94x | 19% |

| Brainbees Solution | 18,227 cr | ₹ 2,172 cr | NA | -4% |

| Red Tape | 8,500 cr | ₹ 664 cr | 50x | 29% |

- While Trent trades at a premium valuation, its higher margins, brand equity, and expansion plans justify investor confidence.

- Investors should note that the company should continue reporting strong growth numbers in order to justify the future valuation.

- Recently, the stock has corrected about 40% from its all time high owing to pressure of delivering growth in line with the high valuation.

Company valuation insights: Trent

As per the Discounted Cash Flow analysis:

It estimates the intrinsic value of Trent shares based on expected future cash flows:

- Intrinsic Value Estimate: ₹5,607 per share

- Upside Potential: 18%

- WACC: 12.1%

- Terminal Growth Rate: 7.6%

Despite the recent stock correction, strong growth catalysts and market dominance make Trent a decent long-term bet..

Major risk factors affecting Trent

1. High valuation risk: Trent trades at 127x P/E, making it vulnerable to corrections if growth slows.

2. Competition from Reliance & Aditya Birla

- Reliance Retail’s aggressive expansion in fashion could challenge Trent’s dominance.

- ABFRL’s strategic partnerships (e.g., Reebok, Tumi) intensify the battle in premium fashion.

3. Economic slowdown impact: Any decline in consumer discretionary spending could affect sales, especially in premium categories.

4. Supply chain disruptions: Fluctuations in raw material prices (cotton, fabric) and import duties impact costs.

Technical analysis of Trent

- Resistance: ₹5200

- Support: ₹4500

- Momentum: Neutral, Bullish

- RSI (Relative Strength Index): 54 (Neutral)

- 50-Day Moving Average: ₹5590

- 200-Day Moving Average: ₹6400

TRENT stock recommendation by Ketan Mittal

Buy / Accumulate on Dips

Target Price: ₹5607 (12 months)

If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0d

Rationale

Strong industry leader with market dominance and brand power

Steady revenue growth across both Zuio and Westside.

Valuation is high, so short-term challenges exist

Technical setup positive, with potential breakout aheadIf you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

Trent Ltd. continues to impress with its robust revenue growth, aggressive store expansion, and strong positioning in India’s booming retail sector. Its focus on private-label margins, omnichannel strategies, and synergies within the Tata ecosystem make it a standout player.

While the stock trades at premium valuations, its growth trajectory justifies the optimism. For long-term investors seeking exposure to India’s consumption story.