Introduction

In the bustling world of business, the game-changing moves of mergers and acquisitions (M&A) are pivotal in shaping the face of various industries. Did you know that in 2022, the M&A market in India soared past a whopping USD 160 billion?

M&A is a strategic move used by companies to expand their reach, boost their market presence, and diversify their operations. But there is one type of M&A that might not be as well-known as others – the conglomerate merger.

Let’s dive deep into what conglomerate mergers are, explore their different types, and weigh their pros and cons.

Conglomerate Merger Meaning

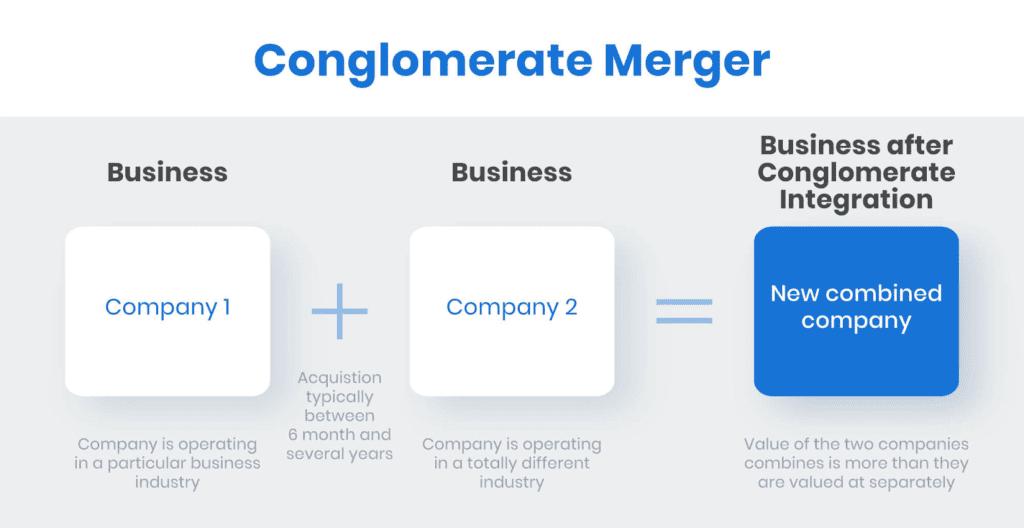

A conglomerate merger is an amalgamation or merger of two companies from entirely distinct industries or business sectors, uniting to establish a single corporate organisation. This type of merger typically involves companies from diverse industries or those situated in different geographical regions.

Source: DealRoom

This is in contrast to horizontal mergers, which involve firms from the same industry, or vertical mergers, where a firm acquires a supplier or distributor.

Conglomerate mergers bring together entities that have no immediate business relationship. The businesses involved in such a merger neither overlap nor compete with each other; however, they perceive potential advantages in combining their operations.

For more understanding: Mergers vs. Acquisitions – How are they different from one another?

Types of conglomerate mergers

Conglomerate mergers are divided into two unique categories:

Pure conglomerate merger: Here, companies that have no connection in their business activities merge. For instance, let’s say a software development firm entering into a merger with a fast-food chain.

Mixed conglomerate merger: In this scenario, the merging entities have some operational synergy despite primarily operating in different sectors. A car manufacturer merging with a tech company to improve their vehicles’ infotainment systems serves as an example.

Pros of a conglomerate merger

Conglomerate mergers present several advantages to the participating companies:

1. Diversification: A key advantage is diversification. By venturing into new sectors, companies can mitigate their risk exposure. This conglomerate diversification can bolster their resilience against economic slumps and market fluctuations.

Further, given that the merging entities operate in separate industries or markets, the consolidated company is less susceptible to sales downturns in any single industry or market. This could potentially enable the company to maintain more consistent cash flows than its competitors.

2. Cross-selling products: If the companies involved in the merger are engaged in diverse businesses but share the same target markets, a conglomerate merger could facilitate cross-selling of their existing products. This cross-selling strategy could ultimately result in increased profits for the newly formed entity.

3. Synergy possibilities: Despite the differences in industries, there are often prospects for synergies that save costs. Shared resources, such as distribution channels, marketing prowess, or research and development facilities, can enhance efficiency and boost profitability.

4. Market share expansion: A merger with a firm from a distinct industry can result in a substantial increase in market share. This can benefit companies aiming for swift expansion.

5. Risk reduction: In certain instances, conglomerate merger can stabilise the financial standing of the involved companies, thereby mitigating risk and enhancing long-term viability.

6. Access to novel technologies: Firms from unrelated sectors may possess unique technological know-how. Through a merger, they can leverage these technologies to augment their offerings.

Cons of a conglomerate merger

While conglomerate merger present a variety of potential benefits, they also carry certain disadvantages:

1. Absence of synergy: Despite the potential for synergy, it is not a certainty. The anticipated benefits may fail to materialise if the firms are unable to effectively integrate and actualise these synergies.

2. Integration difficulties: The process of merging two firms from disparate industries can be complex. Differences in corporate cultures, management approaches, and procedures can pose integration challenges, impacting the overall success of the merger.

3. Regulatory obstacles: Depending on the scale and nature of the merger, regulatory bodies might scrutinise the transaction more thoroughly. This could lead to delays and elevated compliance costs.

