According to the Bank for International Settlements (BIS), the notional amount outstanding of equity derivatives is more than a quadrillion US dollars. That’s a market so huge most of us can’t even imagine it.

In this article, we’re going to explore what equity derivatives are, why they’re so popular, and whether you should get in on the action. Let’s dive right in.

What is an equity derivative?

Equity derivatives are just that – instruments that derive value from equities. They’re directly tied to the movements of the underlying asset. For instance, the price of a TCS option, which is a derivative, is dependent entirely on the value of TCS stock trading on the NSE.

These are complex financial instruments that provide investors with a variety of opportunities to manage risk, speculate on price movements, and hedge against potential losses in the market.

Types of equity derivatives

There are several financial instruments that can be derived from one underlying asset. In this article, we’re focusing on equities only.

- Futures: These are agreements to buy or sell equities at a predetermined price on a future date. They are standardised and traded on exchanges, offering a high level of liquidity and transparency. Futures are usually considered risky since they involve leverage.

- Options: Options provide the buyer with the right, but not the obligation, to buy (call) or sell (put) a specific quantity of the underlying equity at an agreed price within a set period. Options are a popular instrument used for speculation, hedging positions, and generating passive income.

- Swaps: Equity swaps involve the exchange of cash flows based on the return of an underlying equity or equity index. They enable investors to benefit from the difference in returns without owning the underlying asset. Credit swaps were one of the biggest financial assets that led to the financial collapse of 2008-09.

- Equity Linked Notes (ELNs): ELNs are even more complex debt securities with returns linked to the performance of a stock. These are structured products that combine a fixed-income instrument and a derivative instrument.

You may also like: Futures vs. Options: Differences every investor must know!

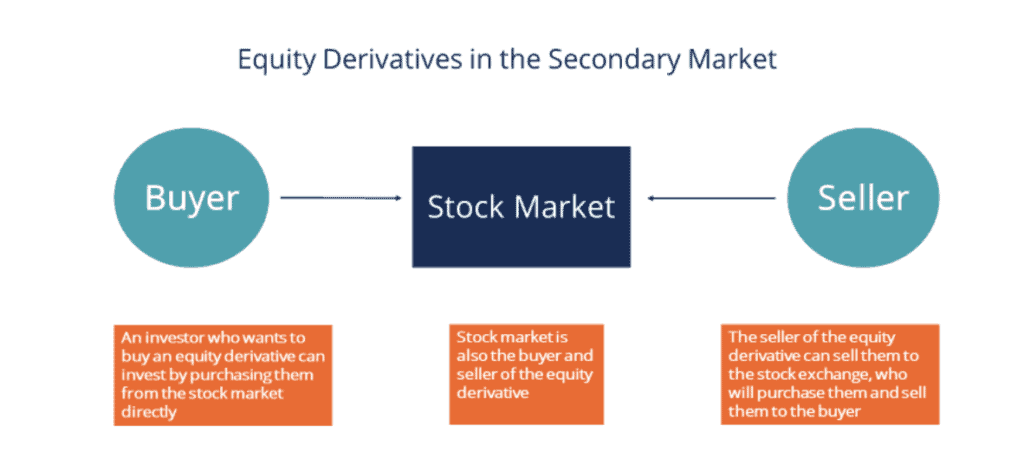

How are equity derivatives traded?

Equity derivatives are traded through various channels, linking the buy and sell sides to the equity markets. There are two sides to equity derivatives trading:

Buy side

The buy side generally involves investors, asset managers, and hedge funds, including mutual funds, pension funds, and insurance companies. These are entities with large amounts of capital that they either own, or manage for other wealthy companies and individuals.

Sell side

Sell side entities are usually market makers (who provide liquidity in the market), and investment banks that are both sellers and intermediaries between the buy and sell sides. Investment banks assist in the creation, pricing, and trading of derivative products.

Also Read: Leverage in stock market – strategies, risks and rewards

How the sides come together

The buy and sell sides usually come together in two ways: OTC trading or exchange trading. OTC trading usually happens between large entities that have an existing relationship. They decide prices mutually, settle and negotiate terms, and go through with the deal without having to pay brokers and dealers.

On the other end of the spectrum, exchange-traded derivatives are for retail investors like us who have to follow specific rules that are guaranteed by the exchange and the regulator.

Why the market is so big

One primary reason for the market’s vast size is the use of derivatives for hedging. Investors, financial institutions, and corporations use equity derivatives to mitigate risks associated with their stock investments. By using futures and options, they protect themselves against violent price movements in the underlying assets, thus reducing potential losses.

The second reason is the sheer size of the participants of these markets. Institutional investors, such as pension funds, mutual funds, and insurance companies, have large amounts of money to put in the market, and due to leverage and payoffs, they prefer to trade in derivatives than direct equities.

These players adjust their portfolios, manage risks, and seek additional returns from the derivatives market, contributing to the market’s size due to the sheer volume of assets they manage.

Technological advancements have also enhanced access to these markets. Online trading platforms and brokerages have made it easier for retail investors and traders worldwide to participate in derivative markets, which has also somewhat contributed to the size of the market.

Also Read: How to trade in options and maximise your profit?

Should you invest?

In conclusion, while equity derivatives offer a wide array of opportunities for investors, they also come with inherent complexities and risks that demand caution and careful consideration.

We encourage you to stick to your risk profile and analyse your investment goals before you decide to invest in equity derivatives.