Although it might seem complex, the principle behind arbitrage trading is quite simple – taking advantage of price disparities. This type of trading, when done correctly, is largely risk-free and holds the potential for massive gains.

In stock markets around the world, when thousands of companies are traded on multiple exchanges at the same time, there are bound to be some inefficiencies. Arbitrage exploits these inefficiencies to make money. It involves identifying opportunities to buy and sell similar assets in different markets to take advantage of tiny price differences at scale.

What is arbitrage trading?

In stock markets around the world, when thousands of companies are traded on multiple exchanges at the same time, there are bound to be some inefficiencies. Arbitrage exploits these inefficiencies to make money.

It involves identifying opportunities to buy and sell similar assets in different markets to take advantage of tiny price differences at scale.

Arbitrage is used whenever any stock or commodity can be purchased at a given price and sold in another market at a higher price. Since there is no speculation involved, a successful arbitrage trade is considered risk-free.

Since most exchanges, whether they trade stocks or commodities, are highly digitised, arbitrage trading opportunities usually only exist for seconds or a couple of minutes before markets adjust themselves again. With advancements in technology, arbitrage is becoming increasingly difficult for traders.

Since one cannot realistically expect to beat a highly computerised market solely through human skill, traders have recently come to use equally sophisticated algorithms to identify and take advantage of arbitrage.

You may also like: A beginner’s guide to understanding share price calculations

An arbitrage example

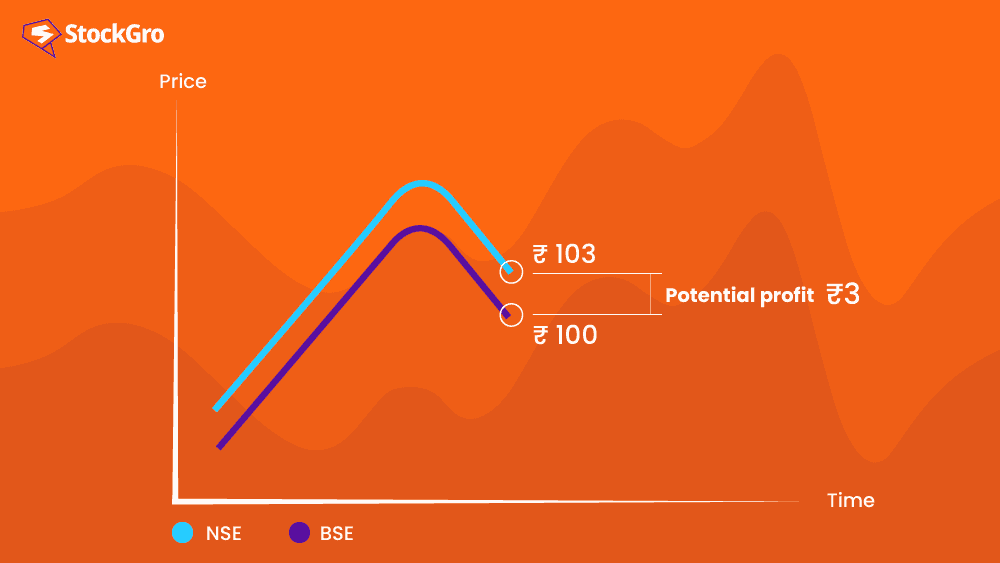

Let’s say Company X, that is listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), is currently trading at ₹100 at the NSE. Now, due to a temporary discrepancy, Company X is being traded at ₹103 at the BSE. This situation is usually caused due to order imbalances. To make a profit, an arbitrage trader could simultaneously buy the stock on the NSE at ₹100 and sell it on the BSE at ₹103, pocketing a risk-free profit of ₹3 per share. This type of arbitrage is known as spatial arbitrage, as it exploits the price difference between the two exchanges.

To execute this trade, however, the trader must act quickly before the price disparity corrects itself. There are also other things to keep in mind – the trader must account for transaction costs, market liquidity, and the time taken to execute these trades.

