Imagine a world where every sip of your favourite PepsiCo beverage contributes to the growth of a single company. That’s exactly the case with Varun Beverages Limited (VBL), a dominant force in India’s beverage industry. As the largest bottler for PepsiCo in India and with an expanding presence across multiple geographies, VBL has consistently captured the attention of investors.

But is it a good stock to invest in? Let’s dive deep into its business model, key growth drivers, valuation insights, and potential risks.

Stock Overview

| Ticker | VBL |

| Industry/Sector | FMCG (Consumer Foods) |

| Market Cap (₹ Cr.) | 1,65,576 |

| Free Float (% of Market Cap) | 39.50% |

| 52 W High/Low | 681.12 / 488.50 |

| P/E | 66.90 (Vs Industry P/E of 51.10) |

| EPS (TTM) | 7.67 |

About Varun Beverages Limited

Varun Beverages Limited (VBL) is one of the largest franchisees of PepsiCo globally, engaged in manufacturing, bottling, and distributing carbonated soft drinks (CSDs), non-carbonated beverages (NCBs), and packaged drinking water.

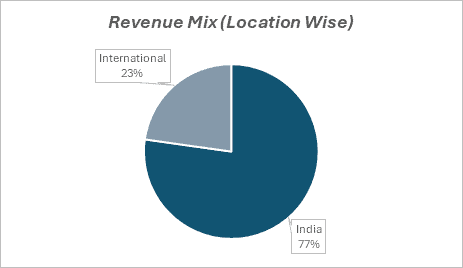

As of Q4CY24, the company operates in 10 countries with franchise rights and an additional four countries with distribution rights. It manages 34 manufacturing units in India, two in Nepal, and one in Sri Lanka, among others. Operations across these regions account for approximately 83% of its net revenues

VBL’s unique business model covers end-to-end execution, including manufacturing, distribution, and customer management. While PepsiCo provides brands, concentrates, and ATL marketing support, VBL handles manufacturing and supply chain operations, driving market share, cost efficiency, and capital optimisation. Its integrated network ensures efficient product delivery.

Key business segments

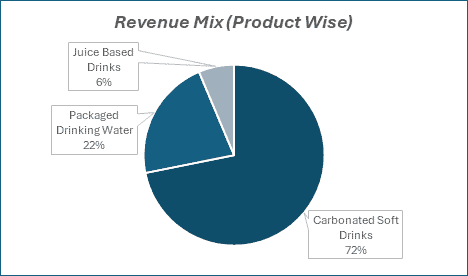

VBL operates across three main beverage categories:

- Carbonated Soft Drinks (CSDs): The largest revenue contributor, including brands like Pepsi, Mountain Dew, Mirinda, and 7UP.

- Non-Carbonated Beverages (NCBs): Growing at a faster pace with brands such as Tropicana, Sting, and Gatorade.

- Packaged Drinking Water: Sold under the Aquafina brand, benefiting from the rising demand for clean drinking water.

The company also benefits from its exclusive long-term franchise agreement with PepsiCo, ensuring stable demand and a strong brand portfolio.

Primary growth factors for VBL

VBL’s impressive growth can be attributed to several factors:

· Expanding distribution network: VBL currently reaches 4 million FMCG outlets out of 12 million, with plans to expand to 8-10 million outlets by adding 10-12% new outlets annually, tapping into India’s vast untapped market.

· Product portfolio expansion: The company is launching new products, including Sting Gold in the energy drink segment, along with value-added dairy, sports drinks (Gatorade), and juice offerings to cater to evolving consumer preferences.

· Strategic acquisitions & market consolidation: The acquisition of BevCo strengthens VBL’s presence in South Africa and the Democratic Republic of the Congo (DRC), while expansion into the snacks segment in Zimbabwe and Zambia further diversifies revenue streams.

· Manufacturing & supply chain expansion: New greenfield and brownfield facilities enhance production capacity, improve market reach, and lower transportation costs, boosting overall operational efficiency.

