Successful traders do not just rely on intuition. They employ a wide array of tools and techniques to make informed decisions. The accumulation distribution indicator (A/D Indicator) is one such tool that is an essential part of a trader’s journey.

In this comprehensive guide, we’ll explore the ins and outs of the A/D Indicator, its advantages and limitations, and how you can use it in your trading strategy.

What is the ADI (Accumulation distribution indicator)?

The accumulation distribution indicator is a cumulative volume-based indicator. It incorporates volume and price to check how much money is flowing in and out from an asset. It primarily assists in gauging the prevailing supply and demand dynamics in the market.

This further helps to understand if there is active buying (accumulating) or selling (distributing) happening in the securities.

Marc Chaikin was the analyst who developed the accumulation distribution line. He has also developed two other indicators known as the Chaikin oscillator and the Chaikin money flow indicator.

You may also like: Mastering the on balance volume (OBV) indicator

Understanding the accumulation distribution indicator

To understand the accumulation distribution indicator, it is essential to comprehend its core principles: the concept of accumulation and distribution.

Accumulation refers to gathering or accumulating a particular asset, typically by strong buyers who believe in its future potential. During an accumulation phase, the price may rise as buying pressure increases.

Distribution is the process of selling or distributing an asset, usually by informed sellers who believe the asset is overvalued or that it has reached a peak. During distribution, the price tends to decline as selling pressure intensifies.

The ADI seeks to visualise and quantify these accumulation and distribution phases by analysing price action and volume data, allowing traders to make informed decisions.

Accumulation Distribution Formula

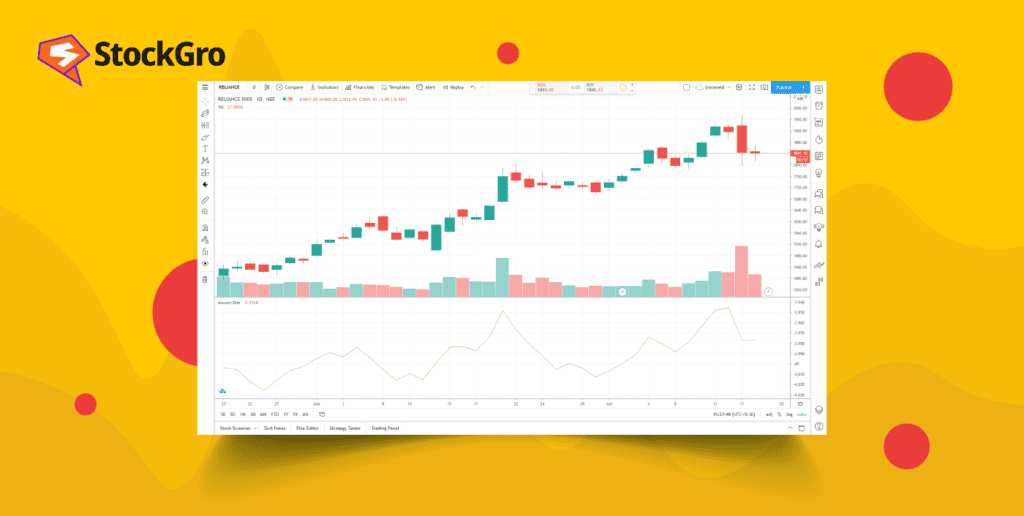

Ideally, you can add the A/D indicator on your trading platform to use it. Let us look at the calculation of the accumulation distribution indicator:

1. Money flow multiplier (MFM):

The formula to calculate the MFM is as follows:

MFM = [(Closing price – Lowest price) – (Highest price – Closing price)] / (Highest price – Lowest price)

MFM helps to gauge the direction and strength of the money flow. A high MFM indicates buying pressure, while a low MFM suggests selling pressure.

2. Money flow volume (MFV):

This component represents the volume of an asset that has been bought or sold during a specific period. It is calculated as follows:

MFV = MFM x Volume

MFV measures how strong the money flow is. High MFV values suggest strong accumulation, while low values indicate distribution.

3. The accumulation distribution line:

(ADL) is a summation of the money flow volume for each period. This means that you can calculate the ADL by adding the current money flow volume to the previous ADL:

ADL = Previous ADL + Money Flow Volume

Also Read: What is ADX indicator? Make informed trades by tracking market trends.