The process of taking an arbitrage trade

Here is a step-by-step process that will help you identify arbitrage trading opportunities in the stock market.

- Choose your assets – You must choose stocks, currencies, or commodities that are highly correlated in some way. That way, you could try to understand how discrepancies occur and how to spot them. Opportunities could also arise from large events or mergers, such as in the case of HDFC recently.

- Analyse your market and track prices – Keep a check on different markets where your assets are traded. Compare prices on different exchanges, across countries, or even over different time periods.

- Calculating your spread and costs – The spread is the price difference between the same or similar assets in different markets. This has to be large enough to cover your costs and make a worthwhile profit.

- Risk assessment – Evaluating your risks before entering the trade is important. Realistically analyse your execution speed, liquidity, market volatility, and potential external events that could have an impact on your calculations.

- Execution strategy and automation – Depending on the type of trade, you could choose different execution methods. There are plenty to choose from. Since many arbitrage trading opportunities require split-second decision-making, sophisticated trading algorithms and automation tools are often used to minimise human error.

- Monitoring and adaptation – Markets are hardly static. A successful arbitrage trader needs to adjust strategies often and learn from their mistakes to ensure that they get better at understanding the market over time.

Also Read: Exploring the art of speculation

Types of arbitrage trading

There are many ways to engage in arbitrage trading. Here are some types:

- Spatial arbitrage – When traders buy assets from different geographic locations, it is called spatial arbitrage. Due to different statutory rules and regulations, some countries could potentially offer better bets on the same asset. This is more common in commodity trading than in stock.

- Cross-exchange arbitrage – Unlike spatial arbitrage, this type happens between exchanges within the same physical jurisdiction. Traders make a profit from the price differences across exchanges by buying low and selling high.

- Triangular arbitrage – As the name suggests, triangular arbitrage involves trading three assets. In this type, traders shift their capital from one asset to another very quickly with the help of special algorithms and equipment. As long as they maintain low transaction costs, traders can net a decent profit with such manoeuvres.

- Statistical arbitrage – This approach involves identifying patterns or relationships between different assets and exploiting those patterns for profit at scale. Statistical arbitrage often involves pairs trading, where a trader simultaneously goes long on one asset and short on another that are historically correlated. This is also a popular risk management tactic.

- Risk-free rate arbitrage – This type of arbitrage takes advantage of differences in interest rates. A trader involved in this segment might borrow funds at a lower interest rate and invest in a higher-yielding asset, effectively profiting from the difference in rates. Some also call this ‘yield farming.’

Why is arbitrage trading important?

From a market point of view, arbitrage trading is not merely opportunism – it actually serves a larger positive purpose. Since arbitrage traders actively search for and exploit price discrepancies across different markets, they help ensure that prices for identical or closely related assets converge to their true fundamental values.

Hence, by taking arbitrage trades, they make arbitrage opportunities less frequent.

Since arbitrage involves frequent and volumetric trading, liquidity is also a positive byproduct. The presence of arbitrageurs can narrow bid-ask spreads and make it easier for other traders to enter or exit positions without significantly impacting prices.

In the larger scheme of things, arbitrage trading reduces discrepancies across markets. When resources (or lack thereof) cause price imbalances across markets, arbitrage trading balances supply and demand.

Even though this is a profit-making venture at the micro level, arbitrage trading optimises and balances resources and capital across markets by identifying discrepancies and quickly correcting them.

Also Read: Leverage in stock market – strategies, risks and rewards

Conclusion

Even though arbitrage might sound like an easy way to make money without significant risk, you must remember that there’s no such thing as a free lunch. There are risks involved in everything, even when it might seem to be the opposite.

Arbitrage traders usually need to stay on edge, constantly monitoring asset pairs, markets, and prices to identify trades. And that’s not even the hardest part. Simultaneously planning and executing a large trade is a very stressful endeavour marred with high chances of error and loss.

We encourage you to do your own research before you start arbitrage trading and keep these risks in mind. Until then, happy learning!