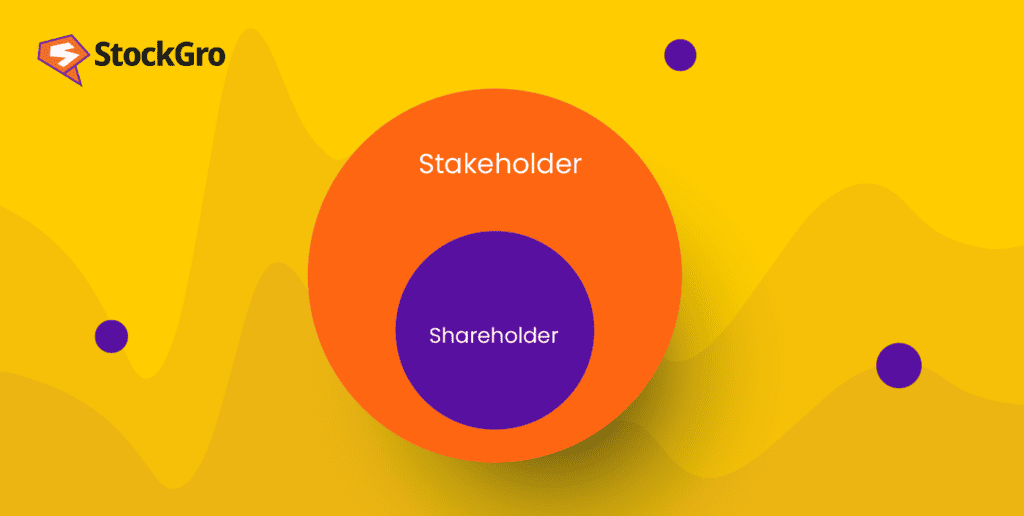

If you were to buy one stock of Reliance Industries Ltd. on an exchange today, you would become a registered stockholder of the company. This means that even though you’re a very very small fish, you’re still an owner of Reliance Industries.

However, by no means are you a stakeholder in Reliance’s operations. To become a stakeholder, you’d have to have a ‘stake’ in any of Reliance’s operations. As a stakeholder, the outcome or costs of these operations would directly affect you, incentivising your participation.

In this brief article, we’re going to explore what shareholder vs stakeholder are, when you can be one and not the other, and what the difference in responsibility is.

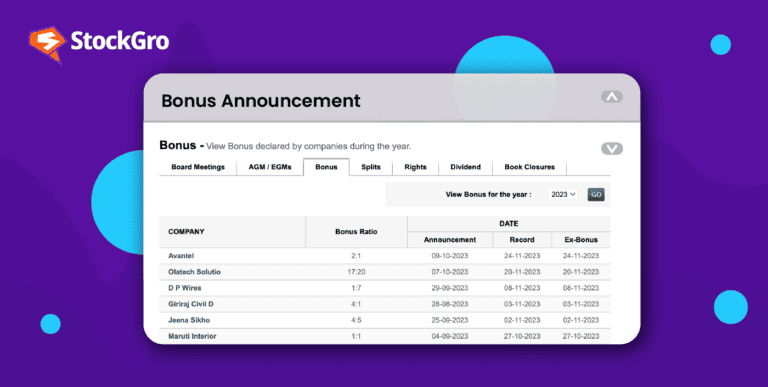

You may also like: A guide to stock dividend

Who is a shareholder?

A shareholder is someone who owns stock in a company. The quantity doesn’t matter. While someone who owns 0.00004% of a company would have no say in the company’s operations compared to someone who owns 10% or 15%, they’re a shareholder nevertheless. Shareholders who own less than 50% of shares have a non-controlling interest in the company, meaning that while they have a significant vote in the company’s decisions, they don’t have the final say.

The incentive for minority shareholders is a financial return on the investment. As a shareholder, you’re most likely interested in seeing the company grow, pay out dividends, and have your per-share price go up so you can sell for higher later on.

As a shareholder, you’re also privy to voting on company policies like mergers and acquisitions, electing the board of directors, etc. These decisions start to matter as you own more and more of the company because it is these decisions that, in a large way, decide how the company performs financially.

Types of shareholders

There are different types of shareholders, depending on the type of shares they own:

- Common shareholders – These are people who hold common stock – the ones traded on the markets every day. Anyone can own common stock in a company, vote on corporate policies, and elect the board of directors. However, owning common stock comes with a lot of risk. If the company ever goes bankrupt, common stockholders can only claim assets after the bondholders, debtors, and preferred shareholders are paid in full.

- Preferred shareholders – These holders have preferred stock. This means that while these shares earn less returns in the long-term, they’re given preference over common shareholders if the company goes under. Preferred shareholders can’t vote on policies or elect board members.

- Advisory shares – Advisory shares are usually issued by early-stage companies that value financial and strategic guidance from established advisors like entrepreneurs, angel investors, senior executives, or other businesspeople. Advisory shares don’t come with a right to vote; advisory shareholders are given stock options in payment.

Also Read: An essential guide to shares – types & significance

Who are stakeholders in a company?

A stakeholder is anyone who could be impacted by a project that a company is working on. Stakeholders could be people who work on that project inside the company, the team that manages the project, external collaborators, suppliers, logistics teams, etc. In this case, shareholders could also be project stakeholders if the company expects it to impact the share price.

