Authorised share capital is the highest number of shares a company can issue as per its Articles of Association. This limit is decided by the company’s founders or board of directors and can be changed by a special resolution from the shareholders.

The authorised share capital is key in a company’s corporate governance. It sets the amount of money a company can get from selling its shares. This impacts the company’s ability to grow, take on new business, and expand.

You may also like: What is equity share capital? [Explained]

Authorized share capital meaning and significance

The main reason for having an authorized share capital limit is to safeguard shareholders’ interests. By capping the number of shares that can be issued, the company makes sure existing shareholders don’t lose their share value with the issue of new shares. This also helps keep a steady ownership structure and avoid hostile takeovers or other unwanted ownership changes.

If a company’s authorized share capital is too low, it might not be able to issue new shares for extra capital, limiting its growth or new business chances. On the other hand, if it’s too high, it could be seen as overvaluation or financial instability, which is not good.

In different places, authorized share capital is also known as “authorized stock,” “authorized shares,” or “authorized capital stock.”

Additionally, having a well-defined authorized share capital can increase a company’s credibility with investors and financial institutions. It provides a clear picture of the company’s potential for raising funds and its growth prospects. Companies can also amend their authorized share capital through shareholder approval, allowing flexibility to adapt to changing business needs. This flexibility is crucial for companies looking to expand, merge, or acquire other businesses.

On top of that, the concept of authorized share capital is essential for regulatory compliance. Companies must adhere to legal requirements regarding the issuance of shares, ensuring transparency and accountability in their financial practices. This helps maintain investor confidence and promotes a fair and orderly market.So basically, authorized share capital plays an important role in maintaining shareholder value, providing growth opportunities, and ensuring regulatory compliance, making it a cornerstone of corporate governance.

Terms related to authorized share capital

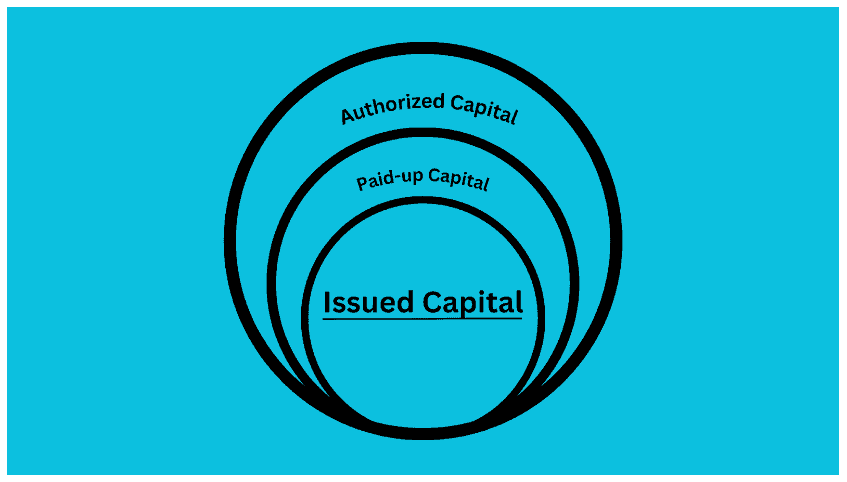

Authorized share capital refers to the total value of shares a company can issue to raise funds. It consists of three parts: subscribed capital, paid-up capital, and issued capital.

Subscribed capital

When a company launches an Initial Public Offering (IPO), interested buyers agree to purchase shares from the company’s treasury. The capital calculated based on these commitments is termed as subscribed capital. Major buyers usually include foreign institutional investors, domestic institutional investors and high net worth individuals.

Subscribed capital is a crucial component of a company’s equity structure as it represents the portion of the authorized capital that investors have committed to buying. This commitment indicates the level of confidence and interest that investors have in the company’s potential for growth and profitability. The process of subscribing to shares involves investors submitting applications and agreeing to the terms set forth by the company, including the price per share and the number of shares they wish to purchase.

