All stocks are subject to price fluctuations depending on the market conditions. Some are highly volatile, while others are less volatile. But do you know of stocks whose price movements follow the business cycle? Yes, there are some industries in the economy whose share prices are largely dependent on macroeconomic factors.

We will discuss such stocks in this article, with their features and impact on investors. Read further to know its benefits and limitations to see if such cyclical stocks are for you.

You may also like: What are cyclical and non-cyclical stocks?

What Are Cyclical Stocks and How Do They Work?

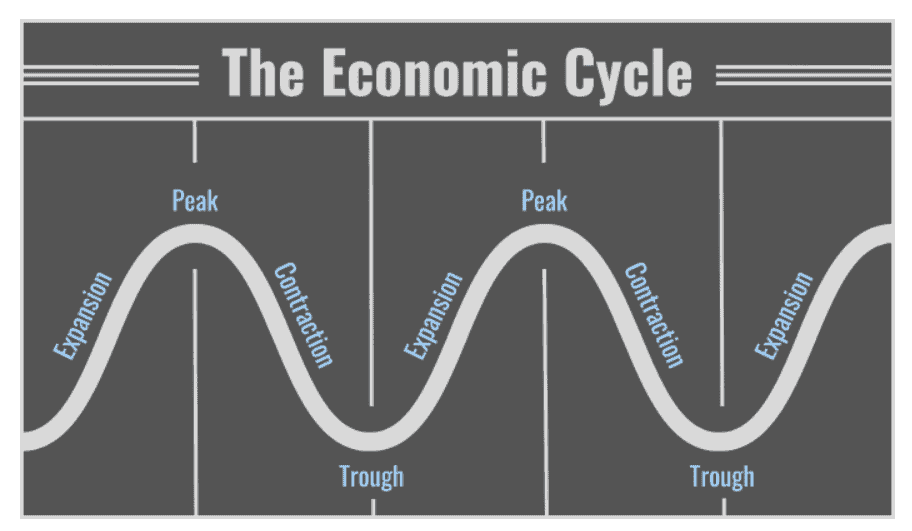

A cyclical stock is one where the price of the stock relies on macroeconomic conditions, i.e., it moves as per the economic movement of the country. These stocks follow the economic or business cycle, whose prices go through four phases.

It is essential to know the four phases of a business cycle to understand the functioning of cyclical shares:

- Expansion – The first phase of the business cycle is the expansion or growth phase, where businesses are booming, leading to a rise in the whole economy.

- Peak – The economy has grown to its maximum potential when it reaches the peak phase. It indicates that the economy cannot grow any further.

- Contradiction – Once the economy has reached its highest point, a correction takes place. Here, employment falls, prices fall, and the overall economy starts going downward.

- Trough – When the economy continues to fall, a recession occurs. Prices fall further, and more people lose jobs, leading to an economic depression or trough.

Source: The Street

Post the trough, the economy slowly starts recovering and reaches the expansion phase again. Every economy goes through this cycle, but the time and recovery strategies indicate how strong an economy is.

Sectors that directly deal with consumer-related non-essential goods and services, generally fall under the cyclical industries.

Consider the example of a luxury bad. Would you buy it when your job is insecure and at stake? No, you would rather save the money and use it for essential needs.

So, when the economy is in a recession, such industries also see a downside as consumers focus more on their basic needs. Hence, the prices of such stocks follow the economic patterns.

Cyclical stocks Examples

Let us take the example of some cyclical industries in India to understand the impact of the economic cycle on them:

- Travel industry – Consider the situation of travel facilities like airlines, railways, etc., during an economic depression. People hardly travel during such times unless there is an emergency. So, economic lows have a significant impact on travel. The impact, is then passed on to hotels providing accommodation as there are no visitors.

Examples of cyclical stocks in India: Indigo Airlines, Lemontree hotels

- Non-essential retail industry – Take the cosmetic industry, for example. It is a non-essential product in the retail sector. During an economic slowdown, people would prefer saving their money for essentials rather than spending on make-up and cosmetic products.

