TVS Motor Company, a dominant player in the Indian automotive industry, has made significant strides in the two-wheeler and three-wheeler segments. With a strong presence in domestic and international markets, the company’s commitment to innovation, electric mobility, and premium product offerings has cemented its position as a leader. But is TVS Motor a compelling investment choice?

Let’s dive into the company’s fundamentals, growth drivers, and financial insights.

Stock Overview

| Ticker | TVSMOTOR |

| Industry/Sector | Automobile (Two & Three Wheelers) |

| Market Cap (₹ Cr.) | 1,16,387 |

| Free Float (% of Market Cap) | 49.12% |

| 52 W High/Low | 2958.00 / 1873.00 |

| P/E | 58.49 (Vs Industry P/E of 20.66) |

| EPS (TTM) | 41.56 |

About TVS Motor

Founded in 1978, TVS Motor Company is the flagship company of the TVS Group, one of India’s largest diversified industrial conglomerates. With a legacy of excellence in engineering and innovation, TVS Motor has emerged as the third-largest two-wheeler manufacturer in India.

The company has a strong distribution network across 80+ countries and a broad product portfolio spanning motorcycles, scooters, mopeds, and electric vehicles (EVs).

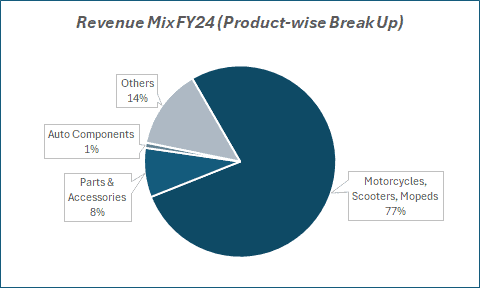

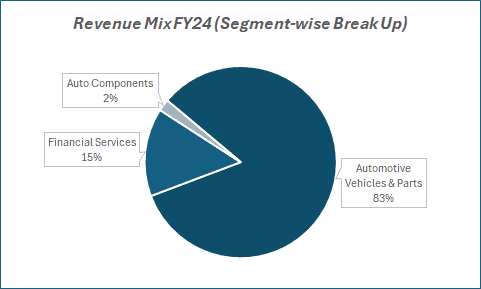

Key business segments

The key business segments of TVS Motor are:

- Two-Wheelers: Contributing over 85% of revenue, TVS offers motorcycles like Apache, scooters like Jupiter, and mopeds under the XL brand.

- Three-Wheelers: Specializing in passenger and cargo carriers for urban mobility.

- Electric Vehicles (EVs): The TVS iQube, a leading electric scooter, has seen robust adoption and increasing penetration in major cities.

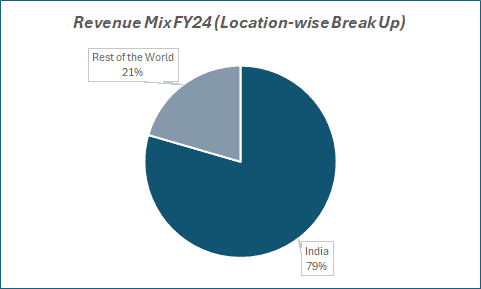

- International Business: Strong presence in African, Asian, and Latin American markets, contributing to the company’s overall volume growth.

- Financial Services: TVS Credit Services supports vehicle financing, driving sales through easy credit accessibility.

Primary growth factors for TVS Motor

TVS Motor’s key growth drivers:

- Electric Mobility Transition: TVS iQube has gained market traction, supported by government incentives and rising EV adoption.

- Premiumisation: Strong brand recall of the Apache series in the premium motorcycle segment, coupled with new product launches.

- Global Expansion: Consistent growth in export volumes and aggressive market penetration strategies in Africa and Latin America.

- Operational Efficiency: Cost optimisation and supply chain resilience driving margin expansion.

- Strategic Partnerships: Collaborations with BMW Motorrad for premium bikes and investments in EV technology ventures.

Detailed competition analysis for TVS Motor

Key Financial Metrics – FY 24;

| Company | Revenue(₹ Cr.) | EBITDA(₹ Cr.) | EBITDA Margin (%) | PAT(₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| TVS Motor | 39144.74 | 5543.41 | 14.16% | 1822.01 | 4.65% | 58.49 |

| Bajaj Auto | 44870.43 | 8761.56 | 19.53% | 7440.65 | 16.58% | 29.55 |

| Eicher Motors | 16535.78 | 4326.91 | 26.17% | 3553.29 | 21.49% | 33.32 |

| Hero MotoCorp | 37788.62 | 5349.63 | 14.16% | 3862.41 | 10.22% | 17.56 |

| Atul Auto | 527.29 | 39.97 | 7.58% | 7.07 | 1.34% | 62.42 |

Key insights on TVS Motor

- Achieved a solid revenue CAGR of 14% over the last 5 years and 26% over the last 3 years, driven by strong product innovation and market expansion.

- Maintains healthy EBITDA margins between 11% and 14%, reflecting efficient operations and cost management.

- Delivered consistent profit growth with an 18.2% CAGR over the past 5 years, supported by robust demand and operational excellence.

- Holds a strong market presence with a 15% market share in the domestic two-wheeler segment, ranking third after Hero MotoCorp and Bajaj Auto.

- Leading the EV transition with its iQube model, achieving 3x YoY growth and establishing TVS as a prominent player in India’s emerging EV market.