Types of stakeholders

There are two main types of stakeholders for a company:

- Internal stakeholders – Internal stakeholders are individuals directly affiliated with the organisation, including colleagues and collaborators from different departments. Typically, these stakeholders are employed by the company. In this case, shareholders qualify as internal stakeholders due to their connection through company stocks. Their interest, which is the company’s financial growth, is significantly influenced by the projects the company undertakes.

- External stakeholders – On the other hand, external stakeholders are individuals without a direct association with the company, such as customers, end users, and suppliers. Despite being external, the company’s projects still impact them. These external stakeholders may or may not be shareholders.

Also Read: Unlocking the power of preference shares

Shareholder vs Stakeholder

Here are some differences between shareholder vs stakeholder in a company.

| Aspect | Shareholders | Stakeholders |

| Definition | Owners of company equity (shares/stocks). | Individuals or entities with an interest in or affected by the company’s activities. |

| Primary interest | Financial returns, mainly through dividends and capital appreciation. | Diverse interests, including financial, social, environmental, and ethical concerns. |

| Relationship with the company | Direct ownership of a portion of the company. | Varied relationships; not necessarily direct ownership, but may include customers, employees, suppliers, etc. |

| Legal rights | Hold legal rights, such as voting on certain company decisions. | Limited legal rights, often without voting power, but may influence decisions through other means. |

| Focus | Primarily focused on financial performance and value creation. | May have a broader focus, including ethical practices, sustainability, and corporate social responsibility. |

What Legal Rights Do Shareholders and Stakeholders Hold?

Shareholders and stakeholders have different legal rights in a company. While both play significant roles in its operations, the rights they hold vary depending on their involvement and the structure of the company.

Shareholders’ Legal Rights:

Shareholders are individuals or entities that own shares in a company. Their rights are primarily focused on the ownership and governance of the company. These legal rights include:

- Right to Vote: Shareholders have the right to vote on significant company matters, such as electing directors to the board, approving mergers or acquisitions, and other important decisions at the Annual General Meeting (AGM) or Extraordinary General Meeting (EGM).

- Right to Dividends: Shareholders are entitled to receive dividends (a portion of the company’s profits) if declared by the board of directors. The amount is usually proportional to the number of shares held.

- Right to Information: Shareholders have the right to receive financial statements, annual reports, and other relevant information to make informed decisions about their investments.

- Right to Attend Meetings: Shareholders can attend AGM or EGM and participate in discussions about the company’s performance, strategies, and future plans. They can ask questions and express opinions.

- Right to Transfer Shares: Shareholders can sell, transfer, or trade their shares freely (except in cases where there are restrictions imposed, like in private companies).

- Right to Residual Assets: In case of liquidation, shareholders have the right to claim the company’s residual assets after all debts and liabilities have been settled. However, this right comes after creditors and bondholders have been paid.

Stakeholders’ Legal Rights:

Stakeholders are individuals or groups who have an interest in the company’s performance and operations but do not necessarily own shares. Their rights are more varied and less formalized than those of shareholders, but they still hold significant influence over the company. These rights can include:

- Employees: Employees have the right to fair wages, benefits, job security, and safe working conditions. They also have the right to participate in company initiatives, such as pension plans or employee stock ownership programs (ESOPs), if offered.

- Creditors: Creditors, including banks and financial institutions, have the legal right to receive payments on loans or debts owed by the company. If the company defaults, creditors can take legal action to recover their funds.

- Suppliers: Suppliers have the right to receive payment for the goods or services they provide to the company. They can enforce contracts legally if the company fails to honor agreements.

- Customers: Customers have the right to receive goods and services that meet agreed-upon standards and quality. They can seek legal remedies if a product is defective or if services are not rendered as promised.

- Regulatory Bodies: Government agencies and regulators have the right to ensure that the company complies with all relevant laws and regulations, including tax laws, environmental regulations, and labor laws. Non-compliance can result in legal actions, fines, or penalties.

While stakeholders hold rights that are more focused on their specific interests in the company, shareholders have formal ownership rights that include governance and profit-sharing.

Conclusion

In conclusion, the distinction between shareholder vs stakeholder is important to understand the web of relationships surrounding a company. While shareholders, as equity owners, focus on financial returns and have direct legal rights, stakeholders are a broader spectrum of individuals or entities with varied interests.

FAQs

The importance of shareholders and stakeholders depends on the context in which you’re looking at the company. Shareholders have more direct influence on the company’s decisions through voting rights, as they own the company. However, stakeholders, including employees, customers, and creditors, are critical for the company’s long-term sustainability. A company’s success depends on balancing both parties’ interests — shareholders may drive profitability, while stakeholders ensure operational stability and long-term growth.

Employees are typically considered stakeholders, not shareholders. They have an interest in the company’s success because it affects their job security, wages, benefits, and work environment. However, if employees own shares in the company (e.g., through an Employee Stock Ownership Plan or ESOP), they can also be considered shareholders, giving them additional rights and responsibilities in the company.

CEOs are generally considered stakeholders because they have a vested interest in the company’s success, which impacts their compensation, job security, and professional reputation. However, if a CEO owns shares in the company, they are also shareholders. In many cases, CEOs are both stakeholders and shareholders, especially if they hold equity in the company as part of their compensation package.

Yes, someone can be both a shareholder and a stakeholder. For instance, if a person owns shares in a company, they are a shareholder. If they are also an employee, customer, or supplier, they would be a stakeholder. For example, an individual who holds shares in a company and also works for that company as an employee is both a shareholder and a stakeholder, as they have interests in both ownership and operations.