Welcome to the world of commodity swaps, where financial instruments meet the tangible assets that power our economies. Whether you’re a seasoned investor or new to the concept, join us as we journey through the intricacies of these essential instruments. Learn to Build a better portfolio: How to invest in commodities for the long run.

Discover how commodity swaps play a role in managing risk, diversifying portfolios, and shaping modern finance.

What are Commodity Swaps Used For?

A commodity swap is a financial arrangement where parties pay based on the price of a specific commodity, for example, oil and wheat. One party might pay the other based on the commodity’s future price changes. These swaps help manage risk.

For example, a company reliant on oil might use a commodity swap to protect itself from rising oil prices. It’s like making a financial bet on whether a commodity’s price will go up or down in the future.

In addition to hedging price fluctuations, commodity swaps are often used by businesses that rely heavily on raw materials. By entering into such a swap, companies can stabilize costs and make financial planning more predictable.

These contracts typically involve a floating and a fixed leg. One party pays based on the actual market price (floating leg), while the other party pays a pre-agreed fixed price (fixed leg). For instance, an airline company may enter into a swap to lock in fuel prices, ensuring that sudden increases won’t affect its operational budget.

Commodity swaps can also be advantageous for financial institutions to enhance their diversified portfolio towards non-traditional assets.

You may also like: What is a commodity? A short guide before you trade

What are Commodity Swaps Used for?

Commodity swaps serve several important purposes, primarily centered around managing risk. The most common reason for engaging in a swap is to align with the risk tolerance of a party involved. For those looking to hedge against the volatility of commodity prices, entering into a swap allows them to pay or receive a fixed price.

On the side of commodity producers, this mechanism ensures a stable selling price, while end-users benefit from a consistent buying price. For instance, airline companies face substantial fuel costs and are particularly vulnerable to fluctuations in oil prices. By utilizing a commodity swap, they can effectively mitigate this risk.

Conversely, some parties may seek greater exposure to the underlying commodity. For example, a trader borrowing at HDFC might opt for a commodity-for-interest swap to capitalize on the potential for high returns driven by commodity price movements.

As financial instruments, commodity swaps are typically cash-settled, meaning investors do not need to handle any physical delivery of the commodity.

Functioning of commodity swap

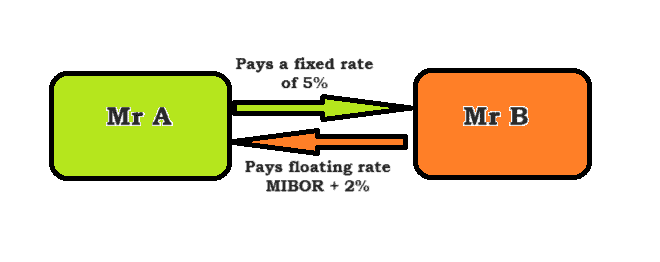

A commodity swap comprises two parts: floating leg and fixed leg. The value of the floating leg is determined by the market price of a particular commodity or an agreed-upon commodity index, whereas the value of the fixed leg is established in advance as per the contract terms. Learn about all different types of Swaps Derivatives here.

While oil is a common underlying asset, commodity swaps can involve various commodities like precious metals, industrial metals, natural gas, livestock, or grains.

Typically, large financial institutions engage in commodity swaps rather than individual investors. The consumer of the commodity holds the floating leg, guaranteeing a fixed price, while the producer holds the fixed leg, paying a rate tied to the commodity’s spot market price.

The commodity swap dealer usually trades in cash-settled transactions, but physical delivery can be specified.

Types of commodity swaps

- Interest rate swap (IRS): Interest rate swaps are commonly referred to as plain vanilla swaps. In the IRS, counterparties exchange cash flows to either hedge interest rate risks or speculate.

Typically, they swap a fixed interest rate for a floating one. The exchanged cash flows depend on an agreed-upon notional principal amount, which isn’t initially exchanged.

- Commodity swap: Commodity swaps involve exchanging cash flows dependent on commodity prices. Crude oil is a common subject of commodity swaps, primarily involving large institutions aiming to hedge against market price fluctuations.

