The forward market, or the forward exchange market, is a platform for traders to enter into agreements for future dates at pre-determined prices.

The forward market is a significant tool in hedging investment risks.

Read further to understand how forward markets work and the benefits of entering forward contracts.

What is a forward market?

A forward market is where the buyers and sellers enter into an agreement to exchange financial instruments on a future date at a pre-determined price. It means that the delivery of the financial instrument will happen on a future specified date but at the price decided today.

While the forward market caters to various financial products, it specialises in dealing with foreign exchange transactions.

The forward market falls under the purview of over-the-counter (OTC) markets, meaning traders cannot enter into such agreements on the stock exchange.

You may also like: Key risks in investing in the stock market

Types of forward contracts

- Closed outright forward – Two parties enter into an agreement with exchange rates fixed on the basis of spot rates plus a premium.

- Long-dated forward – Forward contracts where the maturity date is far, i.e., at least longer than one year.

- Non-deliverable forward – This contract does not involve physical transfer of assets. The difference between the contract rate and the spot rate (current rate) is exchanged between the parties.

- Flexible forward – This is where the parties have the right to execute contracts before or on the maturity date.

Forward contracts and their features

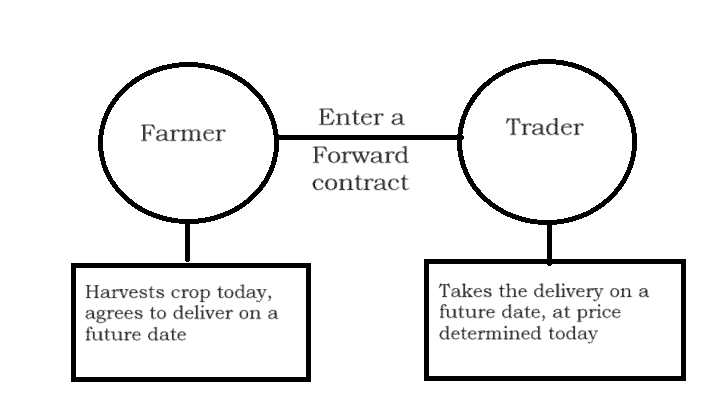

Agreements in the forward market to deliver on a future date but at a predetermined price are called forward contracts.

The value of the contract is derived from the asset under consideration. Hence these are derivative contracts.

For example, a forward contract in the foreign exchange market derives its value from the currency traded.

Features of forward contract:

- Forward contracts do not follow a standard format. They can be customized as per the requirements of the parties involved.

- The settlement of forward contracts can happen in different ways like closed outright or flexible forward.

Components of a forward contract:

- Asset – The underlying asset based on which the price of forward contracts is determined.

- Price – The price at which the execution takes place.

- Spot rate and exchange rate – These components are significant in a forex forward contract. The spot rate is the rate prevailing in the market. The exchange rate is the date decided by both parties to execute the contract at a later date.

- Expiration date – The date of delivery or the date of executing the contract.

- Quantity – Determines the number of units in a forward contract.

Benefits and risks in the forward market

Pros of trading in the forward market:

- The primary reason for two parties to enter into a forward contract is to hedge the risk of losses due to changes in prices in the future. Forward contract is a popular hedging tool.

- Forward contracts are customisable based on the requirements of the parties. This makes forward markets more friendly.

The common risks involved in forward contracts are:

- Defaults – Since the execution of contracts is on a future date, the possibility of parties defaulting is high.

- Regulatory risks – These contracts are not regulated by the Securities and Exchange Board of India (SEBI). Hence, parties involved are not covered for defaults in the forward market. This increases the chance of fraudulent activities.

Also read: What is EBITDA?

Difference between forward market and future market

While both the forward and futures markets deal with settling transactions on a future date at predetermined prices, they have a few differences based on their features:

| Forward Market | Futures Market |

| An understanding between two parties to execute a contract on a future date. | A contract between two parties with an intermediary to settle the transaction at a later date. |

| These contracts are not regulated. | Contracts in the futures market are regulated |

| The settlement terms of these contracts are not standardised. They are customisable. | The terms of futures markets are standardised. |

| Forward markets are prone to high degrees of default risk. | The risks in the futures market are relatively lower. |

Spot market

The prime factor distinguishing the spot market and the forward market is the date of execution.

As the name suggests, the spot market deals with contracts where the execution or delivery happens on the spot. The delivery takes place immediately and the price is based on the spot price, i.e., the price prevailing in the market.

Forward markets commission

Formed in 1953, the Forward Markets Commission (FMC) is a wing of the SEBI. The role of FMC is to regulate transactions in the futures and the commodities market.

The FMC works with these markets to set standard procedures, conduct periodic audits and publish information to the public, wherever necessary.

The Ministry of Finance supervises the activities of the FMC.

Also read: What are outstanding shares?

Example

Considering examples of forward contracts in different markets:

- Commodities Market

Let us assume Mr A wants to buy gold after one year. The gold price in India is nearly ₹ 6,000 today.

Mr A speculates that the prices may increase to ₹ 6,800 in one year.

Mr B, a gold seller, feels the gold rate has reached its all-time high and the price may decrease from here. He speculates the price to come down to ₹ 5,500 in one year.

Mr A and Mr B enter into a forward contract to hedge the risk of losing money in the future and agree to execute the contract after one year at ₹ 6,000.

If the price goes up as per A’s speculation, he makes a profit. Else, Mr B earns a profit.

- Forex Market.

Mr A. from India wants to buy a property in Singapore after one year. He feels the exchange rate may be higher after one year. Hence, he enters into a forward contract to buy the property after one year, based on today’s exchange rate.

Bottomline

The forward market is an over-the-counter arrangement between two parties to mitigate the risk of price changes in the future.

Since it is an unregulated market, the risk of default is high. Hence, traders must ensure to set the right terms while entering such agreements.

In the forward market, the primary currency instruments include forward contracts, FX swaps, currency options, and currency futures. Forward contracts allow parties to buy or sell currencies at a predetermined price for future delivery. FX swaps involve exchanging currencies for a set period with a later reversal transaction. Currency options provide the right to buy or sell currency at a specific price before a set date, while currency futures are standardized contracts traded on exchanges, similar to forwards but with set terms.

The Forward Market Commission (FMC) was responsible for regulating forward markets, ensuring transparency and fairness in trading. It set rules for forward contracts, supervised market activities to prevent manipulation, and licensed market participants. The commission’s role included protecting investors by ensuring compliance with regulations. In 2015, the FMC was merged with the Securities and Exchange Board of India (SEBI), which now oversees commodity and forward markets in India.

In the foreign exchange forward market, two parties agree to exchange currencies at a predetermined rate for a future date. These contracts are tailored to the specific needs of the participants and help hedge against currency risk. The forward rate is determined by adjusting the current spot rate for the interest rate differential between the two currencies. The contract is settled on the agreed-upon date, with either physical delivery or cash settlement, providing protection against unfavorable currency fluctuations in the future.