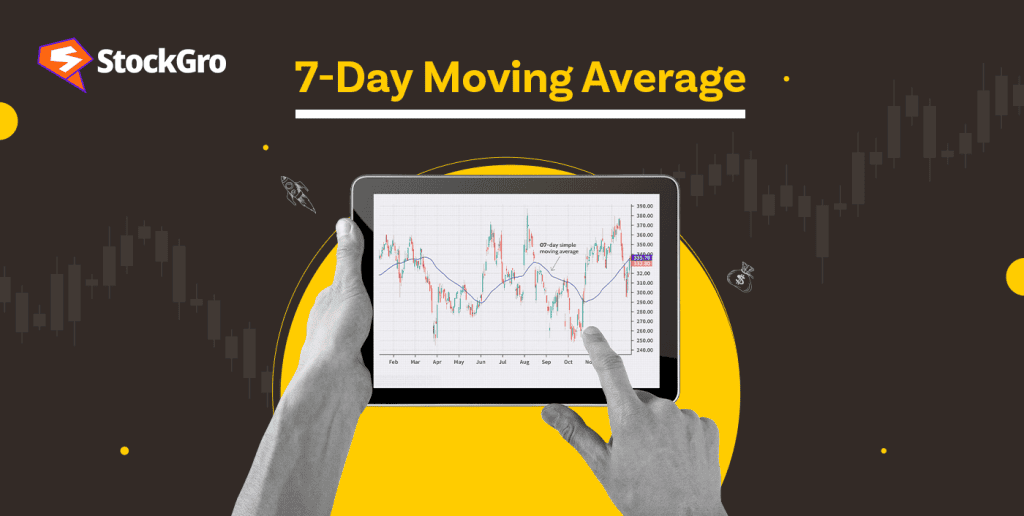

Ever wondered how precisely traders spot temporary stock market trends? The 7-day moving average (7-DMA) is among the most simple and often used instruments in technical analysis. This indicator facilitates the observation of short-term market trends by helping to moderate daily price fluctuations.

Traders trying to identify developing trends or possible reversals over a little period may find the 7-DMA especially helpful. This instrument offers insightful analysis of market behaviour by averaging the closing values of a stock over the past seven days, therefore guiding traders in their decisions.

This article will go over the 7-day moving average coupled with its computation technique and how traders could utilise it to enhance their trading strategies.

Also read: Mastering moving averages: A key indicator for trading success

What is a 7-day moving average?

In trading, a typical technical indicator used to study short-term price patterns is the 7-day moving average. Over the past seven trading days, a stock’s or another financial instrument’s average closing price. Every day this computation is revised, replacing the oldest data point with the newest to provide a “moving” average.

The 7-DMA’s main goal is to flatten daily price swings, therefore facilitating observation of the underlying trend. Prices in markets can be erratic, shifting often. The 7-DMA filters noise by averaging these motions, therefore presenting a sharper image of the direction of the stock.

The 7-DMA is important since it enables traders to spot temporary patterns. If the stock price often stays above its 7-DMA, for instance, it may imply an uptrend; prices below the average could point to a down trend. For active traders concentrated on short-term prospects especially, this makes the 7-DMA a useful tool for making fast buy or sell choices.

How is the 7-Day Moving Average Calculated?

Finding the 7-day moving average (7-DMA) is quite simple and just calls for three steps.

- Gather the closing prices: Over the past seven trading days, compile the stock’s closing prices.

- Add them together: Add these seven closing prices to get the total sum.

- Divide by seven: Divide the total sum by seven to calculate the average. This average represents the 7-DMA for that day.

Example:

| Day | Closing price (₹) |

| Day 1 | 100 |

| Day 2 | 102 |

| Day 3 | 101 |

| Day 4 | 103 |

| Day 5 | 104 |

| Day 6 | 106 |

| Day 7 | 105 |

| Total | 721 |

The 7-day moving average for this data is:

7 day moving average = ₹7217 = ₹103

The oldest data point (Day 1) is eliminated and the average is updated as fresh data, such as the closing price for Day 8, comes in. This guarantees that the moving average strategy responds dynamically to the most recent market trends.

Further reading: A Guide to Simple Moving Averages: Formula and Key Differences with EMA

How the 7-day moving average helps traders

The 7-day moving average is a helpful tool for traders offering information on trends, significant levels, and anticipated market movements. Here’s how it benefits:

Identifying trends

The direction of a stock’s short-term trend is visually guided by the 7-DMA.