· Shift towards non-carbonated beverages: With increasing consumer demand for healthier alternatives, VBL is capitalizing on the growth of non-carbonated beverages, particularly in the energy and juice segments.

· International growth: Expanding into new markets reduces reliance on India, creating diversified revenue streams and long-term growth opportunities.

Detailed competition analysis for VBL

Key Financial Metrics – Dec ’24 (Trailing Twelve Months);

| Company | Revenue(₹ Cr.) | EBITDA(₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Varun Beverages | 20481.33 | 4711.07 | 23.00% | 2635.76 | 12.87% | 66.90 |

| Nestle India | 19965.27 | 4715.81 | 23.62% | 3363.26 | 16.85% | 62.43 |

| Marico | 10379.00 | 2123.00 | 20.45% | 1633.00 | 15.73% | 51.28 |

| Jubilant Foodworks | 2150.76 | 402.04 | 18.69% | 49.93 | 2.32% | 117.93 |

| Devyani International | 4785.54 | 797.16 | 16.66% | -38.98 | -0.81% | 945.00 |

Key insights on VBL

· VBL has recorded a 23% revenue CAGR over the last 5 years, with a median sales growth of 24.7% over the last 10 years.

· EBITDA margins have remained 20-23% over the past 3 years, while profit has grown at a 40.9% CAGR over 5 years.

· The company maintains a Debt-to-Equity ratio of 0.75, ensuring financial stability while supporting expansion.

· VBL has a solid 3-year ROE of 27.9%, reflecting efficient capital utilisation and strong profitability.

· Currently reaching 4 million outlets, with plans to expand to 8-10 million, tapping into India’s vast untapped market.

· High-margin Sting energy drink contributes ~10% of sales, alongside growth in dairy, sports drinks (Gatorade), and juices.

· The BevCo acquisition strengthens its international presence, while new manufacturing facilities enhance production capacity and market penetration.

Recent financial performance (Q4 CY24)

| Metric | Q4 CY23 | Q3CY24 | Q4 CY24 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 2730.98 | 4932.06 | 3817.62 | -22.60% | 39.79% |

| EBITDA (₹ Cr.) | 418.29 | 1151.12 | 579.97 | -49.62% | 38.65% |

| EBITDA Margin (%) | 15.32% | 23.34% | 15.19% | -815 bps | -13 bps |

| PAT (₹ Cr.) | 143.55 | 628.92 | 196.33 | -68.78% | 36.77% |

| PAT Margin (%) | 5.26% | 12.75% | 5.14% | -761 bps | -12 bps |

| Adjusted EPS (₹) | 0.41 | 1.91 | 0.55 | -71.20% | 34.15% |

- Strong volume growth: VBL reported a 39.79% YoY increase in revenue for Q4CY24, contributing to 25.5% growth for CY24. This was primarily driven by the expansion of international operations, with South Africa adding 43 million cases and the DRC contributing 7.8 million cases.

- Improved realisation & Market growth: Realization per case increased 1.3% to ₹177.9, supported by a better product mix. India’s organic volume grew 11.4%, while international markets recorded a 6.3% growth in CY24, reinforcing VBL’s strong market position.

- Stable margins & Cost efficiencies: EBITDA margins YoY remained stable at 15.2% in Q4CY24. However, gross margins improved by 290 bps to 55.5%, benefiting from strategic PET chip procurement, sugar reduction initiatives, and increased backward integration efforts.

- Product mix & Regulatory impact: The share of low-sugar and no-sugar products rose to 53% of total sales volume. However, Zimbabwe’s shift to a zero-sugar portfolio impacted growth due to the introduction of a sugar tax.

- Strengthened financial position: VBL successfully raised ₹7,500 crore through a QIP, which was utilized for debt repayment and acquisitions, further strengthening its balance sheet.

- Optimistic outlook: The management remains confident about sustaining double-digit growth, backed by continued demand expansion and strategic business initiatives.

Company valuation insights – VBL

VBL is currently trading at a P/E ratio of 66.90, higher than the industry average of 51.10, reflecting a premium valuation due to its strong growth trajectory. Despite robust fundamentals, the stock has underperformed Nifty 50, delivering a -14% return over the last 12 months, compared to Nifty 50’s 5% gain.

