The commodity market is a key part of our economy, benefiting a diverse group, from farmers to everyday consumers like you and me. This market plays a powerful role in influencing prices, offering risk management solutions, and shaping economic policies. Its importance is even more impactful in a resource-rich nation like India. For more about the function of the commodity market in India, continue reading .

What is the commodity market?

A commodity is a tangible good that can be exchanged with others of the same type. This includes anything movable but not money or securities. Common examples are grains, gold, and oil. These commodities are often used to produce other goods or services.

Derivatives are financial tools where a base asset determines its value. Derivatives with a commodity as the base asset are known as commodity derivatives.

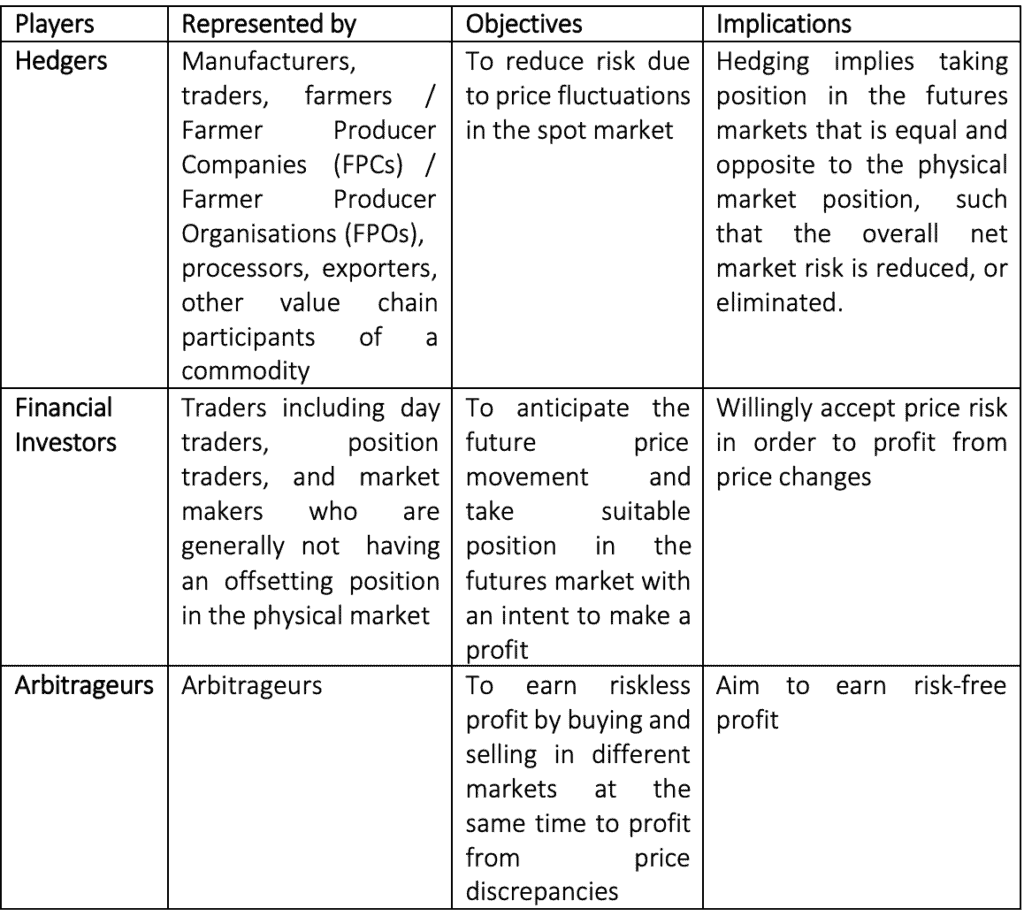

The commodity market, then, is a platform where these commodities derivatives are traded, much like company shares are traded in the stock market. There are various participants in the commodity market. There are hedgers, like farmers or manufacturers, who use the market to manage the risk of price changes. Then, some investors and arbitrageurs trade to make a profit from price movements or differences.

To know more: What is a commodity? A short guide before you trade

Types of commodities

| Category | Sub-Category | Examples |

|---|---|---|

| Agricultural Commodities | – | Chana, cotton, soybeans, maize, guar gum, sugar, soybean oil, and palm oil |

| Non-Agricultural Commodities | Bullion and Gems | Gold, silver, diamonds |

| Energy commodities | Crude oil, natural gas | |

| Metal commodities | Aluminium, brass, copper, iron, lead, nickel, zinc |

Trading in commodities market

In India’s commodity market, trading primarily occurs through two types of contracts: forwards and futures.