- Uptrend: The stock price shows positive momentum when it stays regularly above the 7-DMA.

- Downtrend: Should the price stay below the 7-DMA, it reflects a negative attitude.

- Example: A stock selling at ₹110 with a 7-DMA of ₹105 shows an increasing trend, which motivates traders to seek for purchase prospects.

Support and resistance levels

A dynamic support or resistance level is the 7-DMA most of the time.

- Support: Prices bouncing back after touching the 7-DMA indicate strong buying interest.

- Resistance: Prices struggling to move above the 7-DMA may signal selling pressure.

- Example: A stock hovering near ₹150 but unable to break above its 7-DMA of ₹152 may indicate resistance.

Must read: Understanding support, resistance and trendlines

Entry and exit points

One can use crossovers with the 7-DMA as either entry or exit signals.

- Bullish signal: Often a cue to buy is when the price moves over the 7-DMA.

- Bearish signal: A decline below the 7-DMA would indicate a selling possibility.

- Example: Once a stock moves above its 7-DMA following a period of consolidation, a trader can choose to purchase.

Volatility assessment

- Large deviations from the 7-DMA can highlight increased volatility, potentially indicating reversals or overbought/oversold conditions.

- Example: If a stock trading well above its 7-DMA is overheating, traders should be ready for a pullback.

Advantages and limitations of the 7-day moving average

Advantages

- Simple and easy to calculate: Both novices and experts will find it easily available using the simple formula.

- Quick snapshot of short-term trends: The 7-DMA shows the short-term trend direction of the stock clearly by smoothing out daily price swings.

- Timely decision-making: The 7-DMA allows traders to spot possible locations of entrance and exit, therefore guiding their quick response in turbulent markets.

Limitations

- Prone to false signals in volatile markets: The 7-DMA can produce false buy or sell signals during highly volatile times, which would lead traders to act too early.

- Limited for long-term analysis: The 7-DMA is less useful as a short-term indicator for examining more general market patterns or investment plans spanning months or years.

- Reliance on historical data: The 7-DMA is reactive rather than predictive since it only takes historical prices and cannot explain abrupt market movements, including economic events or breaking news.

Bottomline

To evaluate short-term market patterns and guide their judgements, traders really need the 7-day moving average. Understanding its computation, relevance, and application helps traders to properly spot trends, create entry and exit points, and control risk.

Combining the 7-day moving average with other technical signals improves its accuracy and usefulness.

Accept the ability of the 7-day moving average to improve your trading plans and keep ahead of the market. Discover its possibilities and include it into your trading tool set for best results.

FAQs

What is the 7-day moving average?

In trading, the technical indicator known as the 7-day moving average (7-DMA) examines short-term price trends. It computes a stock’s average closing price over the preceding seven days, therefore flattening daily price swings to expose underlying patterns. To help with fast decision-making, traders utilise the 7-DMA to spot trends, support and resistance levels, and possible entrance and exit locations.

How do you calculate the 7-day average?

Get a stock’s closing prices over the past seven days to get its 7-day moving average. To find the average, add these costs and then divide by seven. This normally shows that day’s 7-DMA. Update the computation by removing the oldest price and adding the most recent closing price as fresh data arrives to guarantee the average captures the most current market trends.

How do you read a daily moving average?

Plotting the average closing prices over a defined period, say, seven days, you may read a daily moving average on a chart. The stock price is said to be in an uptrend if it is above the moving average; if it is below, a downswing. Crossroads, where the price crosses the average either above or below, indicate possible buy or sell chances. This enables traders to spot patterns and base wise selections.

What does 7 day rolling mean?

Calculating a 7-day rolling average updates everyday by averaging data over the preceding seven days. Every day the oldest data point is eliminated and the newest one is added to produce a “rolling” impression. By offering a constant, updated average, this approach exposes patterns and helps to smooth out transient variations. In banking, medicine, and other industries it’s widely used to examine trends and guide decisions.

Which moving day average is best?

Your trading plan and time range will determine the appropriate moving average. While long-term investors would choose the 50-day or 200-day moving averages to examine more general market trends, short-term traders sometimes employ the 7-day or 20-day moving averages for rapid trend identification. While longer averages offer a smoother, more consistent trend line, each has benefits: shorter averages react fast to price movements. Sort depending on your own trading objectives.