Have you ever wanted a slice of the stock market pie, but the price tag of the shares seemed hefty?

If so, you’re not alone. Many aspiring investors face the same challenge. However, this might change soon as the Company Law Committee (CLC), formed by the Ministry of Corporate Affairs (MCA) in 2019, published its 3rd report in April 2022. In this report, It was recommended by the CLC that CA-13 be amended to allow businesses in India to issue, hold, and trade fractional shares.

Let’s begin with the basics!

What is the meaning of fractional shares?

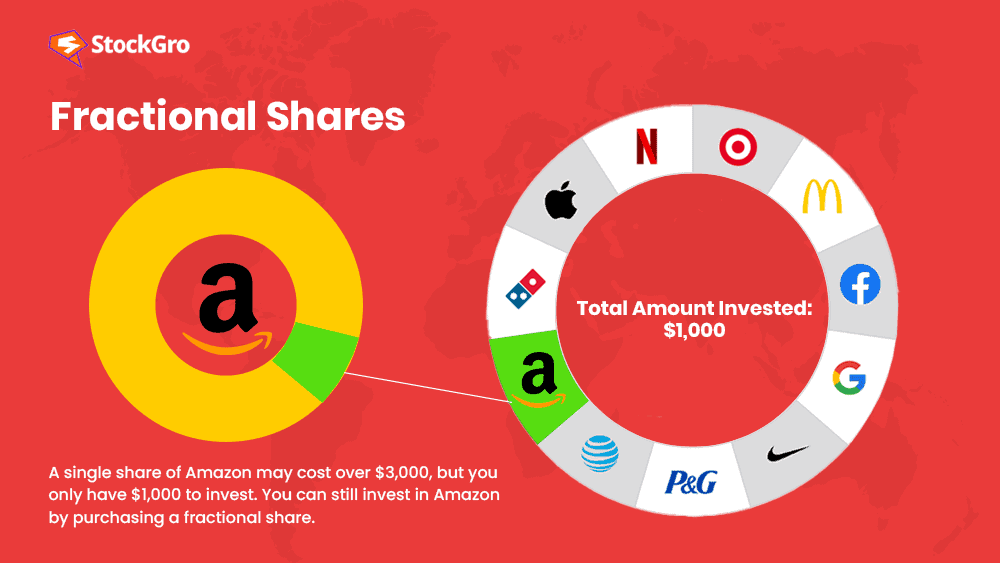

Simply put, a fractional share is a portion of a company stock that is less than one full share.

Consider MRF, a renowned company, where a single share costs around Rs 1.09 lakh. To acquire one share, you’d need to invest over Rs 1 lakh. Now, imagine fractional ownership is allowed. You could invest as little as Rs 25,000 and own a quarter or even smaller parts of a share.

The pros & cons

As with any financial innovation, fractional shares come with their own set of advantages and disadvantages.

Pros:

- Accessibility: The most significant advantage of fractional shares is accessibility. They break down the financial barriers that often deter small investors from participating in the stock market.

- Diversification: Fractional shares empower investors to diversify their portfolios effectively. Instead of putting all their eggs in one basket, You, as an investor, can spread your investments across various stocks, reducing your overall risk.

- Eliminate cash drag: In the past, investors often had to keep cash sitting idly in their accounts while they saved up enough to purchase full shares. Fractional shares eliminate this cash drag by allowing you to put your money to work immediately.

Cons:

- Limited voting rights: While fractional shares allow you to own a portion of a company, they usually have limited or no voting rights. This means you won’t have a say in the company’s major decisions, unlike shareholders with full shares.

- Fees: Some brokers charge additional fees for trading fractional shares. It’s essential to be aware of these fees and factor them into your investment decisions.

- Liquidity risk: In some cases, holding fractional shares might limit your ability to trade. If too many investors hold fractional shares of a particular stock, it can lead to reduced liquidity, making it harder to buy or sell those shares.

Where do they exist?

Fractional shares have yet to be universally available. Their availability depends on the country and the sophistication of the local brokerage industry. But it’s widely available only in the United States.

As for India, it’s currently not possible to own a fractional share. The Companies Act does not permit the holding of fractional shares. Section 4(I) of CA-13 reads thus: “the amount of share capital with which the company is to be registered and the division thereof into shares of a fixed amount and the number of shares which the subscribers to the memorandum agree to subscribe, which shall not be less than one share.”

But that might start to change soon as there is a new wave of young investors who know how to utilise the power of the internet, and they are questioning why fractional shares aren’t allowed in India.

Also Read: Take a tour of the economic concept of the ‘liquidity trap’.

Impact on trading liquidity & volatility

Now, let’s talk about the impact of fractional shares on trading liquidity and volatility in the stock market.

Impact on trading liquidity:

- Fractional shares act as a catalyst for increased liquidity in the stock market. By allowing more participants to invest with smaller budgets, they effectively expand the pool of potential buyers and sellers.

- This increased liquidity can lead to smoother trading experiences for everyone involved. With more participants, there’s less likelihood of sudden price swings caused by large trades.

Impact on volatility:

- On one hand, fractional shares can potentially dampen extreme price swings. When more people have access to a particular stock, it’s less likely that a single large trade will significantly impact its price.

- On the other hand, fractional shares can also lead to more speculative trading. Some investors might buy fractions of shares with the sole intention of short-term gains, which could increase short-term volatility.

In essence, fractional shares add liquidity to the stock market, making it more accessible and reducing the likelihood of massive price fluctuations.

However, they also introduce the possibility of increased speculative trading, which can lead to short-term volatility. Like most things in the financial world, it’s a trade-off.

What has to change next?

To foster the expansion of fractional ownership in India, it’s essential to establish a well-defined and customised regulatory framework that can effectively address the distinct challenges associated with fractional ownership.

This framework should be designed to prioritise investor protection and uphold the integrity of the market.

Brokerage firms should proactively adjust their operational methods by forging strategic partnerships with depositories and leveraging innovative technologies. Additionally, there is potential in exploring the implementation of mandatory proxy voting rights for fractional shareholders, as this would significantly enhance their participation in corporate decision-making.

Furthermore, it is important to focus on educating investors about the merits and risks of fractional ownership.

Also Read: What is swing trading?

Conclusion

Fractional shares can revolutionise the way people invest in the stock market in India. They offer accessibility, diversification, and the elimination of cash drag, making investing more inclusive than ever before.

However, they also come with limitations, including limited voting rights, potential fees, and the risk of reduced liquidity for some stocks.

If owning fractional shares becomes possible in India, then it’s crucial for investors to understand their implications fully. Like any financial tool, they can be a valuable addition to your investment strategy when used wisely.

Happy investing!