Introduction

You might have probably heard of Bitcoin, Ethereum, Tether, etc.

In the dynamic realm of finance, a new medium of exchange has been established with the advent of cryptocurrencies. These digital currencies, a product of technological advancements and a quest for decentralisation, are redefining the conventional understanding of money.

The transformation of money has been remarkable, transitioning from the barter system to the utilisation of precious metals and presently to the established fiat currency system.

As we advance towards a cashless society, the acceptance of cryptocurrencies continues to accelerate. Amid discussions of them potentially replacing fiat currencies in the future, it is evident that cryptocurrencies are evolving into a global phenomenon.

This makes understanding the differences between traditional federal currency and cryptocurrency very important.

Understanding federal currency

Federal currency or fiat money is the currency that is basically issued and regulated by a government authority. Here, the government authority is typically a central bank. Fiat currency functions as a legal tender and is not necessarily underpinned by a physical commodity.

Instead, federal currency, like Rupees, value is derived from the demand of supply and demand in the marketplace. Alternative to other forms of money, including cryptocurrencies and commodity-based currencies, fiat currencies exhibit relative stability. This stability allows regulators and governments to steer the economy against potential recessions and inflation.

Must read: How much is the Rupee worth across the globe?

Understanding cryptocurrency

Cryptocurrencies are digital or virtual currencies that can be used for investment purposes or as a means of exchange. Due to their virtual nature, they leverage cryptographic technology for transaction processing, security, and verification.

In contrast to federal currency, cryptocurrencies operate independently of a central authority. They exist as unalterable entries in a database, such as a blockchain, that remain unchanged unless specific conditions are fulfilled.

The network’s decentralisation implies there is no central server where transactions are stored or any governing authority.

The inception of cryptocurrencies was an unintended byproduct of Satoshi Nakamoto’s creation of Bitcoin. Nakamoto’s primary intention was not to create a currency but to establish a peer-to-peer electronic cash system that could conduct transactions without central supervision.

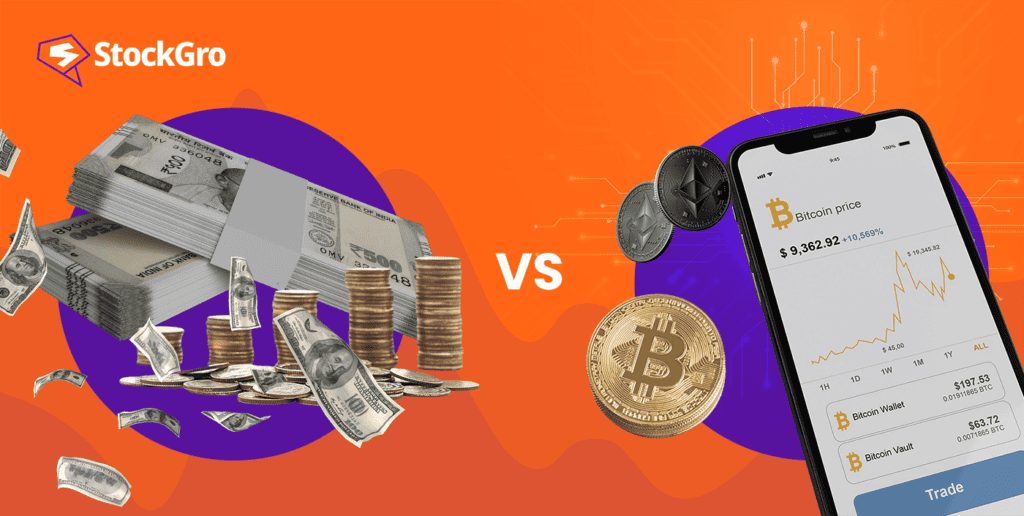

Federal currency vs cryptocurrency

Federal currency is different from cryptocurrency in many ways; let’s see these parameters.

1. Legality

Fiat or federal currencies are issued by governments and are regulated, issued and maintained by a central bank, like the Reserve Bank of India. They are recognised as legal tender, often serving as the official method for settling transactions.

A cryptocurrency, in contrast, is simply a virtual currency or asset that performs as a medium of exchange. Here, the currency is free from any governmental control, and no central entity has the power to regulate or influence its value.

Because of this many countries have also banned cryptocurrencies and currently there are no formal rules regulating it.

2. Issuing medium

The issuance and operation of federal currency such as Rupee is the responsibility of the central bank or an authorised entity, like the RBI, within the country of origin.

Conversely, cryptocurrency is not a product of government issuance or regulatory authority and functions independently within a private system.

Also read: Ever wondered how ChatGPT makes money?

3. Tangibility

When talking about tangibility or physical feel, cryptocurrencies lag that. Since they are digital currencies, they only operate online, and you can not feel it.

Whereas a fiat or federal currency has a physical aspect in terms of coins and notes. Fiat currency is tangible, and you can feel it.

4. Storage

Cryptocurrencies cannot be stored in a bank account, and since they are digital assets, they reside in unique cryptocurrency wallets. These wallets contain specific information that authenticates users as the rightful owners.

However, federal currencies can be deposited in bank accounts, and their digital counterparts can be held on digital payment platforms. Ownership is conferred upon those in possession of the currency.

Remember, digital currencies are not similar to cryptocurrencies. Thus, understand the difference between digital currency vs cryptocurrency.

5. Supply

The control of federal currency supply rests with governments. For instance, in India, the RBI has the authority to mint new money and augment the money supply as deemed beneficial for the economy.

However, cryptocurrencies, being independent of government control, have varying supplies. Take Bitcoin, for example, which has only 21 million supply, indicating that only this much quantity will ever be in circulation. Once all bitcoins have been mined, no additional ones will be produced. But this is not the same for all cryptocurrencies.

Thus, understanding the difference between bitcoin vs cryptocurrency is important.

6. Intermediaries

Another difference between federal currency and cryptocurrency is the need for an intermediary.

The transaction and transfer of federal currency necessitate the involvement of banks. This holds even for digital transactions, where payment processors and banks act as middlemen. In contrast, cryptocurrencies operate without the need for any intermediary to facilitate transfers or validate transactions.

7. Safety

Engaging in transactions with federal or fiat currency is considered more secure due to the backing of a central authority, like RBI. This backing allows for easier detection and resolution of fraudulent activities.

On the other hand, dealing in cryptocurrencies carries a higher risk. The potential for anonymous transactions contributes to this risk. Furthermore, cryptocurrencies lack the backing or operation of a government or any central authority, which can lead to issues such as data hacking and fraud in crypto transactions.

8. Value and volatility

The value of the federal currency, such as the Rupee, does not fluctuate much. However, the market value of cryptocurrencies is subject to significant fluctuations, changing not just daily but potentially every minute. It is essential to note that not all cryptocurrencies exhibit the same volatility.

Also read: What is a commodity? A short guide before you trade

Bottomline

To wrap up, it is crucial to remember that when dealing with cryptocurrencies, you are speculating on a new asset class. It is an area that is not fully understood by many, and its future trajectory remains uncertain.

Given this unpredictability, it is best to analyse your risk profile before investing. Maintaining a diverse portfolio with a mix of cryptocurrencies and other assets will continue to be the prime strategy for mitigating risk.