“Bull markets and Bear markets can obscure mathematical laws, they cannot repeal them.” — Warren Buffett.

In the stock market -you would have heard of these two terms, “Bear” and “Bull”. You often hear these terms in forecasts, discussions and news channels.

Like people go through specific stages in their lives, so does the stock market experience cyclical stages. These stages are referred to as bullish and bearish markets, characterised by an increase or decrease, respectively.

Let’s delve deeper into the bull and bear markets.

What is a bull market?

The bull phase can be referred to as the phase of optimism. During a bull market, the investors are very confident about the economy and business as there is good demand for products and services. The rise in the stock prices is not a one day or two day event; it could be prolonged, i.e., for years. Since investors are confident that the asset’s value will rise.

The bull market can be characterised as the period of economic expansion, corporate growth, low unemployment, higher consumer spending, confidence and optimism.

Because of all this, the stock market rises, leading to the “bull market”.

Such a stock price rally does not occur only for a day or week; it could last up to years. A bull market can be defined as a phase of the economy where there is growth in businesses, expansion of the economy, a lower unemployment rate and greater spending power among consumers coupled with confidence and optimism.

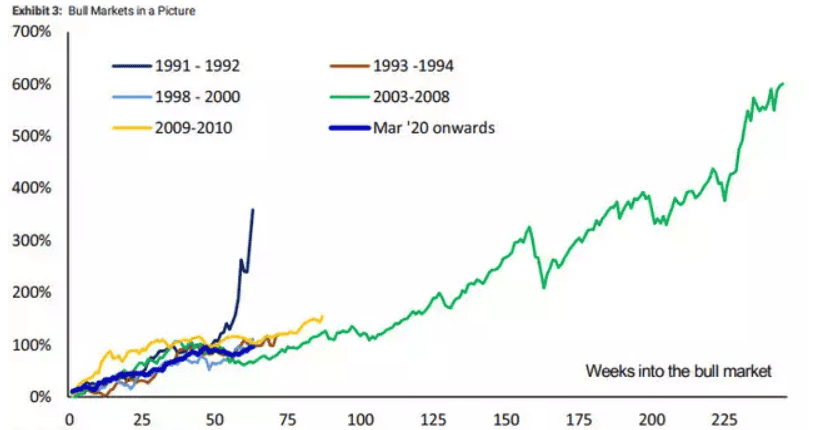

According to a report (2021), over thirty years – India has had six bull markets, which are illustrated in the following diagram:

Source: The Economic Times

Also read: Key risks in investing in the stock market

What is a bear market?

A bear market is nothing but the opposite of a bull market. The phrase bear market denotes moments of negative sentiments, while the economy is not growing fast, companies not performing well, high rates of unemployment, etc.

As a result of all this negativity, stock prices plummet for a long time, which causes a bear market. It is generally assumed by experts that during bear markets, the stock market index decreases by no less than 20% from recent peaks.

In a bear market – the investor’s mood turns into a very depressing and fearful state, which leads to declines in the prices of stocks. Investors entirely stay away from buying but instead focus on selling their shares. They run towards fixed-income securities or cash.

Examples include the Great Depression, the 2000 dot-com bubble, and the 2007-08 housing crisis.

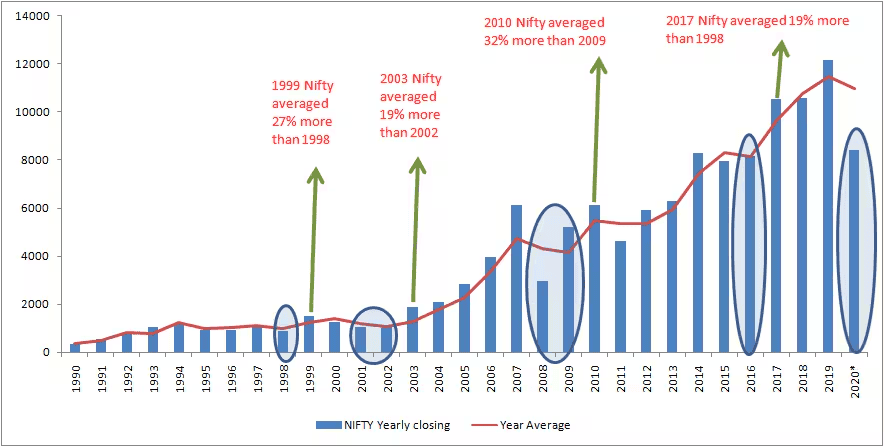

Below is a chart of bear markets in India:

Source: CNBC TV-18

Must read: Your ultimate guide to investing in a bear market

Indicators – Bull and bear market

Here are some indicators:

- How is the economy performing? Bullish trends are usually associated with favourable economic indicators such as:

- GDP growth,

- Low unemployment, and

- Increasing consumer confidence.

