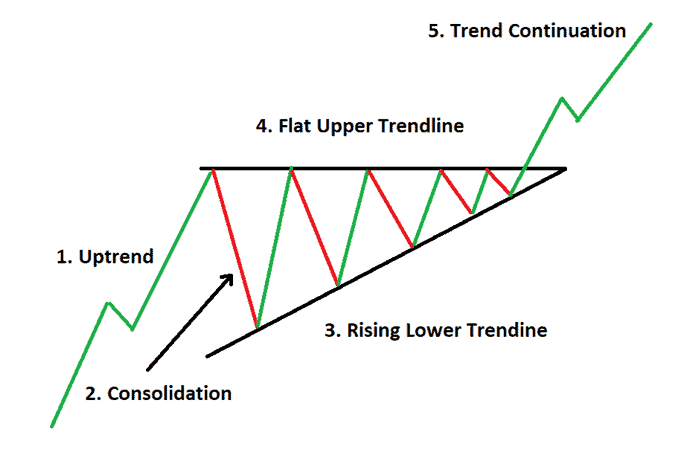

Technical analysis is a tool that uses charts, patterns and indicators to potentially establish the movement of prices. Traders and investors use this technique in the stock market to generate consistent profits. One tool that is employed as part of technical analysis is the ascending triangle pattern. This pattern is seen on a bullish trend and many traders use it to find breakouts.

What is an ascending triangle pattern?

An ascending triangle or the rising triangle line chart pattern is a bullish pattern that occurs in an uptrend. It follows a horizontal resistance level and a rising support level. It is a continuous pattern, as it follows the uptrend and gives a breakout in a similar direction as the trend.

You may also like: What do these symmetrical triangle patterns suggest?

Identification of an ascending triangle chart pattern

The ascending triangle pattern is a bullish pattern that can be easily recognised by the existence of the following two parts:

- Flat resistance line: It is a straight line that acts as a potential barrier to the price. Resistance at this level represents a selling pressure becoming significant.

- Rising support line: This is an upward-sloping trendline that is the support level. It shows that buyers are looking to buy the shares even at lower highs.

To further recognise the ascending triangle pattern, you must look for the following characteristics:

- Higher lows: The price consistently forms higher lows, showing buyers are becoming more aggressive.

- Horizontal resistance: The price touches this straight line level at least a minimum of two times without breaking it.

- Lower volume: Volume decreases as the pattern develops, displaying a lower buying that happens for the trades.

Formation of an ascending triangle pattern

If you want to see the ascending triangles breakout, the volume should be increasing. If there is a decrease in trading volume as the pattern forms, it is possible that the trade will be unsuccessful.

While the stop losses create selling pressure, there is also a buying pressure created by buyers which shows a strength in the share, ultimately leading to an ascending triangle pattern breakout.

Also read: Deciphering the rising wedge pattern in stock trading

How do you trade the ascending triangle chart pattern?

Entry point

Traders enter a long (buy) position when the price breaks out from the straight resistance level. This breakout signals a potential continuation of the uptrend.

Stop-loss order

Avoid losses by placing a stop-loss with a buffer order below the ascending support line. This level acts as a critical support. If the price breaks below it, the pattern may have failed.

Price target or exit

The ascending triangle pattern target for the trade can be estimated by measuring the distance between the triangle at its widest point and adding that measurement to the breakout point. It gives you a potential price target for your trade.

To reduce false breakouts, traders often wait for confirmation of the breakout. This involves monitoring volume to ensure it increases when the breakout occurs.

Also read: Triangle chart patterns: A smarter way to technical analysis

Common pitfalls when trading the ascending triangle chart pattern

Trading the ascending triangle pattern can be a profitable strategy but just like any other trading approach, it comes with its own set of challenges. Here are some common challenges to be aware of when trading this pattern:

False breakouts

One of the most significant pitfalls in trading ascending triangles is false breakouts. Sometimes, the price may appear to break out of the pattern, only to reverse and move in the opposite direction. To cancel out this risk, wait for a confirmation signal.