- Currency swap: This involves the interchange of interest and principal repayments on debt issued in various currencies. Unlike notional principal swaps, these contracts include interest obligations. Currency swaps typically occur between different countries. Companies engaged in international business find themselves exposed to foreign exchange risks. This challenge requires innovative financial tools to mitigate risks. Your answer to this challenge is the cross-currency swap. Understand cross currency swap with an example.

- Debt-Equity swap: This swap involves exchanging debt for equity or vice versa, often for financial restructuring. One party might exchange another’s debt for an equity position.

For instance, a company might offer an attractive trade ratio like 1:2, where bondholders receive stocks worth twice the bond value.

- Total return swap (TRS): Total return swaps exchange total returns from an asset for a fixed interest rate. This allows one party to pay a fixed rate for ownership of an underlying asset, such as stocks, bonds, or an index, without actual ownership.

- Credit default swap (CDS): A credit default swap offers insurance to a party if a third-party defaults on a loan extended by the second party. The first party commits to covering the principal and interest amount lost in the event of borrower default.

During the 2008 financial crisis, CDS played a significant role, especially concerning mortgage-backed securities, municipal bonds, and corporate bonds, as investors sought to offset credit risk with one another.

Also Read: The value add of exotic options trading

Parties involved in commodity swaps

Hedgers: These are producers or consumers of the commodity. They use commodity swaps to mitigate price risk. For example, a coffee producer may enter a swap to secure a fixed price for their coffee, shielding themselves from adverse price movements.

Speculators: Speculators look to profit from price fluctuations. They don’t have a direct interest in the physical commodity but engage in swaps to capitalise on anticipated market movements.

Arbitrageurs: Arbitrageurs look to profit from price differences among marketplaces or tools. They enter commodity swaps when they perceive a pricing inefficiency, aiming to profit from the price convergence.

Financial Institutions: Banks and financial institutions often act as intermediaries, facilitating them. They connect hedgers, speculators, and arbitrageurs, providing the necessary infrastructure and expertise for these transactions.

Advantages and disadvantages of commodity swap

| Advantages | Disadvantages |

| Commodity swaps allow producers and consumers to hedge against price volatility, reducing financial risk. | They can be intricate and require a good understanding of commodities, making them challenging for beginners. |

| They provide a mechanism for price discovery in commodity markets, aiding in fair pricing. | Default risk from the counterparty exists, which can lead to significant losses. |

| Contracts can be tailored to specific commodity needs, enhancing flexibility. | Some commodity markets may lack liquidity, limiting exit options. |

| Commodity swaps enhance market liquidity. | Changing regulations may impact the trading environment and terms of commodity swaps. |

Also read: Forward markets – meaning, types and features

Difference between commodity and financial derivatives

| Factors | Commodity swap | Financial derivatives |

| Nature of underlying assets | Involve physical commodities. | Involve financial instruments, such as stocks, bonds, currencies, or interest rates. |

| Purpose | Mainly used for hedging against price fluctuations or securing physical supply. | Used for various purposes, including hedging, speculation, and reducing risk. |

| Market participants | Attract producers, consumers, and traders dealing with physical commodities. | Attract a broader range of participants, including investors, institutions, and speculators. |

| Underlying risk | Primarily address commodity-specific risks like supply and demand dynamics. | Address financial market risks, such as interest rate changes or stock price fluctuations. |

| Settlement and delivery | May involve physical delivery of the commodity or cash settlement based on market prices. | Typically settled in cash without giving actual possession of the primary asset. |

Bottomline

Commodity swaps provide a means for producers, consumers, and traders to secure prices and ensure a stable supply.

While advantageous for risk mitigation and market participation, It also pose challenges, particularly for those less familiar with the complexities of the commodities market.

Therefore, understanding the mechanics, participants, and various types of commodity swaps is essential for anyone seeking to navigate this specialised segment of the financial world effectively. Enter the world of financial derivatives. Learn about currency futures, options, and swaps, and understand the difference between swaps and options.