If you were asked to describe the financial market in one word, what would that word be? Uncertainty is the word that best describes the financial markets. Do you agree?

The financial market, particularly the stock market, is subject to the highest degrees of price fluctuations and volatility. So, how do investors handle these risks?

The market has various tools to mitigate these risks, and the balanced advantage fund is one of them.In this article, we will discuss the meaning, benefits and steps to invest in a balanced advantage fund. So, if you are an investor looking to manage your risks, this is for you.

What is a balanced advantage fund?

A balanced advantage fund is a hybrid mutual fund that is also referred to as a dynamic asset allocation fund.

As the two terms suggest, these mutual funds intend to make dynamic investments in different asset classes to balance risks. A balanced fund is where a portion of investments goes into equities, which have high exposure to risks and returns, and another portion of investment goes into debt securities that provide stable returns at low risks.

You may also like: Exploring the bond market for beginners

Understanding the asset allocation in a balanced advantage fund.

The asset allocation in a dynamic fund is done by the mutual fund manager managing the fund. These funds are dynamic and flexible, because of which the fund manager keeps adjusting the proportion of investments in debt and equity based on changing market conditions.

Since asset allocation largely depends on the external factors in the market, there is no fixed ratio that fund managers follow for allocating funds. However, as a basic strategy, they allocate more to fixed-income securities when the equity market is unfavourable and vice versa.

Market valuations are critical in ascertaining the risks associated with equity markets. An overvalued equity market is not very suitable for making investments. So, fund managers usually divert assets to debt funds in an overvalued equity market and move them back to stocks when the equity market is undervalued.

The constant movement to provide the best return to clients adds weight to the term “balanced advantage funds”.

How do balanced advantage funds generate returns?

Equity investments are suitable for investors looking for high returns but are also associated with higher risk. However, equity investments in the long term are less risky. So, the first leg of return comes from equity investments in the long term.

The second leg of returns comes from more stable debt investments. Debt investments are less risky as they are not as volatile as stocks. They generate fixed, periodic income for investors.

Also read: The Complete Guide to NFO – New Fund Offers

Benefits and risks

Advantages of dynamic asset allocation funds:

- As said by various stock broking firms, balanced advantage funds offer investors the best of both worlds. They offer the benefits of debt and equity along with minimising risks.

- Balanced advantage funds do not require investors to be conscious of market timings and conditions, as fund managers move the funds as required.

- These funds are ideal for novice investors as it exposes them to different financial markets.

- Since balanced funds invest in different assets from different sectors, investors may be eligible for tax exemptions based on the investment.

Limitations of investing in dynamic funds:

- Though these funds aim to offset the risk through diversification, a portion of allocation goes to equities, and there is always a degree of risk attached to equity investments. The investor may incur heavy losses if fund managers do not act quickly based on market conditions.

- Debt investments are less risky but are not risk-free. They are exposed to interest rate risks, credit risks and so on. Interest rate risk is where the current rate of the debt fund is lower than the market rate. Credit risk is where the security issuer (Debt borrower) fails to make periodic payments.

Who should invest in these funds?

- Investors new to the world of investment and not confident about managing their investments on their own can consider balanced advantage funds.

- Balanced advantage funds are suitable for those who wish to maintain a diverse portfolio.

- Investors who wish to enjoy high returns in the equity market but want to limit their risks can try their luck at balance advantage funds.

- This is also suitable for investors who want stability and the thrill of trading in the stock market.

How to invest in dynamic asset allocation funds?

Before investing in a mutual fund, investors must assess the fund’s historical performance. Investors must also ask their fund managers for details of the kind of stocks and debts the mutual fund company will invest in. Investors must proceed only after they are sure the fund’s objective aligns with their personal investment objective.

Steps for investing:

- Demat accounts are not mandatory for mutual funds, but you have an account with the mutual fund company. So open it if you do not already have one.

- Decide the amount of investment. The amount depends on factors like liquidity, other commitments, financial goals, etc.

- Investors can choose SIP (Systematic Investment Planning) and make periodic payments or lumpsum investments, where the whole amount is invested at once.

- Fill in the KYC (Know Your Customer) documents and let your fund manager start investing.

To calculate balanced advantage fund returns, various stock broking companies provide mutual fund calculators that help ascertain the return on investments.

Also read: Crack the code to steady gains with value funds

Example

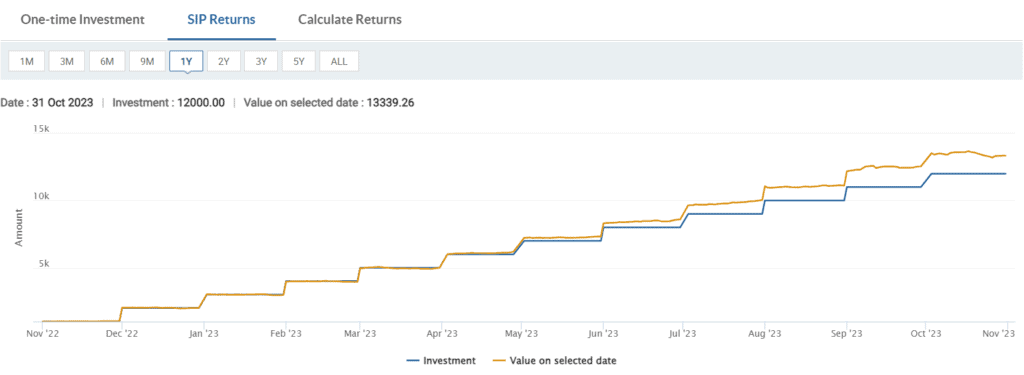

Consider the example of the HDFC balanced advantage fund:

Fund size: ₹ 64,319.08 crore

Expense ratio: 1.45%

Net Asset Value (NAV) as of 31 Oct 2023: ₹ 32.53

Dynamic asset allocation strategy:

- 69.4% in domestic equities (Large-cap stocks – 43.77%, Mid-cap stocks – 6.66%, Small-cap stocks – 8.06%)

- 27.02% in debt investments (Government securities – 16.17%, Low-risk securities – 10.85%)

- 3.94% in other assets

The above chart shows the return on investments for a period of 1 year through the SIP mode.

If an investor invests ₹1,000 every month from 31 Oct 2022 to 31 Oct 2023 (₹12,000 in total) in HDFC BAF, the value of the investment as of 31 Oct 2023 will be ₹13,366.45, giving an absolute return of 11.39%.

Bottomline

The balanced advantage fund, or the dynamic asset allocation fund, is a type of mutual fund that invests in different classes of assets to balance the components of risk and return.

It is a suitable investment option for those investors looking to have exposure to both equity and debt markets to get the benefits of both kinds of investments.

However, like every other mutual fund, balanced advantage funds are subject to risks, too. Hence, such funds must depend purely on the individual investor’s financial objective.