Lack of volume

If you want to see the ascending triangles breakout, the volume should be increasing. If there is a decrease in trading volume as the pattern forms, it is possible that the trade will be unsuccessful.

Overtrading

Traders are tempted to enter into multiple trades based on ascending triangles in rapid succession, especially if they have had success with the pattern earlier. Overtrading leads to higher risk and higher losses.

Ignoring the market context

Ascending triangles in an uptrend are more reliable. When an ascending triangle pattern is in the bearish market, it is a wrong signal and traders should avoid entering into the trade in such a phase. Trading any strategy in isolation, without taking into consideration the broader market conditions, entails risk. Always analyse the market context before entering a trade.

Poor risk management

Failing to set proper stop-loss orders and risking too much capital on a single trade is a common pitfall. Always calculate your position size based on your risk tolerance. Planning for your entry and exit points ahead is also advised.

Ascending Triangle Vs Descending Triangle: Key Differences

Have you ever wondered how certain patterns in the stock market can give you clues about the next big move? Well, ascending and descending triangles are two such patterns that can help traders make informed decisions. Let’s break them down to see what sets them apart:

| Ascending Triangle | Descending Triangle | |

| Shape | Formed by a flat upper trend line and an upward sloping lower trend line. | Formed by a flat lower trend line and a downward sloping upper trend line. |

| Market Sentiment | Bullish sentiment as buyers are pushing prices higher. | Bearish sentiment as sellers are driving prices lower. |

| Breakout Direction | Typically breaks out upwards, signaling a potential bullish move. | Usually breaks out downwards, indicating a possible bearish move. |

| Volume Behavior | Volume often increases as the pattern develops, confirming bullish sentiment. | Volume can vary; often increases as the breakout approaches, indicating bearish pressure. |

| Trading Strategy | Traders may look to buy when the price breaks above the upper trend line. | Traders might consider selling or shorting when the price breaks below the lower trend line. |

| Timeframe | Can appear on various timeframes, from minutes to daily charts. | Also found across different timeframes, suitable for both short-term and long-term trades. |

So basically, ascending triangles signal bullish trends with their upward momentum, making them attractive for buyers, while descending triangles represent bearish trends, often leading traders to sell. Recognizing these patterns can enhance your trading strategy, whether you’re aiming for quick gains or long-term investments.

Pros and Cons of Ascending Triangle

If you’re getting into technical analysis, you might hear about the ascending triangle pattern. Many traders like it because it can suggest that prices might go up.

However, just like any trading method, it has its strengths and weaknesses.

Let’s take a look at the pros and cons of using the ascending triangle pattern so you can make smart choices.

Pros:

- Bullish Signal: Ascending triangles are generally seen as bullish patterns. They indicate increasing buying pressure, suggesting that a breakout is likely. Traders often see this as a sign to enter a position before the price rises.

- Clear Entry and Exit Points: This pattern provides traders with well-defined entry points (just above the resistance line) and exit points (just below the support line). This clarity can help in managing risk effectively.

- Higher Probability of Success: Historically, ascending triangles have a higher chance of resulting in a successful breakout compared to other patterns. This can make them appealing to both novice and experienced traders.

Cons:

- False Breakouts: One of the main risks of trading ascending triangles is the potential for false breakouts. Sometimes the price can break above the resistance level only to fall back, leading to losses for traders who jumped in too quickly.

- Timing Issues: Identifying the perfect moment to enter or exit can be tricky. Traders may face challenges determining when to act, leading to missed opportunities or poor decisions.

- Market Conditions: The effectiveness of the ascending triangle can be influenced by broader market conditions. In a bearish market, even a strong ascending triangle might fail to yield the expected results.

Knowing the pros and cons of ascending triangles helps traders make better choices. Just like with any trading strategy, it’s important to use this information alongside other tools and insights for the best outcomes.

Conclusion

Trading the ascending triangle pattern requires a structured approach that includes careful entry points, exit strategies, and well-placed stop-loss orders. Remember that no trading strategy is foolproof and it’s crucial to combine technical analysis with proper risk management to improve your overall trading success. Continuous monitoring and adaptation to market conditions are important to stay ahead to win as a trader.