Once the subscription process is complete, the company allocates shares to the investors based on demand and availability. The subscribed capital then becomes part of the company’s issued capital, which is the actual amount of capital raised from the shareholders. This capital is used by the company to fund its operations, expand its business, and achieve its strategic objectives.

The success of an IPO and the amount of subscribed capital can significantly impact the company’s market valuation and its ability to attract further investments in the future.

Paid-up capital

After the subscription phase, the company invites these interested buyers to pay either partial or the full amount for the shares they committed to buy. The total money collected through this is called the paid-up capital. In simple terms, paid-up capital is the portion of subscribed capital for which the company has received payment.

Paid-up capital is an important part of a company’s financial setup, showing the actual money received from shareholders in exchange for their shares. This capital forms part of the company’s equity and is used to run the business, invest in new projects, and support growth.

Unlike authorized share capital, which is the maximum amount a company can raise by issuing shares, paid-up capital reflects the real investment made by shareholders.

To convert subscribed capital into paid-up capital, the company asks shareholders to pay the amount they agreed to. This can be done in parts or all at once, based on the subscription terms. Once the payment is made, the company updates its financial records to show the increase in paid-up capital.

A high paid-up capital is often seen as a sign of financial strength and investor trust. It gives the company the funds it needs to achieve its goals and boosts its reputation with creditors and future investors. Additionally, having more paid-up capital helps the company secure loans and other funding, showing a strong financial base.

Issued capital

Post receiving the payments, the company issues shares to the shareholders. The money received during this phase is termed as issued capital. The shares are sold to various types of shareholders like retail investors, institutional investors and so on. Once the shares are issued, shareholders have the choice to either keep the shares or sell them.

Issued capital is a subset of the company’s authorized share capital, which represents the maximum amount of share capital that the company is authorized to issue to shareholders as per its corporate charter.

The authorized share capital sets a ceiling on the number of shares that can be issued, providing a framework within which the company can raise funds. When a company decides to issue shares, it does so within the limits of its authorized share capital.

The process involves offering shares to potential investors, who then purchase these shares, contributing to the company’s issued capital. This capital is crucial for the company’s operations, expansion, and other financial needs.

Moreover, the issued capital reflects the company’s ability to attract investment and its overall financial health. Companies need to manage their issued capital effectively to ensure they have sufficient funds for growth while maintaining a balance with their authorized share capital.

Shareholders who receive these shares become part-owners of the company and have the right to vote on important corporate matters. They can also benefit from dividends and potential capital gains if the company’s share price increases.

Also Read: Working capital – the what, how, and why of business lifelines

Let’s look at the picture below to understand authorised share capital better.

Authorized share capital example

Take a company that can issue up to 1,00,000 shares at ₹10 each. This sets the authorized share capital at ₹10,00,000. The company chooses to release only 10,000 shares and asks interested shareholders to pay ₹5 per share to show their agreement. When all 10,000 shares are subscribed, the paid up capital reaches ₹50,000. Upon issuing all these shares to the shareholders, it’s called the issued capital.

Different stages of capital related to the example of authorized share capital provided

| Stage | Description | Amount (₹) | Shares Involved |

| Authorized Share Capital | Maximum value of shares the company is allowed to issue. | 10,00,000 | 1,00,000 |

| Subscription | Shareholders show interest by paying a part of share value. | Not Applicable | 10,000 |

| Paid Up Capital | Amount actually paid by shareholders for subscribed shares. | 50,000 | 10,000 |

| Issued Capital | Value of shares issued to shareholders. | Not Specified | 10,000 |

This table provides a breakdown of the different stages of capital mentioned in the example, showing the relation between the amount in rupees and the number of shares involved at each stage.

Also Read: The Capital Asset Pricing Model (CAPM) – Explained

Final words

Authorized share capital is key to a company’s corporate governance structure. It sets the max number of shares a company can issue, impacting the company’s capacity to raise capital, grow, and expand. By having a fitting authorized share capital limit, companies can safeguard shareholder interests, keep a steady ownership structure, and set themselves up for long-term success.