Example of Indian stock: Nykaa, owned by Fsn E-Commerce Ventures Ltd

- Automobile – People refrain from scraping old vehicles and buying new ones during a depression. It goes back to saving money for other priorities over luxurious spending.

Example of India stock: Maruti Suzuki India Ltd

Let us now see a cyclical stock in India, whose prices fell during the COVID-19 pandemic. The COVID-19 pandemic led to the global economic slowdown, and India was no exception to this.

Tata Motors: The shares of Tata Motors were trading at around ₹500 in 2017. However, the stock prices started falling in 2018 due to various negative news about Tata Motors and Jaguar Land Rover, its subsidiary. As an impact of such news, the prices fell below ₹200 in 2019.

To add to the crisis, COVID-19 had a severe impact on Tata Motors, and the price went to as low as ₹65 in 2020.

Slowly, along with economic improvement, Tata Motors improved its performance, and the price stands at ₹667.60 as of 20 Oct 2023.

Also Read: Risk management in stock market

Cyclical stocks benefits and limitations

Pros of investing in cyclical stocks:

- If investors invest in cyclical stocks during times of contraction and trough, they make huge returns when the price of such stocks goes up during expansion and peak.

- Cyclical stocks are easily identifiable. Usually, stocks falling under non-essential sectors are covered here. Investors can also track price patterns to identify stocks that move with the economic cycle.

- Speculating the price movements of cyclical stocks is easy and less risky. Predicting the price patterns of regular stocks is complex, whereas, cyclical stocks are directly linked to the economic cycle, making it easy for investors to be prepared for the stock’s highs and lows.

Cons of investing in cyclical stocks:

- To reap the benefits of easy speculation, investors must be capable of predicting economic movements accurately and in advance. Forecasting economic patterns is complex and may not be possible by laymen.

- While cyclical stocks offer heavy profits during expansion and peak, their prices stoop really low during economic depressions, which is risky for investors.

- The economy takes a while to recover after a depression. So, cyclical stocks may take a long time to perform well again. Some stocks fail to recover from economic lows, because of which investors incur heavy losses.

Comparing Cyclical and Non-Cyclical Stocks

While cyclical stocks react to economic cycles, non-cyclical stocks do not get influenced by economic conditions. The prices of such stocks remain stable despite economic lows, given their significance at all times.

Non-cyclical stocks usually include essential industries like food, healthcare, etc.

Stocks in non-cyclical industries are less risky and more stable, as compared to cyclical stocks.

Also Read: Market cycles: Riding the rollercoaster of stocks

Bottomline

Investing in cyclical stocks should purely depend on an individual’s risk tolerance and reward expectation.

These stocks are volatile and follow the economic movement, leading to high returns during booming phases and high risks during falling phases. So, investors trading in cyclical stocks must have a strong grip on the market to analyse and predict future economic movements.

FAQs

How do economic cycles affect cyclical stocks?

Cyclical stocks are highly sensitive to economic cycles. They perform well during economic growth (expansion and peak phases) when consumer spending increases but experience sharp declines during slowdowns (contraction and trough phases). For example, sectors like travel and automobiles suffered during the COVID-19 pandemic due to reduced demand.

When is the best time to invest in cyclical stocks?

The ideal time to invest is during contraction or trough phases when stock prices are low. As the economy recovers, these stocks typically rebound, offering high returns. However, predicting the economic recovery requires a solid understanding of market trends.

What are the key indicators of cyclical stock performance?

Indicators of cyclical stocks include GDP growth, consumer confidence, employment rates, and interest rates. Rising GDP and employment signal better conditions for cyclical stocks, while low interest rates can boost spending on discretionary goods.

How can you identify cyclical stocks in the market?

Cyclical stocks are often linked to non-essential industries like travel, luxury goods, and automobiles. Analysing historical price movements and their alignment with economic cycles can help you identify these stocks.

What industries are typically considered cyclical stocks?

In India, key cyclical industries include automobiles (e.g., Maruti Suzuki), travel and hospitality (e.g., Indigo, Lemon Tree Hotels), non-essential retail (e.g., Nykaa), and real estate. These sectors thrive in economic growth but struggle during downturns.