In the stock market, not everyone is just a regular person buying or selling a few shares. There are big players in the background, trading large amounts. They are called Institutional Investors. Keep reading to learn more about them.

Understanding institutional investors

Institutional Investors are large organisations that manage and invest pooled funds from many sources, like individuals or other firms, to invest in the market. They usually buy and sell large amounts of securities. Hence, their investment decisions create a major impact and influence in the stock market.

Institutional investments come in two types: Foreign Portfolio Investors (FPI) or Foreign institutional investors (FII), which are from foreign institutions. Next, DII full form – Domestic Institutional Investors from within the country.

You may also like: How does arbitrage trading work?

What is DII in share market?

Domestic institutional investors are institutions that invest within the country. In India, they are essentially institutions like banks, insurance companies, and mutual funds investing their pooled funds in domestic securities.

Their investment choices can significantly move the market. This is particularly true when foreign investors pull back. Factors like economic stability and political decisions guide DIIs.

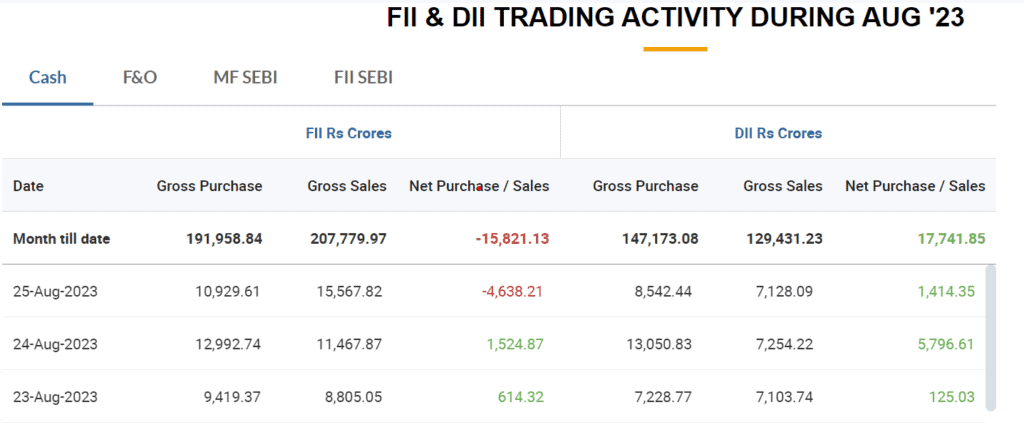

Historically, foreign portfolio investors dominated the market. However, circumstances have changed. As of March 31, 2015, FPIs were far ahead in equity market holdings by 55.45%. However the lead shrank, now as of August 2023, the net value for DIIs amount to ₹.16,327.50 crores, while FII figures are at a contrasting ₹.-15,821.13 crores. This shift emphasizes the growing confidence of Indian institutions in the domestic market.

This increasing involvement indicates a positive view of the Indian market’s potential. When these major entities invest confidently at home, it’s worth noting for all investors.

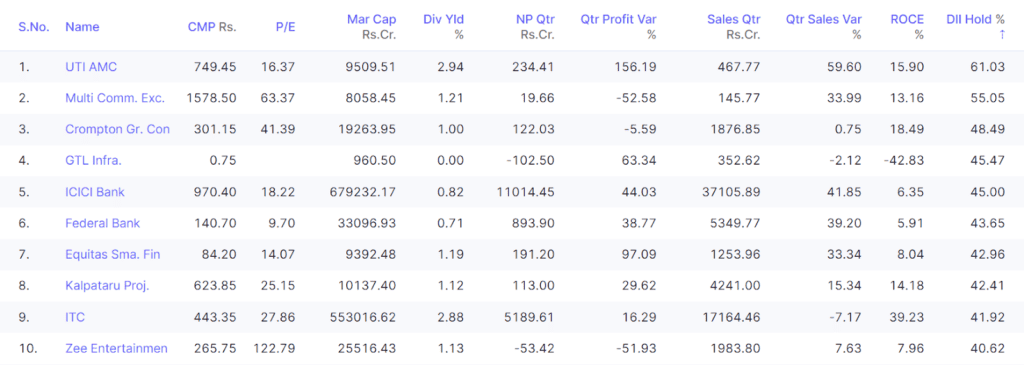

Top 10 DII positions by percentage of holdings

Also read: What is book value? How is it calculated?

