Bonds are debt instruments that are one of the suitable investment avenues for investors looking for stable income. Bonds come in various types based on their features. Deep discount bonds are one of those types where bonds are offered at a discount.

Let us discuss the meaning, features and calculations of deep discount bonds. Read further to know if this option meets your investment objectives.

What are bonds?

Bonds are debt financing instruments. They are also called fixed-income instruments, as they provide a fixed interest to investors at periodic intervals. Governments and corporations issue bonds to the public to raise funds in the form of loans.

Also read: Bond voyage: Unraveling the intrigue of Bonds

Depending on the interest rate and issue price, bonds are classified into different types like zero-coupon bonds, inflation-indexed bonds, deep discount bonds, floating rate bonds, etc.

What is a deep discount bond?

Before we delve into deep discount bonds, it is essential to understand the meaning of the two primary concepts of bonds – the face value and the issue price.

- The face value refers to the value at which the bond was created. It is the value that the issuer will pay the bondholder at the time of maturity.

- The issue price is the cost at which the bondholder purchases the bond.

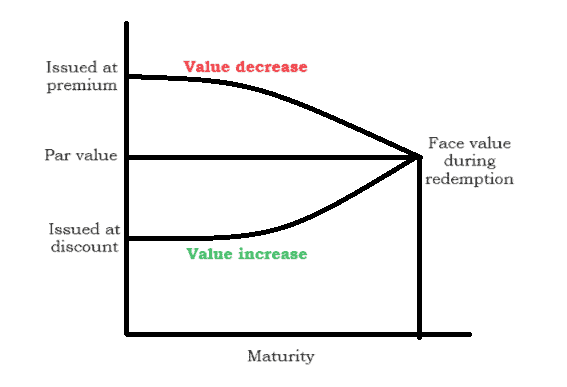

- When the issue price = face value, the bonds are issued at par.

- When the issue price > face value, the bonds are offered at a premium.

- When the issue price < face value, the bonds are issued at a discount.

When bonds are issued at a significant discount, they are called deep discount bonds. The distinction between the face value and the issue price of such bonds is 20% or more, i.e., the issue price of deep discount bonds is 20% less than the face value of the bonds.

Also read: Government bonds in India – Meaning, types and features

Features of deep discount bonds

- Deep discount bonds are high-risk bonds whose demand is significantly lower than others in the debt market.

- Deep discount bonds carry minimal to no periodic interest at all in some cases, as they offer heavy discounts at the time of issuance.

- Some deep discount bonds fall under the category of junk bonds as the creditworthiness of the issuer of such bonds is low. These bonds usually have concerns around repayment, making them highly risky.

- Similar to other bonds, the issuer must pay the face value to the owner of the bond during redemption, if it is held until maturity.

Bond prices and interest rates move inversely. If the interest rate in the market increases, the value of existing bonds offering lower interest rates falls. The low value naturally impacts the demand for such bonds. Issuers resort to offering bonds at discounts to overcome the lack of demand. When investors still do not find it attractive, issuers offer further discounts, leading to deep discount bonds.

Deep discount bond calculation

The price of deep discount bonds can be calculated as below if the face value, discount rate and maturity period are known:

P = F/ (1+r)^n P = Price, F = Face value, r= discount rate, n = Number of years till maturity.

The formula to calculate the yield-to-maturity (YTM) on discount bonds:

YTM = {C + [(F-P)/n)]} / {(F + P)/2}

C = Interest, F = Face value, P = Issue price, n = Number of years till maturity

Yield to maturity helps to ascertain the total returns earned from a bond that is held until its maturity.

Deep discount bonds example

Consider Company ABC Ltd offering bonds of face value ₹1,000 at an issue price of ₹750, with a maturity period of 3 years.

These bonds are issued at a discount of 25% and will be redeemed at ₹1,000 upon maturity.

Below are examples of some of the deep discount bonds issued in India:

- IDBI deep discount bonds: Industrial Development Bank of India (IDBI) was one of the initial issuers of discount bonds in 1992. The face value of the bond was ₹1,00,000, to be redeemed after a maturity period of 25 years. The bond was issued at ₹2,700.

- Sardar Sarovar Narmada Nigam Ltd deep discount bonds: SSNNL issued deep discount bonds in 1993 for a period of 20 years, with a face value of ₹1,11,000. The bond was offered at ₹3,600 in 1993.

You may also like: What are bonds and debentures? How are they different from each other?

Deep discount bonds: Pros & cons

Pros of investing in deep discount bonds:

- Given the significant difference between the issue price and face value, deep discount bonds result in high profits.

