Currency exchange plays a very important role in the global foreign exchange economy. Companies engaged in international business find themselves exposed to foreign exchange risks. This challenge requires innovative financial tools to mitigate risks. Your answer to this challenge is the cross-currency swap. Let us understand the mechanics, benefits, risks, and real-world applications of cross-currency swaps.

What is a cross-currency swap?

A cross-currency (xccy) swap facilitates exchange between cash flows in two distinct currencies. Corporations typically employ this financial instrument for two primary purposes:

Firstly, it allows them to secure funds in a market where they possess a comparative advantage.

Secondly, it enables them to construct a portfolio denominated in a different currency of choosing at a lower cost.

These swap arrangements are characterised by their involvement with two currencies and the corresponding interest rates associated with those currencies. Their unique nature makes them valuable tools for hedging risks stemming from both interest rates and exchange rates.

You may also like: The world of currency fluctuations: How does it impact your investments?

Illustrating cross-currency swaps with an example

Let’s explore a cross-currency swap with an example:

A U.S.-based company, A Ltd, is keen to expand its operations in India, requiring INR 8 crore for the venture. Indian banks are willing to offer a loan but at a hefty 14% interest rate. However, A Ltd can secure a loan at a more favourable 6% interest rate in the United States.

On the other side of the globe, we have B Ltd, an Indian company with ambitions to grow its presence in the United States. They need USD 1 million to fuel their expansion. In the U.S., they can access a loan at an 8% interest rate, but in India, the loan comes with a steeper 12% interest rate.

For the sake of simplicity, let’s maintain an exchange rate of $1 = Rs. 80, signifying that 1 U.S. dollar CCY(full form: currency) can be exchanged for 80 Indian rupees.

Recognising the similarity in their needs, A Ltd and B Ltd decide to help each other. They enter into a cross-currency swap agreement.

Here’s how it works:

Company A secures a USD 1 million loan at 6% for five years and transfers the amount to Company B.

In return, company B obtains an INR 8 crore loan at 12% for five years and transfers the amount to company A.

Let’s delve into the interest calculations to grasp this better:

Company A pays USD 60,000 as interest to its lender while receiving the amount from Company B in the U.S.

Simultaneously, Company B pays INR 96 lakh as interest to its lender in India, as Company A pays back the same to Company B.

The interest exchange continues for five years, eventually leading to the repayment of the principal amount in the last year. Both companies secured loans at a 2% discount in their home countries.

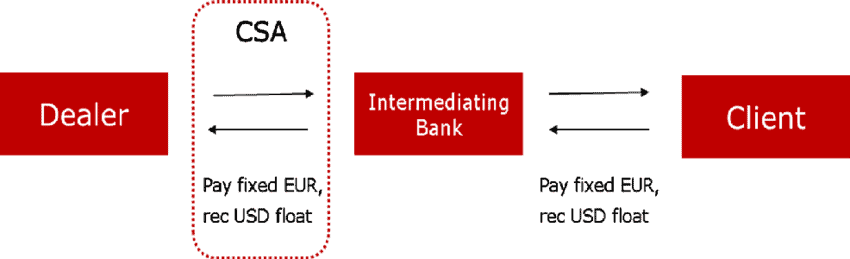

Now, it’s important to note that this example simplifies the concept of cross-currency swaps for explanatory purposes. In reality, companies may not find each other with matching requirements.

In practice, companies typically approach a bank for assistance in these transactions. Company A approaches a swap bank for the best possible INR loan terms. The swap bank might quote a 6.25% rate to Company A while retaining 0.25% as its commission. Likewise, Company B would be offered a 12.25% rate for obtaining a dollar-denominated loan.

The distinction between an interest rate swap and a currency swap lies in the actual exchange of notional principal between the two counterparties. In an interest rate swap, only the difference amount is exchanged.

Lastly, it’s worth mentioning that the interest rates in these scenarios can either be fixed or floating. Banks and counterparties can choose between LIBOR (London Interbank Offer Rate) or MIBOR (Mumbai Interbank Offer Rate), depending on what aligns best with their needs.

Also read: Forward markets – meaning, types and features

Benefits of a CCS

Let’s explore the benefits of a Cross Currency Swap:

Favourable interest rates

One of the most evident advantages of a cross-currency swap is the ability to secure borrowing at a more favourable rate. It empowers parties to access funds at a cost that is advantageous for their financial objectives.

Eliminates Foreign Currency Exposure

An alternative approach to acquiring foreign currency cash flows involves borrowing in the domestic currency and then engaging in currency exchange at the spot rate, which is the current exchange rate. However, this method carries a risk linked to the volatility of the spot rate. If the spot rates keep fluctuating in an unfavourable direction, the party may have to pay significantly higher than they had initially borrowed at the higher foreign rate available.

Cross-currency swaps offer a solution to this uncertainty by allowing parties to lock in the fixed exchange rate at the very start by providing them with a clear understanding of their cash flows.

Risks linked with a CCS

Counterparty Risk:

This is a risk of a counterparty failing to meet their payment obligations. Any party defaulting on their payments, gives rise to this risk. In such a scenario, the parties are not able to meet their loan liabilities. Swap banks play a crucial role in evaluating the creditworthiness of parties and ensuring their ability to fulfil their contractual obligations, thereby reducing the counterparty default risk.

Interest rate Risk:

The interest rate holds a significant risk for entering into a cross-currency swap. If the parties decide to enter into a contract with a fixed rate for a longer duration, interest rates can change unfavourably, leading to potential losses that could have worked in favour of the counterparties.

Where are cross-currency swaps used?

- The banking sector and financial institutions harness the power of cross-currency swaps for various purposes. It includes gaining access to foreign currencies, which they can subsequently use for lending purposes. Additionally, banks employ these swaps as a strategic tool for hedging their foreign currency funding exposures or for optimising the composition of their balance sheets.

- Corporations around the world are using cross-currency swaps to expand their business across different nations. As compared to taking loans through banks, using a cross-currency swap is a smarter option to employ when it comes to easy financing.

Also read: All you need to know about the basics of forex trading in India

Conclusion

Swap contracts possess a remarkable flexibility that allows them to be tailored to the specific requirements of all involved parties. Similar to cross-currency swaps, there are other instruments like cross-currency futures and options to hedge the risk of exchange rate fluctuations.

These contracts can potentially create mutually beneficial arrangements for all participants, including intermediaries such as banks that play a crucial role in facilitating these transactions.

However, it’s essential for participants to exercise caution and remain cognizant of potential challenges since these contracts are executed over the counter without the oversight and regulations that govern many other financial instruments.