4. Shareholder doubts: Shareholders might be sceptical of conglomerate merger, viewing them as ventures with high risk. This scepticism can result in a decline in the stock prices of the companies involved.

5. Distraction from core operations: Managing a conglomerate merger can divert a company’s attention from its core operations. This could impede its ability to compete effectively in its primary industry.

Also read: The mega merger of HDFC and HDFC Bank

Conglomerate merger example

The term ‘Conglomerates’ has been familiar to the Indian business market since Independence, often used to refer to conglomerates such as the TATA Group, Reliance Industries, Aditya Birla Group, and ITC Limited.

These conglomerates are renowned for their business diversification strategy, which has been implemented for decades through the merger or acquisition of various companies. This strategy has expanded their market presence and ensured consistent profitability across all sectors they operate in.

Despite the active merger market in India, there have been relatively few instances of conglomerate merger.

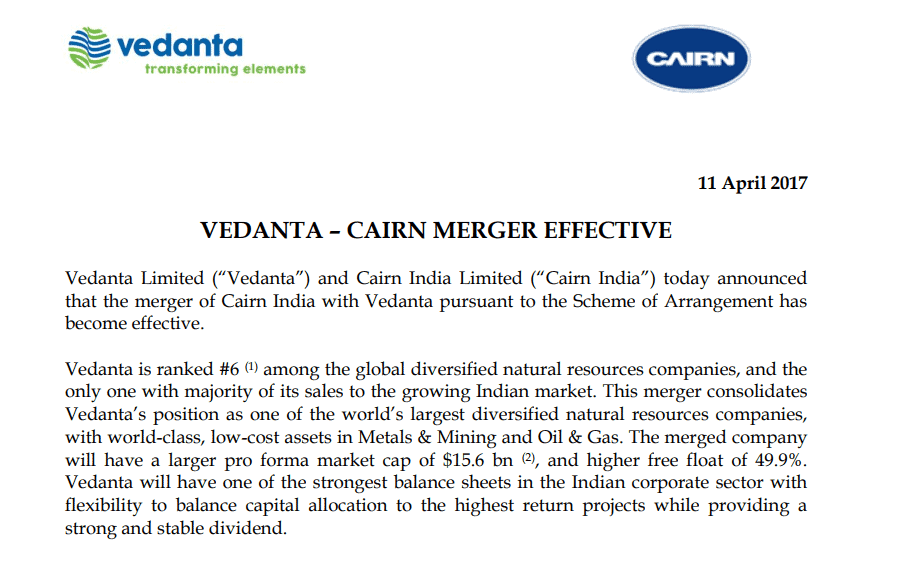

However, for instant reference, the merger deal between Vedanta Ltd and Cairn India is one of the conglomerate merger examples in India. Vedanta is a metal and mining company that announced the acquisition of oil-producing company Cairn India in 2011 and merged the entity Cairn India into Vedanta in 2017.

Source: Vedanta Limited

You may like: Zee-Sony merger to pave way for $10 billion media giant after NCLT nod

Vertical Merger vs Horizontal Merger

When you compare vertical and horizontal mergers, it’s essential to understand how they differ in terms of structure, objectives, and impact. These two types of mergers play important roles in business growth strategies but differ in their approach.

Here are the major differences between a vertical merger and a horizontal merger:

| Criteria | Vertical Merger | Horizontal Merger |

| Definition | A vertical merger is a merger where companies from the same industry but operating at different stages of the production or supply chain merge with each other. | A horizontal merger takes place between companies in the same industry or at the same stage of production in order to become one entity. |

| Objective | The goal of a vertical merger is to streamline the supply chain, improve efficiency, and reduce costs by integrating operations. | The aim of a horizontal merger is to increase market share, reduce competition, and exploit economies of scale. |

| Example | A manufacturer merging with a supplier or distributor (e.g., Microsoft acquiring Activision to control content). | An example of horizontal merger would be HP’s merger with Compaq to consolidate market position in the tech industry. |

| Impact on Competition | A vertical merger may reduce competition by limiting access to key supplies or distribution channels for competitors. | A horizontal merger reduces competition directly by consolidating market players, potentially leading to monopolistic outcomes. |

| Benefits | Ensures supply chain control, lowers transaction costs, and boosts production efficiency. | Increases market share, expands product offerings, and leverages economies of scale for better pricing power. |

| Challenges | Vertical mergers can lead to increased complexity, operational challenges, reduced flexibility, and Antitrust issues. | Horizontal mergers can cause integration challenges between companies, risk of reduced competition, and decreased innovation. |

Bottomline

Conglomerate merger stand out in the world of mergers and acquisitions (M&A), as they bring together companies from completely disparate industries to generate synergies and discover new prospects. These mergers can offer diversification, enhance market share, and provide access to novel technologies and resources.

However, they also pose integration difficulties and regulatory obstacles.

Comprehending the intricacies of conglomerate merger is vital for businesses contemplating such a strategy and investors assessing the potential implications for their investment portfolios. Read to learn all about takeover, takeover is a common term in the business world where one company acquires another to expand its operations and reach.

Stay ahead of the market with real-time alerts, intraday trade signals, and stock recommendations from SEBI-registered analysts. Check out expert trade calls app now!