On the other hand, bear trends are linked to:

- High unemployment,

- Declining GDP, and

- Reduced consumer spending.

- How is the market responding? You can gauge the bear or bull market by the prevalent investor sentiment and level of confidence. Bullish markets are usually accompanied by optimistic moods. Whereas, bear markets are defined by negative moods.

- How is the market doing? A bull market is characterised by an upward trend with continual increases. However, a bear market experiences continuous declines.

Bull market vs bear market

Here is a quick look at the bullish vs bearish market.

| Feature | Bull Market | Bear Market |

| Price Trend | Upward | Downward |

| Investor Sentiment | Optimistic | Pessimistic |

| Economic Indicators | Positive | Negative |

| Business Growth | High | Low |

| Risk Appetite | High | Low |

| Investment Option | Shares | Cash/Fixed income instruments |

Impact on investors

Investors can be impacted both in the bull market and the bear market. Thus, knowing what both these markets mean in advance can help make better decisions.

Bear market – In a bear market, it is possible that investors might lose the value of their portfolios, whether equity or mutual funds. But, this could also provide them with investing opportunities. Since the stock prices will fall, they can invest in undervalued stocks with good fundamentals and enjoy long-term benefits.

Bull market – In an upward trend, it is possible to receive high returns from one’s investments. However, there is also the possibility of overpricing with subsequent crashes in the stock market.

Strategies for investors

The proper approach to navigating bull and bear markets is to have a strategic view.

Bull market strategies:

- Diversify your investments: Even when the market is moving up, diversification can help manage risks and capture opportunities across diverse assets.

- Invest in growth: You can think of investing in growth stocks and sectors expected to gain from the economic growth.

- Buy and hold: Acquiring and retaining shares, believing that one day their worth will appreciate, is a great approach.

- Frequent reviews: Repeatedly assess the portfolio so you can change it according to evolving market conditions and investment objectives.

Bear market strategies:

Bear market investing needs careful planning. Here are the strategies listed below:

- Long-term investments are the way to go: Naturally, bear markets can be scary; however, having a strong and unchanging perspective on the long-term can greatly assist investors.

- Defensive stocks: Look at firms that supply basic commodities like food and drinks, health products and services or even electricity. These stocks are very stable over time and have a long-term value assurance even during a recession.

- Bonds and fixed income: Putting a portion of your money into bonds or fixed-income options that typically pay a constant interest but are less volatile than stocks could be a way to minimise loss.

- Cash reserves: Holding cash or liquid assets protects against future market falls. Plus, ensures readiness to buy when the market improves.

You may also like: High stakes, high rewards: Navigating the risk-return trade-off

Bottomline

Bull and bear markets are unavoidable. But you can be prepared. During a bull market, prices rise, and investors have positive sentiment. In contrast, during a bear market, prices fall, and investors have negative sentiment.

Understanding bullish vs bearish is essential to beat market volatility. Investing is still risky, and there are no profits that can be assured. In the end, you need to be informed, be calm, and take calculated actions.

Navigating the stock market starts with understanding the two most common phases: bull markets and bear markets.. To learn how to ride the bull and survive the bear, explore the StockGro app and build your financial skills with real-time insights.

FAQs

1. Is it better to buy in a bull or bear market?

Investors are given chances in any type of stock market, be it bear or bull. In cases where prices are rising, bull markets have an upward trend and will eventually lead to some profits for them later. In contrast, during bearish phases, there are opportunities to acquire undervalued shares. This aspect is all about the investor’s approach towards trading, how much risk they can tolerate and their aim over the years.

2. Why is it called a bull market?

The bull phase can be referred to as the phase of optimism. During a bull market, the investors are confident about the economy and business as there is good demand for products and services. All this causes the stock market to rise, leading to the “bull market”.

The bull market can be characterised as:

- Period of economic expansion,

- Corporate growth,

- Low unemployment,

- Higher consumer spending,

- Confidence and optimism

3. Which is better, bullish or bearish?

No one is inherently better; there are advantages to both bullish and bearish markets alike. When prices rise in a bullish market, conditions for growth and profitability arise as investors take advantage of prevailing market trends (momentum). On the other hand, during a bear phase, stocks may be purchased by investors who can buy them at cheaper yet more alluring rates before prices start picking up again later on.

4. What signals a bull market?

The indication of a bull market is characterised by consistently increasing stock prices. It reveals a strong trust among investors, favourable signs of economic growth such as GDP growth, as well as the good performance of companies. Other signs may include high trading volumes, reduced unemployment rates and general hopefulness in areas such as real estate or production.