Role of DII in share market

- Domestic institutional investors play a key role by funding capital to top businesses of the country and ensuring a smooth flow of stock trading in the market.

- As it involves a vast amount of funds, they have a big say in how stock prices change.

- Their considerable investments drive them to closely monitor assets and advocate for better business management practices.

Also read: FII vs DII

How can retail investors benefit?

Domestic institutional investors operate with a research-backed approach. They have expert teams with SEBI (Securities and Exchange Board of India) certification that guide their investment decisions. This extensive research enables them to make well-informed investment choices.

As mentioned, both DIIs and foreign portfolio investors are significant players in the market. Their investment choices can shift market trends. But there’s a clear distinction: India puts limits on FPI investments, restricting the volume they can invest in a particular company. DIIs don’t have these boundaries.

For the individual or retail investor, watching the actions of DIIs can be beneficial. Platforms like the National Stock Exchange (NSE) provide insights into DII and FPI activities. By observing where these major institutions are investing, retail investors can glean hints about potential market movements. Given the challenge of comprehending every detail about a company, tracking DII investment trends offers a simplified way to gauge a stock’s potential future performance.

Types of DIIs

Indian mutual funds:

Mutual funds pool money from several investors to buy a diverse range of securities. There are various fund types available for investors to choose from, based on their risk appetite and financial goals.

As of July 31, 2023, the Indian mutual fund had Assets Under Management (AUM) amounting to ₹. 46,37,565 crore. Their popularity in India stems from their adaptability, catering to both beginners and experts. By investing in mutual funds, individuals can indirectly become a part of the DII landscape.

Indian Insurance Companies:

Insurance companies based in India offer a plethora of products, from health insurance to retirement plans. But they’re not just about insuring; they also play a significant role in the share market.

The insurance companies in India now manage assets exceeding ₹.60 trillion. Among these, LIC stands out prominently, holding a dominant ₹. 10 lakh crore.

Insurance companies in India offer a wide range of services beyond just traditional insurance products. Apart from insurance solutions, they provide financial options such as loans. Additionally, they offer specific financial products like Unit Linked Insurance Plans (ULIPs), which combine insurance coverage with investment opportunities in the stock market.

Pension funds

Pension schemes aim to offer a comfortable retirement. Government-led schemes like the National Pension Scheme (NPS) and the Employees’ Provident Fund (EPF) contribute substantially to DIIs.

Pension funds are built from contributions made to pension plans by both employees and employers. This pooled money is usually invested in stable assets that generate regular income, aligning with the primary goal of pensions, i.e. ensuring consistent and steady returns.

Banking & Financial Institutions

Banks, the very entities we trust with our savings, are also influential DIIs. Beyond the familiar territory of savings and loans, they invest in the share market.

And though they might not have made significant waves since 2020, there’s been a notable rise in bank assets across various sectors. In the quarter ending in June 2023, the banking held assets worth ₹.191.6 lakh crore

The diverse types of DIIs, with their specific focuses and objectives, collectively shape the trajectory of the Indian stock market. Note that each category of DII mentioned charges a fee for managing investments. They either collect asset management fees or take a portion of the profits from successful investments.

In a nutshell

The Indian stock market’s dynamics are significantly influenced by both individual and institutional players. Among these, domestic institutional investors hold a pivotal role. With their investments across various sectors, they greatly influence the market’s direction.

For individual investors in India, watching the moves of DIIs and understanding their actions can be beneficial for all market participants. Their growing interest in the local market signals a positive outlook for India’s financial future.