- Deep discount bonds are usually low-priced compared to other bonds in the market, making discount bonds accessible to all kinds of investors.

- Deep discount bonds are suitable for long-term investors as they reap high profits at the time of maturity.

- Discount bonds are easily tradable in the secondary market, making these bonds highly liquid.

Cons of deep discount bonds:

- Issuers offering deep discount bonds are generally considered to be in distress. Anything available at a discount is usually seen as an item of low quality. Similarly, deep discount bonds are seen as instruments with low reputations.

- The possibility of defaults is high for deep discount bonds, making them high-risk investments.

- A zero-coupon bond is a variant of a deep discount bond that does not pay any interest. Such bonds defeat the purpose of fixed-income securities.

What is the difference between a zero coupon and a deep discount bond?

At first glance, zero-coupon bonds and deep discount bonds may seem similar—both offer no regular interest payouts and are sold at a price significantly lower than their face value. However, there are key differences:

| Feature | Zero Coupon Bond | Deep Discount Bond |

|---|---|---|

| Interest Payout | No periodic interest | No periodic interest |

| Issued By | Typically governments or corporates | Usually issued by government agencies, PSUs, or large corporates |

| Price Discount | Moderate to significant | Steep discount (up to 80–90% lower than face value) |

| Maturity | Typically 1 to 10 years | Often long-term (10–30 years) |

| Tradability | Actively traded in secondary markets | Traded but less liquid due to longer maturities |

In short: Every deep discount bond is a zero-coupon bond, but not every zero-coupon bond is deeply discounted.

Best Strategies for Profitable Deep Discount Bond Trading

Trading deep discount bonds isn’t about short-term gains—it’s about timing, patience, and understanding interest rate cycles. Here are some strategies to help you make the most of them:

1. Buy During High-Interest Rate Periods

Deep discount bonds benefit the most when interest rates are falling. Buying them when rates are high means their value could rise as rates drop, allowing you to sell before maturity at a higher price.

2. Hold Till Maturity for Tax-Efficient Gains

If you’re a long-term investor, holding the bond until maturity ensures you receive the face value, which is significantly higher than your purchase price. This is especially effective for tax planning.

3. Use as a Long-Term Goal Investment

Want to fund your child’s education or your retirement? A ₹1,000 face value deep discount bond might cost ₹300 today—making it ideal for long-term compounding without market volatility.

4. Pair with Short-Term Income Instruments

Balance your portfolio by combining deep discount bonds with income-generating assets like fixed deposits or dividend stocks to maintain liquidity.

5. Monitor Market for Exit Opportunities

If interest rates decline and bond prices rise, consider selling in the secondary market before maturity to book profits early.

Key Challenges and Risks in Trading Deep Discount Bonds

While deep discount bonds can be highly rewarding, they come with their own set of risks:

1. Long Lock-In Period

These bonds often mature after 10, 15, or even 30 years. If your financial goals change, early exit might not be easy.

2. Interest Rate Sensitivity

Bond prices and interest rates move in opposite directions. If interest rates rise, your bond’s market value could fall.

3. Liquidity Risk

Not all deep discount bonds are actively traded. If you need to sell before maturity, finding a buyer could be difficult.

4. Tax Implications

Capital gains on redemption may be taxable depending on your holding period. Without proper planning, taxes can reduce your effective returns.

5. Credit Risk

Although many deep discount bonds are issued by PSUs or government-backed institutions, those from private companies carry the risk of default.

Bottomline

Deep discount bonds are debt instruments offered by the government and corporations to raise loans from the public. These bonds are offered at a price that is quite lower than their face value. Deep discount bonds are associated with high risks and returns. Hence, these bonds are a suitable avenue for those investors who are willing to take high risks for high returns in the long term.

Frequently Asked Questions (FAQs)

A deep discount bond is a zero-coupon bond issued at a steep discount to its face value. It doesn’t pay periodic interest. Instead, you receive the full face value at maturity. For example, you might buy a bond at ₹250 today that matures at ₹1,000 in 20 years.

Redemption usually happens automatically at maturity, when the issuer credits the face value to your registered bank account. If held in demat form, the bond is credited and settled through your broker or depository.

Yes, but only if the bond is listed and actively traded in the secondary market. Keep in mind that early redemption might not fetch the full face value and depends on market demand.

Yes. The difference between your purchase price and redemption value is considered capital gain. If held for more than 12 months, it qualifies as a long-term capital gain (LTCG) and may be taxed accordingly.