The company is well-positioned to sustain its earnings momentum, driven by:

· Deeper market penetration in newly acquired African territories.

· Steady domestic demand growth, supported by an expanding product portfolio.

· Aggressive distribution expansion, with a targeted 10% annual increase in outlets.

· Growing refrigeration infrastructure, especially in rural and semi-rural areas, supporting higher beverage consumption.

With a projected CAGR of 12% in revenue, 11% in EBITDA, and 17% in PAT over CY24-26, VBL’s long-term growth prospects remain strong. The company continues to enhance its footprint through strategic acquisitions (BevCo in South Africa and DRC), manufacturing capacity expansions, and an increased focus on high-margin categories such as energy drinks (Sting), dairy, and sports beverages (Gatorade).

Applying a 55x CY26E EPS (₹11.9), the target price is set at ₹650, implying a 30% upside potential.

Major risk factors affecting VBL

· Rising competitive pressure & Demand uncertainty: Increasing competition, raw material inflation, and potential demand slowdown could impact growth momentum.

· Regulatory & environmental risks: Changes in government policies on sugar-based drinks, plastic packaging, and taxation (e.g., Zimbabwe’s sugar tax) may pose challenges.

· Forex & Geopolitical risks: Exposure to international markets brings risks from currency fluctuations and political instability in key regions.

· Franchise & cost volatility: Dependence on PepsiCo and fluctuations in PET resin and sugar prices could affect profitability and operational stability.

Technical analysis of VBL share

VBL is trading at its 52-week low, with strong support around ₹470. The formation of a Black Marubozu candle with a -4.8% decline signals short-term bearish sentiment.

The RSI at 29.98 has entered the oversold zone, suggesting a potential reversal if momentum stabilizes. Additionally, the price has crossed below the lower Bollinger Band, and a rebound above it could present a buying opportunity.

Relative strength against the benchmark index has weakened for three consecutive days and currently stands at -0.17, indicating continued underperformance.

The trend remains weak, with immediate resistance at ₹550. A breakout above this level could push the price toward ₹590, and further strength may extend the rally to the target of ₹650. The stock is currently trading below its key moving averages, reinforcing a weak technical setup.

· RSI: 29.98 (Oversold)

· ADX: 30 (Strong Trend)

· Resistance: 550

· Support: 470

VBL stock recommendation

Current Stance: Buy with a target price of ₹650 (12-month horizon), short-term volatility expected.

Why Buy Now?

Despite recent underperformance, Varun Beverages remains a compelling growth story. Its Africa expansion (via BevCo), plus 10% annual retail outlet growth and deeper rural penetration, boost volumes.

Diversification into high-margin offerings like Sting, dairy, and sports drinks strengthens profitability. With CY24–26 revenue, EBITDA, and PAT expected to grow at 12%, 11%, and 17% CAGR respectively, VBL’s strong earnings and operational efficiencies point to solid long-term upside.

Portfolio Fit

VBL is a solid addition for investors seeking exposure to India’s growing FMCG and beverage sector. The company’s continued investments in capacity expansion and product innovation position it well for sustained long-term growth.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebVBL: Budget 2025 opportunities

· Consumer Demand Boost: Increased disposable income through tax cuts or rural employment schemes could drive higher soft drink consumption.

· Manufacturing & Export Incentives: Government support for FMCG exports and local manufacturing could reduce costs and enhance VBL’s global expansion.

· Cold Chain & Infrastructure Development: Investments in logistics, cold storage, and rural electrification could improve distribution efficiency and market penetration.

· GST Rationalization: Possible tax cuts on non-alcoholic beverages could make products more affordable, increasing volume growth.

· Sustainability & Green Initiatives: Incentives for eco-friendly packaging and water conservation could support cost efficiencies and ESG compliance.· MSME & Credit Support: Easier financing for retailers and distributors may strengthen VBL’s supply chain and expand its reach in underserved markets.