The value of an item may go down over time due to changes in the market and other factors. This process is called depreciation. There are various ways to determine depreciation based on the asset type and the reason behind the estimate.

One of these methods is the compound depreciation method, also known as the annuity approach. This method is based on the idea that an object is an investment that gives a steady return over the course of its useful life.

Let’s talk about the annuity method of depreciation. We’ll talk about how it works, its perks and shortcomings, and when it needs to be used.

Also read: The Capital Asset Pricing Model (CAPM) – Explained

What is the annuity method of depreciation?

The annuity method of depreciation tells you how much an item loses in value over time. It is similar to estimating the amount an asset earns each year. It works well for assets that cost more, last longer, and have a fixed rate of return.

To use the annuity method of depreciation, we need to find the asset’s internal rate of return (IRR). The IRR is the percentage showing how much the asset value grows or decreases annually.

We must multiply the IRR by the asset’s original book value to get the depreciation value. After that, we must subtract this amount from the asset’s cash flow. The book value, or carrying value, is the overall amount of outstanding debt reported on a business’s balance sheet.

The annuity depreciation method uses the annuity table to estimate the depreciation amount. The annuity table shows the annuity’s present value and future value while taking the period of the investment into account.

How does the annuity method of depreciation work?

The interest lost on the invested money in an asset is something that is often overlooked in many depreciation calculation methods. The deficit can be compensated by the annuity method of depreciation.

The annuity method makes the assumption that the fund used to purchase an asset is an investment with a yield that can be expected. The idea is that if you had invested the same amount elsewhere, you would have received a particular amount of interest or return on the investment.

Because of this, interest is calculated on the asset’s decreasing balance. After that, it is deposited to an interest account after being deducted from an asset account before being moved to a profit and loss account. Next, a predetermined amount of depreciation is added to the asset for every year that follows. With the help of an annuity table, we can figure out how much depreciation is there. The depreciation amount relies on the rate of interest and the asset’s useful life.

Also read: A simple guide to understanding NAV in mutual funds

Example of annuity method of depreciation

Let’s understand the concept with an annuity method of depreciation example. Suppose a lease was taken for ₹10,000 in 2020 with a working life of 3 years. In the annuity system, interest is charged at a rate of 3% per year on depreciation.

The annuity factor for 3 years at 3% from the annuity table is 0.353530

Now, the depreciation per year will be ₹10,000*0.353530 = ₹3,535.3

Annuity method of depreciation formula

Finding an asset’s constant rate of return is the primary goal of the annuity depreciation method. You may use the steps mentioned below to calculate it:

Step 1: Calculate how much money will flow in the future from each asset.

Step 2: Calculate the cash flows’ internal rate of return.

Step 3: Multiply the asset’s initial book value by the IRR.

Step 4: Deduct the above amount from the current period’s cash flow.

Step 5: The result in step 4 is the depreciation that will be charged to expenses for the current period.

The process determines the amount of depreciation that can be explained over a particular time frame.

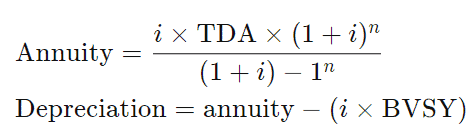

This formula can be used to express the annuity method calculation.

(i=interest rate percentage/100, n=annuity number of years, TDA=total depreciation on amount, BVSY=book value start of year).

Also read: Understanding asset valuation: A comprehensive guide

Pros and cons of annuity methods of asset depreciation

Pros of annuity methods of depreciation

- Interest consideration: The annuity method of depreciation differs from the usual depreciation calculations by including the interest on the money put in the asset.

- Reliability and suitability: It is the most trustworthy and precise calculation method. This method suits assets with a fixed life span and a high initial cost, such as leased machinery.

- Logical method: The method is highly reasonable and scientific as it accounts for the interest factor, which adds more depth to the depreciation calculation.

Cons of annuity method of depreciation

- Complicated calculations: The method depends on many complex calculations, making it difficult and time-consuming to apply.

- Unsuitable for additions: If an asset needs regular additions and improvements, the calculations must be changed a lot, making it hard to use and manage.

- Set depreciation amount: A possibility of unevenly affecting the profit and loss account might be there regarding both depreciation and repairs since the depreciation amount does not change over the asset’s lifetime.

Conclusion

Different factors affect the best method for calculating depreciation, such as the company’s size and industry, the accounting rules it follows, and the kinds of assets it buys.

An asset’s depreciation can be calculated using the annuity approach, which emphasises obtaining a fixed rate of return. It is often used for assets with high upfront expenses or those with a probable extended working life.

Stay ahead of the market with real-time alerts, intraday trade signals, and stock recommendations from SEBI-registered analysts. Check out expert trade calls app now!