Recent financial performance of TVS Motor for Q3 FY25

| Metric | Q3 FY24 | Q2 FY25 | Q3 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 10113.94 | 11301.68 | 11134.63 | -1.48% | 10.09% |

| EBITDA (₹ Cr.) | 1487.97 | 1642.37 | 1664.95 | 1.37% | 11.89% |

| EBITDA Margin (%) | 14.71% | 14.53% | 14.95% | 42 bps | 24 bps |

| PAT (₹. Cr.) | 522.37 | 606.96 | 630.55 | 3.89% | 20.71% |

| PAT Margin (%) | 5.16% | 5.37% | 5.66% | 29 bps | 50 bps |

| Adjusted EPS (₹) | 10.08 | 11.80 | 11.91 | 0.93% | 18.15% |

TVS Motor Financial Update (Q3 FY25)

Financial performance

TVS Motor reported a ~10% YoY growth in overall two-wheeler and three-wheeler sales in Q3 FY25, reaching approximately 12.1 lakh units.

Business highlights

- Motorcycles: Sales grew ~6% YoY to ~5.56 lakh units, supported by strong demand in domestic and export markets.

- Scooters: Witnessed a robust ~22% YoY growth, with sales reaching ~4.93 lakh units, driven by the popularity of premium and electric models.

- Three-Wheelers: Sales declined to ~29,000 units from ~38,000 units in Q3 FY24 due to export market challenges.

- EVs: Continued to strengthen its leadership in the electric segment with a ~57% YoY growth, selling ~76,000 units of its iQube electric scooter.

Updates & Outlook

- Capex: Spent approximately ₹1,300 crore on capacity expansion and product development in the first nine months of FY25.

- Rural Demand: Management highlighted rural demand outpacing urban demand, supporting future growth.

- Q4 Expectations: Anticipates better-than-industry growth, driven by new product launches and market expansion.

- EV Expansion: Plans to introduce additional EV models, further solidifying its market presence.

- PLI Benefits: Management will account for the Production-Linked Incentive (PLI) benefits for the entire year in Q4 FY25 and adopt a quarterly recognition method moving forward.

Company valuation insights – TVS Motor

TVS Motor is trading at a TTM P/E of 58.49, above the industry average of 20.66, reflecting its premium positioning. The stock has gained 16.6% in the past year, outperforming the Nifty 50’s 6.7% return.

Strong domestic demand, supported by rising rural incomes and favorable monsoons, along with expanding global presence through the Norton brand, will drive growth. The company’s EV leadership with iQube further strengthens its market position.

With projected revenue and PAT CAGR of 12% and 18% over FY25E-27E, applying a 35x multiple to its FY26E EPS of ₹68, and factoring in TVS Credit, we estimate a target price of ₹2,740, implying a 13% upside.

Major risk factors affecting TVS Motor

- Competitive pressure: Strong competition from Bajaj Auto, Hero MotoCorp, and new EV players.

- Input cost volatility: Fluctuations in raw material prices like steel and aluminum could impact margins.

- Regulatory changes: Evolving emission norms and EV-related policies may affect business operations.

- Global economic uncertainty: Currency fluctuations and geopolitical risks could impact export revenue.

Technical analysis of TVS Motor share

On the daily chart, TVS Motor is trading above its 50-day and 100-day moving averages and is nearing a breakout above its 200-day moving average, signaling potential upward momentum. The MACD remains positive at 6.03, with the MACD line above the signal line, suggesting a continuation of the current uptrend.

The RSI stands at 57.64, indicating neutral territory, while the relative RSI benchmark for both 21 and 55 days is slightly positive at 0.01 and 0.03, reflecting moderate outperformance against its benchmark. The ADX at 21.61 suggests a moderate to strong trend.

If the stock sustains above the key resistance level of ₹2,550, it could rally towards the target price of ₹2,740. On the downside, strong support is seen around ₹2,200.

- RSI: 57.64 (Neutral)

- ADX: 21.61 (Moderate Trend)

- MACD: 6.03 (Positive)

- Resistance: ₹2,550

- Support: ₹2,200

TVS Motor stock recommendation

Current Stance: Buy with a target price of ₹2,740 (12-month horizon); while competitive pressures in the EV space and subsidy phase-outs pose challenges, long-term growth prospects remain strong.

Why Buy Now?

Market Positioning: TVS Motor’s 15% market share in the domestic two-wheeler segment and growing global presence through the Norton brand reinforce its leadership.

Growth Prospects: Revenue and PAT are projected to grow at 12% and 18% CAGR over FY25E-27E, driven by robust volume growth.

EV Leadership: Strong EV sales momentum with iQube and upcoming product launches further strengthen its competitive edge.

Rural Demand: Favorable monsoons and rising rural incomes are expected to support continued demand growth.

Portfolio Fit:

With a solid market presence, expanding EV portfolio, and consistent financial performance, TVS Motor is a compelling choice for investors seeking exposure to India’s growing automobile sector.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebTVS Motor: Budget 2025-26 opportunities

- Rural Demand: Government support for rural employment and higher agricultural income from favorable MSP hikes can boost demand for two-wheelers.

- EV Adoption: Increased incentives for electric vehicles under FAME and state subsidies will accelerate TVS Motor’s EV growth, especially with the iQube.

- Export Support: Trade agreements and incentives for export-oriented units can benefit TVS’s global expansion, particularly in Latin America and Europe.

- Infrastructure Development: Enhanced road infrastructure and rural connectivity projects will drive higher two-wheeler penetration in underserved regions.

- MSME Financing: Easier financing access for small businesses and individuals can support two-wheeler sales, especially in rural and semi-urban areas.

Final thoughts

With its robust product pipeline, growing EV portfolio, and global market expansion, TVS Motor is well-positioned for sustained growth. For investors seeking exposure to India’s automotive sector, particularly in the two-wheeler and electric mobility space, TVS Motor presents a compelling opportunity. As the company accelerates its electrification journey and strengthens its market presence, it remains a stock to watch for long-term wealth creation.