Beta value in stocks is an integral part of the Capital Asset Pricing Model (CAPM), to calculate an asset’s expected returns.

It also considers the risk-free rate and the equity risk premium to calculate the expected rate of return. Essentially, beta in portfolio management is a measure of risk that’s considered when calculating the rate of return for a diversified portfolio.

What is the meaning of beta in the stock market?

Beta is used to gauge the level of volatility in the returns of investment security compared to the overall market. Beta is employed as a means to assess risk and holds a central role in the Capital Asset Pricing Model (CAPM).

The beta coefficient can be deciphered as follows:

- Beta = 1 signifies that the investment is as volatile as the market itself.

- Beta > 1 denotes that the investment is more volatile than the market.

- Beta < 1 suggests that the investment is less volatile than the market.

- Beta = 0 implies that the investment is uncorrelated with the market.

High Beta: A company with a beta exceeding 1 is much more volatile than the market. For instance, a high-risk technology firm with a beta of 1.75 would have yielded returns 175% higher than the market provided during a given period.

Low Beta: Conversely, a company with a beta lower than 1 exhibits lower volatility than the entire market. For instance, an electric utility company with a beta of 0.45 would have delivered returns equal to only 45% of the market’s returns in a given period.

Negative Beta: A company with a negative beta correlates negatively with the market’s returns. For instance, a gold company with a beta of -0.2 would have experienced a 2% decline when the market was up by 10%.

You may also like: How to compare stocks? Explore the various tools available.

How to calculate the beta of a stock?

To determine a stock’s beta, divide the covariance of the stock’s returns and the benchmark’s returns by the variance of the benchmark’s returns.

The formula for computing a stock’s beta is as follows:

Stock beta formula = COVARIANCE(Rs, Rm) / VARIANCE(Rm)

“Rs” represents the returns of the stock.

“Rm” corresponds to the returns of the entire market or the benchmark being used for comparison.

“COVARIANCE(Rs, Rm)” is the covariance between the stock returns and the market returns.

“VARIANCE(Rm)” represents the variance of the market’s returns.

Comparing high beta and low beta values: the better choice?

High-beta stocks are often considered riskier but offer higher returns. On the other side, low-beta stocks are less risky. They typically yield lower potential returns. You have to choose between high beta and low beta depending upon your investment goals.

For more conservative investors or those with near-term financial goals, low-beta stocks are typically the favoured choice. These stocks tend to exhibit minimal fluctuations in value over time. They belong to companies known for delivering consistent revenues and profits, whether the economic climate is prosperous or challenging.

In contrast, investors aiming for substantial capital gains or day traders seeking rapid profits from volatile stock prices often gravitate towards high-beta stocks. These companies historically experience considerable price swings. This category includes dynamic companies, such as tech startups looking to revolutionise industries, where investing could lead to significant gains or substantial losses.

It’s worth noting that higher beta stocks tend to outperform during bull markets marked by economic expansion and high confidence levels, while lower beta stocks tend to fare better in recessions, aligning with their stability and lower risk profile.

Also Read: Interest rate risk – Meaning and risk management strategies.

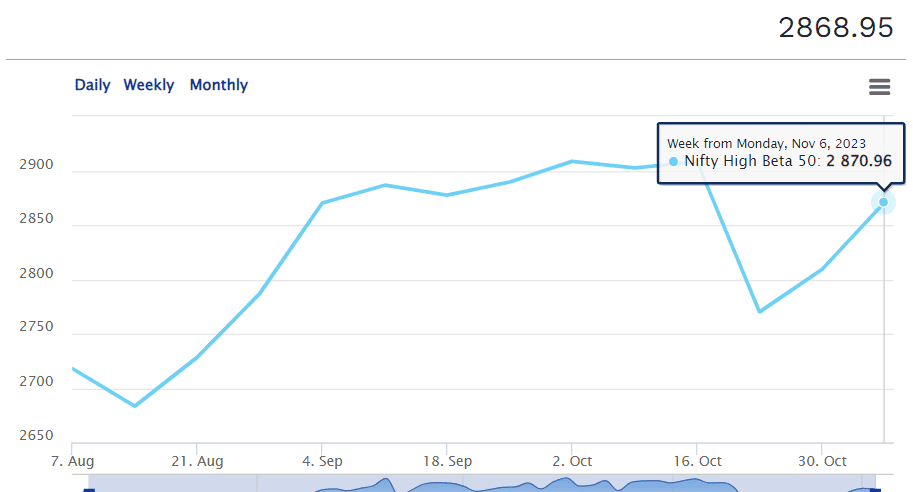

NIFTY high beta 50

It is a stock market index that shows the performance of the top 50 high-beta stocks, for the last 1 year.

Pros and cons of beta values in stock markets

Benefits:

- Beta is a crucial coefficient that aids investors in evaluating securities before making investment decisions.

- It facilitates the assessment of market-related risk associated with a company’s stock, revealing the level of correlation between these factors.

- Investors seeking substantial gains can explore stocks with a beta value exceeding one.

- Those investors looking for a stable return and a consistent cash flow through dividends can opt for stocks with a beta value of one or less.

Disadvantages:

- Beta is based on past data and doesn’t guarantee future results. Market fluctuations can cause the beta value to change, affecting a stock’s volatility.

- Beta primarily measures systematic risk, related to the market. Unsystematic risks, such as high company debt or legal issues, can impact stock price movements even when the overall market rises.

- Investing in high-beta stocks can expose a portfolio to higher risks, potentially trapping investors if other internal factors are not thoroughly analysed.

Also read: What is alpha and beta in the stock market?

Conclusion

Many experts concur that while beta offers some insights into risk, it falls short as a standalone risk assessment tool. Beta focuses solely on a stock’s historical performance concerning the Nifty 50. Beta lacks any predictive value. It overlooks a company’s fundamentals, such as earnings and growth potential.

The beta value of stocks plays a crucial role that investors should consider before venturing into any stock market investment. While it doesn’t provide a comprehensive assessment, beta aids investors in evaluating the market risk linked to a particular investment instrument and its potential impact on the resulting returns.