What does the accumulation distribution indicator tell you?

Essentially the A/D line shows the demand and supply of a particular share. So, the share price can either move in the same direction as the A/D or it can move in the opposite direction, indicating confirmation and divergence respectively.

The accumulation distribution (A/D) line also serves as a tool to evaluate price trends and identify potential reversals. When a security is in a downtrend but the A/D line is in an uptrend, it suggests the presence of buying pressure, indicating a potential price reversal to the upside.

Conversely, if a security is in an uptrend while the A/D line is in a downtrend, it indicates the existence of selling pressure or increased distribution, serving as a warning that the price might decline

Similarly, if the A/D moves in the same direction as the share price, it means that there is a strong buying or selling pressure as indicated by an upward or downward trend.

Analysing the A/D indicator alongside volume data is essential. A strong price move accompanied by a significant increase in volume confirms the sustainability of a trend. Conversely, a weak price move with low volume may indicate an impending reversal.

The A/D Indicator is useful for identifying long-term trends. By analysing the A/D line over extended periods, you can gain insights into the overall health of a market or asset.

A/D indicator – Pros and cons

Pros

- The A/D indicator offers the advantage of helping traders identify potential trend reversals by detecting divergences between price movements and the flow of trading volume.

- It is also effectively used alongside other technical analysis tools to validate and strengthen the signals it generates, enhancing the reliability of trading decisions.

Also Read: Here’s how you can use the MACD indicator

Cons

- The A/D indicator may produce false signals, especially during periods of high market volatility or low liquidity.

- It is a lagging indicator and may not always offer timely signals for entering or exiting positions.

- It may provide information after price movements have already occurred, potentially showing missed opportunities.

- The A/D indicator’s effectiveness is hindered by its inability to account for trading gaps. When these gaps occur, they may not be reflected in the A/D line at all. For instance, if a stock experiences an upward price gap but eventually closes around the midpoint, the A/D line would disregard this gap as it is primarily based on closing prices.

- Identifying subtle alterations in volume flows can pose a challenge. In a downtrend, the rate of change may gradually decrease, but this shift can be challenging, if not impossible, to discern until the A/D line exhibits an upward turn.

Accumulation Distribution Indicator (ADI) vs On Balance Volume (OBV)

In this section, let us help you understand the differences between ADI and OBV:

| Indicator | Accumulation Distribution Indicator (ADI) | On Balance Volume (OBV) |

| Formula | ADI uses a complex formula combining price movements relative to the day’s range and multiplies it by volume. | OBV is also a volume indicator that sums up volume on up days and subtracts volume on down days. |

| Primary Focus | ADI focuses on comparing closing prices to the overall trading range and analyses the flow of money. | OBV mainly tracks volume trends without considering price fluctuations to understand the changes in the price of a stock. |

| Volume and Price Relationship | ADI evaluates whether volume is driven by accumulation (buying) or distribution (selling) using closing prices within the trading range. | OBV assumes that all volume during an up day is positive and all volume during a down day is negative. |

| Usage | ADI helps in spotting divergence between price and volume, suggesting potential reversals. | OBV is used to confirm the strength of price trends; rising OBV indicates upward momentum. |

| Best For | ADI is more detailed in assessing underlying supply and demand forces and is ideal for identifying trend reversals. | OBV is simpler and more suitable for quick volume-based trend confirmations. |

Both indicators serve as volume-based tools, but they cater to slightly different aspects of market analysis. ADI provides a more detailed analysis by focusing on price ranges, while OBV provides a simple look at volume flow.

You can use these tools to get a better understanding of market momentum and potential reversals depending on your trading style and the market you’re analysing.

Conclusion

The A/D indicator is a potent tool for traders and investors to identify potential trend reversals and confirm signals. The A/D Indicator should never be the sole basis for making investment decisions but rather a part of a comprehensive trading approach.

So, whether you are a seasoned trader or just getting started, consider incorporating the A/D indicator into your trading arsenal and take your trades to the next level. With practice and strategy, it can be a valuable ally in your quest for trading success. Find the most effective indicators to boost your intraday trading success. Enhance your strategies with these essential tools for better trades.