Forex trading, sometimes referred to as currency trading, offers investors looking to gain from the always shifting prices of foreign currencies a universe of possibilities. But in this fast-paced industry, success is about learning the correct strategies rather than depending solely on chance. Even the most brilliant deals might result in losses without a strong plan, leaving traders disappointed and overburdened.

For everyone joining the forex market, knowledge of and application of proven trading strategies is crucial. These techniques let traders control risk and make quick decisions in real time in addition to guiding through erratic market swings.

Some of the most successful currency trading strategies that might enable traders to reach consistency and boost confidence will be discussed in this article.

Must read: How Forex Trading Works in India: A Complete Guide

Why trading techniques matter

Forex market trading without strategy can feel like negotiating a wild sea without a compass. This is where defined trading strategies help, they give traders direction and structure, therefore enabling them to avoid emotional decisions motivated by fear or greed. Strategic strategy helps traders to stay to their objectives and prevent expensive blunders.

With prices swayed by world events, economic data, and market mood, the currency market is infamous for its volatility. Trading methods provide traders with the means to fit these always shifting dynamics, therefore enabling them to profit on trends or protect their cash in difficult times.

One more great advantage of trading strategies is consistency. Apart from trust building, a disciplined strategy guarantees efficient management of risk, therefore reducing possible losses and optimising benefits. Simply said, anyone hoping to excel in the cutthroat realm of forex trading must first learn trading methods.

Core currency trading techniques

Trend following

With this approach, one trades in line with a recognised market trend. Riding the continuous movement of a currency pair, traders seek to make money.

Trends are found with tools including the relative strength index (RSI) and Moving Averages (e.g., 50-day or 200-day). Higher highs and lows indicate an uptrend; lower highs and lows indicate a downturn.

A trader might buy EUR/USD, for instance, during an uptrend verified by a 50-day moving average crossing above the 200-day average. Remember that the trend is your buddy. Steer clear of trading against strong trends since losses become much more likely.

Breakout trading

Breakout trading captures price movements when a currency pair breaks through key support or resistance levels.

Traders identify critical price levels using chart patterns like triangles, flags, or horizontal channels. When the price crosses these thresholds, a breakout results; usually, this is followed by more trading activity.

A trader might purchase GBP/USD, for instance, once it breaks above a 1.30 resistance level with significant volume, therefore indicating positive momentum. To minimise losses should the breakout fail, always set stop-losses somewhat below the level of breakout.

Scalping

Scalping is a short-term tactic used to capitalise on little, regular earnings by means of modest price swings.

Scalpers target quick trades within minutes or seconds, using tight spreads and real-time data. Scalping calls both constant price change monitoring and a fast-paced trading platform.

During a tumultuous session, for instance, a trader might start and close several bets on USD/JPY, making modest gains on every trade. Choose low-cost trading platforms since regular trades can rapidly accumulate fees, therefore lowering profits.

Carry trade

Often maintained for a long term, this approach makes money off of interest rate variances between two currencies.

Traders borrow low-yield currencies (e.g., JPY) then purchase high-yield currencies (e.g., AUD). The interest differential adds to the profit, alongside potential currency appreciation.

For example a trader holding AUD/JPY earns daily interest while benefiting from an increase in the AUD’s value. Be cautious of sudden currency depreciation, as it can negate any interest income or gains.

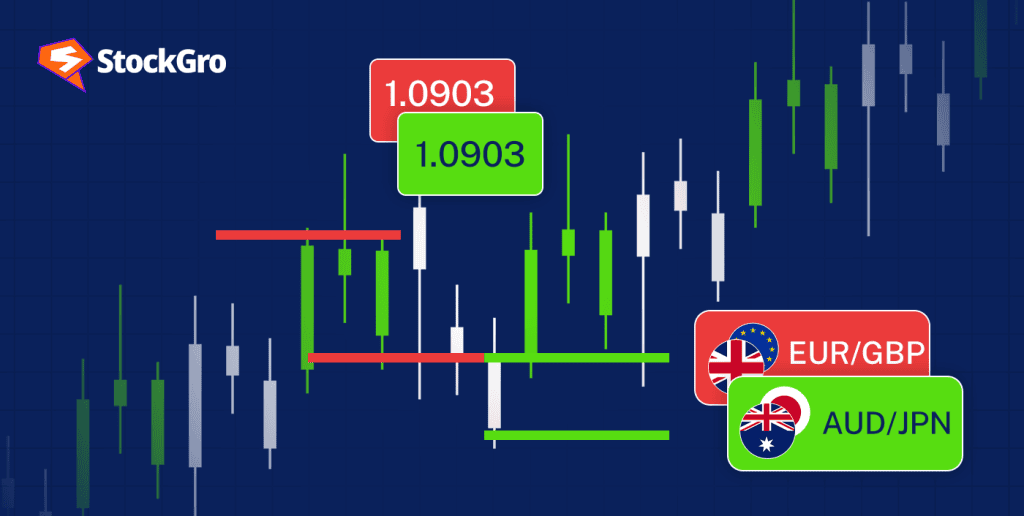

Range trading

This method concentrates on trading in a sideways or non-trending market between well defined support and resistance levels.