- Forwards contracts: Here, two parties agree to buy or sell a commodity at a future date for a predetermined price. This arrangement allows buyers to mitigate the risk of price fluctuations while sellers secure a guaranteed price for their product at a specified future date.

- Futures contracts: Like forwards, these also entail an agreement to purchase or sell a commodity at a future price and date. The key difference is distinct positions for buyers and sellers. The buyer assumes a ‘long’ position, agreeing to purchase the commodity, while the seller takes a ‘short’ position, agreeing to sell.

Additionally available to investors are options contracts, which grant the right—but not the obligation—to purchase or sell at a predetermined price. This flexibility allows traders to capitalise on market changes without committing futures. In summary, the commodity market in India offers diverse ways for investors to engage with and benefit from market dynamics.

Also read: Futures vs. Options: Differences every investor must know!

Functions of commodity exchanges in India

Before the Securities and Exchange Board of India (SEBI) took over as regulator of the commodities market in 2015, the Forward Markets Commission (FMC) was in charge.

The commodity exchanges operate under SEBI’s regulatory framework. These are platforms where trading in commodity derivatives takes place. These can be physical locations or, more commonly now, electronic online platforms, handling immense volumes of trade daily.

Key commodity exchanges in India include

- Multi Commodity Exchange of India Ltd. (MCX)

- Indian Commodity Exchange Ltd. (ICEX)

- National Commodity & Derivatives Exchange Ltd. (NCDEX)

- National Stock Exchange of India Ltd. (NSE)

- Bombay Stock Exchange Ltd. (BSE)

Also read: Difference between Nifty and Sensex

Role of commodity market in India

The functions of the commodity market in India hold significant importance in the country’s economic framework. It acts as a vital platform for the trade of primary products, playing a key role in several economic aspects.

Risk management through hedging

One of the fundamental roles of the commodity market is to offer hedging opportunities. This mechanism allows companies, particularly in sectors like FMCG, to manage risk by securing future prices of raw materials, thereby mitigating the impact of price volatility.

Enhancing agricultural investments

The commodity market is instrumental in strengthening the agricultural sector. It facilitates better investment in critical areas such as storage and logistics. This benefits farmers and intermediaries by lowering the risk of spoiling and promoting sector growth overall.

Ensuring transparency

Transparency is a major challenge in India’s dispersed agricultural sector. The structured environment of the commodity market helps establish transparency, ensure fair trade practices, and protect farmers from potential exploitation.

Portfolio diversification

For investors, commodity markets offer an avenue to diversify investment portfolios beyond traditional options like stocks and mutual funds. This diversification is crucial in managing overall investment risk, especially during periods of inflation.

Curbing speculative demand

The market also plays a key role in managing speculative demand for commodities like gold. By absorbing a significant portion of this demand, the market helps in maintaining a balance, thus safeguarding necessary foreign exchange resources.

Contributing to food security

Commodity markets contribute significantly to food security by enabling farmers to hedge against price fluctuations. This is particularly important in safeguarding farmers’ incomes against unpredictable market trends.

Facilitating aggregation and financing

The market provides an organised mechanism for the aggregation and sale of agricultural products. It also offers structured financing options, reducing dependence on informal financial channels.

Challenges in commodity market

Although the Indian commodity market presents many benefits, there are drawbacks as well.

Leverage risks

In commodity trading, especially online, leverage is a critical tool. It enables traders to manage huge holdings with comparatively little investment. But it’s important to use caution while using leverage. Overusing leverage can result in large losses, particularly if market moves don’t match your expectations.

Liquidity challenges

Liquidity risk arises when it becomes difficult to conclude transactions due to market illiquidity. This risk underscores the importance of understanding market trends and timing your trades effectively.

Extreme volatility

Commodities, especially crude oil and gold, are known for their volatility, more so than stocks and bonds. This results in large price swings, which can disrupt your trading strategies.

Sensitivity to global events

Commodity prices are highly sensitive to global economic and geopolitical events. Factors such as changes in crude oil production or shifts in geopolitical stability can significantly impact prices.

In a nutshell

India’s commodity market is a key economic driver, offering diverse opportunities for stakeholders, from farmers to investors. It offers significant opportunities for risk management, price stabilisation, and investment diversification.

However, navigating this market demands a strategic approach due to challenges such as high volatility, leverage risks, and global economic influences. Managing these complexities is essential for traders and investors to leverage the market’s potential effectively, contributing to both individual financial success and the broader economic development of India.