Have you been worried about the volume of debt you have taken to fund a house or any asset? Similarly, companies also need to monitor and continuously measure the amount of debt they take from the market and various financial institutions to run operations and invest in growth.

It is a criterion even an analyst and investor need to look at for various potential stocks. We will discuss everything about how to measure and interpret this essential ratio called “DEBT -EQUITY (D/E)” and its impact.

Financial ratios and their importance

If you are an investor wishing to invest in a certain company, you may engage in two types of analyses- fundamental and technical. One of the pillars of fundamental analysis is financial ratios.

Before investing in a company’s stocks, financial ratios can be used to assess its financial standing. They can be used to estimate potential earnings, growth of the company, and other critical factors. The ratios can be calculated using figures from the company’s financial statements.

One of the important ratios under Solvency ratios is the Debt to Equity ratio. It is the comparison of how much loan or debt a company has taken and in comparison how much equity (or owned funds) they have to pay off the debt.

Also called the RISK-GEARING ratio, it is an indicator of the external financial risk a company has taken on its balance sheet.

You may also like: Understanding the P/E ratio

What is debt to equity ratio?

The debt to equity ratio is an important type of leverage or solvency ratio. Is the company solvent enough – i.e. can it pay off its liabilities without going bankrupt? This ratio helps investors understand how much debt a company has relative to its shareholders’ equity. It is calculated using the company’s long and short-term debt and its shareholders’ equity. These figures are found in the balance sheet.

Debt to Equity Ratio Formula – Total Debt / Book Value of Equity

The book value of equity also considers the reserves in the balance sheet.

Interpretation of debt to equity ratio

Generally, a company with a low debt-to-equity ratio is desirable. It is because the higher the ratio, the higher the chance that the company might default on its loans. A lower debt-to-equity ratio may not always be a suitable position for a company.

This is because the cost of equity is way higher than the cost of debt in the long run and can be associated with uncertainty regarding dividend payments and the principal repayments at the time of winding up.

While extreme dependence on debt makes a company highly geared and, thus, proportionately riskier in terms of defaults on interest and principal repayments, high dependence on equity is not a good thing either.

This is because unwillingness to take on debt may be directly associated with the company’s creditworthiness and financial position. A healthy mix of both is desirable.

Apart from this, a company with a negative D/E ratio indicates that it is insolvent.

Example for debt to equity ratio

To understand debt to equity ratio better, consider the case of two fictitious companies, ABC Ltd. and XYZ Ltd. whose details are below-

| Total Debt (in Cr.) | Book Value of Equity (in Cr.) | Debt to Equity Ratio | |

| ABC Ltd. | 30 | 10 | 3 |

| XYZ Ltd. | 4 | 3 | 1.3 |

Here, company XYZ Ltd. is desirable by investors due to its low debt-to-equity ratio as compared to company ABC Ltd in theory. However, this is a simplistic view of the interpretation.

One needs to see the industry, the operating environment and the company’s growth path. The shareholders’ meeting and notes in the annual report represent this direction well.

A company with a D/E of 3 can be a capital-intensive industry like construction or even financial services. Thus, it should be compared where each of these companies belongs.

Also, if a company’s profits can service such a debt in the same industry, then it should be taken as a positive sign.

Also Read: Understanding the difference between equity and debt IPO for the right investment

What is a good debt-to-equity ratio?

Generally, a good debt-to-equity ratio is that 2:1. A company’s debt should not exceed twice the amount it has raised via equity, including reserves. This norm, however, varies from industry to industry and the company’s stage in the business life cycle.

For example, a capital-intensive company may have a higher debt-to-equity ratio because of the huge investments they end up making in long-term operational and manufacturing assets.

Similarly, a company in the launch phase of the business life cycle may have a lower debt-to-equity ratio as it has not reached the stage where it can go for debt-based funding compared to a company in its maturity phase.

Debt to equity should not be considered standalone

While we are looking at a “good” D/E, here is an interesting example for our readers of how only looking at a particular ratio can be misleading.

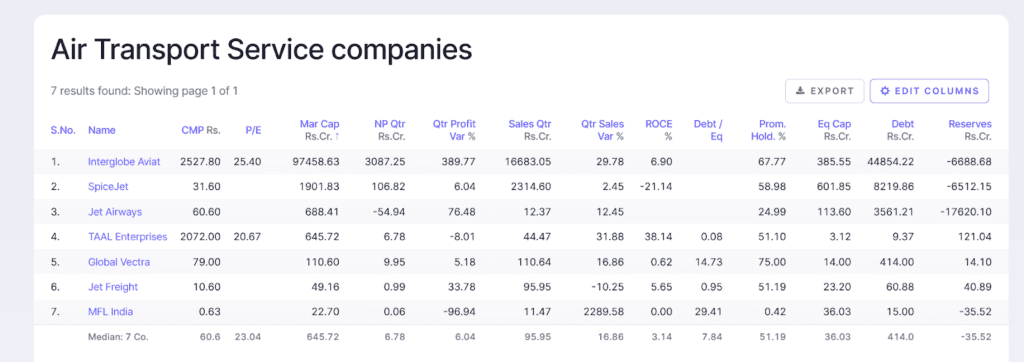

See the chart below and see the Debt/Equity ratio for the top 3 companies in the airline industry is missing. This is an indication of negative D/E. You can see the reserves of these three companies are negative, thus showing that these top three players in an industry can have the lowest D/E!! Isn’t this an enigma?

Interglobe Aviation is the top player with maximum routes and revenue. But it has been burning its equity and reserves on the balance sheet since COVID-19 due to poor profitability. Thus, leading to negative ratios.

Examples of Indian companies managing their debt-to-equity ratio successfully

Companies in India approach money management differently, especially when deciding how much debt to use compared to equity. Here are some real-life examples:

- Understanding the Average: A study took a close look at 300 private companies in India between 1999 and 2010. They found that the average debt-to-equity ratio (D/E) was 1.22, which is actually lower than what’s typical worldwide. It also found that companies in sectors that need a lot of capital upfront, like manufacturing, tend to have higher D/E ratios.

- Focusing on Steel: Another study zoomed in on 66 Indian steel companies and found something interesting. The lower a company’s D/E ratio, the higher its return on equity. This means that companies with less debt than equity were often more successful.

- A Look at a Giant: Reliance Industries Limited, one of India’s biggest companies, was also analysed. The study found that this giant prefers to play it safe, keeping its D/E ratio low compared to others in the industry. Instead of borrowing money, they use their funds to run their operations.

Also Read: Earnings Per Share (EPS): What it means and how to calculate it

Conclusion

Investors can analyse the risk of businesses with high levels of leverage using the D/E ratio. In actuality, debt can aid in a company’s growth and its generation of extra revenue. However, cautious investors should investigate further if a company has depended on debt excessively and disproportionately, particularly concerning the industry norms.