While selling around resistance levels, where the price usually reverses, traders purchase near support levels, where the price is likely to rebound.

In a sideways market phase, for instance, a trader may purchase EUR/GBP at a support level of 0.85 and sell at a resistance level of 0.87. Steer clear of range trading during significant economic news events since these can cause breakouts, therefore invalidating support and resistance levels.

You may also like: Forex trading simplified: Smart tips for success

Advanced techniques for experienced traders

Hedging

Hedging is opening counter trades to defend current positions, therefore lowering the chance of negative price swings.

Traders balance possible losses with linked currency pairs. EUR/USD and USD/CHF, for instance, regularly fluctuate inversely, offering chances for efficient risk reduction. To balance exposure, a trader long on USD/JPY might open a short position on EUR/USD, therefore partially offsetting a loss in one position by a gain in the other.

Hedging is about properly managing risk, not about eradicating all of it in difficult economic times.

Algorithmic trading

Using automated trading programs (bots), this approach runs transactions depending on pre-defined parameters including price levels, technical indications, or volume.

Real-time market signal monitoring by algorithms guarantees speed and accuracy since they run trades without human involvement.

Starting with basic algorithms like moving average crossovers, beginners should test them extensively on demo accounts before using them on actual trading.

News-based trading

Trading based on news bases on reacting to market-moving announcements, geopolitical events, or economic data releases.

For events including political developments, employment statistics, or interest rate decisions, traders check economic calendars. React quickly to news and you can make big money.

A trader might short USD/INR, for instance, expecting a drop in the value of the US dollar after less than expected US job data.

To escape being trapped in excessive market volatility, news-based trading calls for being aware and having a clear exit strategy.

Tips for applying currency trading techniques effectively

Learning money trading strategies is only half the fight; the secret to regular success is using them properly. Here are some doable pointers to maximise your initiatives:

- Combine techniques: Combine methods to boost accuracy instead of depending just on one approach. For instance, use trend following to identify the market direction and breakout trading to confirm your entry points. This combination reduces false signals and enhances profitability.

- Adapt to market conditions: Market behavior isn’t static—it shifts between trending and range-bound phases. Adjust your approach accordingly. For trending markets, focus on techniques like trend following or carry trades. In contrast, range-bound markets call for range trading strategies.

- Use risk management: No strategy is foolproof, so pair every technique with robust risk management. Set stop-loss orders to cap potential losses and maintain proper position sizing to avoid overexposure. This helps protect your capital during unexpected market moves.

- Practice first: Before risking real money, test your strategies on demo accounts. This allows you to fine-tune your techniques, understand market dynamics, and build confidence without financial risk.

Further reading: Forex leverage: Higher returns with added risks? A balanced perspective

Bottomline

In the often changing forex market, success mostly depends on mastering trading strategies. From trend following to sophisticated methods like algorithmic trading, every method gives traders the tools they need to negotiate market complexity, control risks, and grab opportunities.

These strategies should be seen by aspirant traders as stepping stones rather than quick fixes. Explore each method, practice them in demo accounts, and refine your approach based on experience and market conditions. Remember, consistent improvement is key to long-term success.

FAQs

Which strategy is best for currency trading?

The ideal approach for trading currencies depends on personal objectives and state of the market. For long-term moves, trend following is best; for erratic markets, breakout trading works. Scalping carries trade advantages from interest rate variances and fits those looking for quick, tiny earnings. Combining several techniques and adjusting to changes in the market will improve accuracy and profitability, therefore guaranteeing a balanced approach to forex trading.

What is the best way to trade currencies?

Combining trend tracking, breakout trading, and scalping can help you trade currencies the best. Crucially, one should adjust to the state of the market, apply strong risk management, and practise on simulated accounts. Using techniques like algorithmic trading and keeping current on economic happenings will help to improve accuracy and profitability. Long-term forex market success depends mostly on regular practice and rigorous execution.

What is the 5-3-1 rule in forex?

In forex trading, the 5-3-1 rule is a guide for novices looking to streamline their strategy. It advises concentrating on five pairs of currencies, honing three trading techniques, and trading one particular time every day. This approach enables traders to develop a thorough awareness of particular pairings, improve their techniques, and keep consistency in their trading pattern, thereby improving their whole trading performance.

Is currency trading profitable?

Though it needs knowledge, ability, and dedication, trading currencies can be rewarding. Success comes from knowing market trends, using smart plans, and controlling risks. While some traders make regular gains, others could suffer large losses. To improve the possibilities of profitability in the erratic forex market, one must keep informed, practise on demo accounts, and apply strong risk management strategies.

Is forex legal in India?

Forex trading is permitted in India but under close control by the Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI). Only brokers approved by these regulating authorities can trade FX for Indian citizens. To guarantee adherence to the Foreign Exchange Management Act (FEMA), trading consists only in pairs involving the Indian Rupee (INR).