From November 2019 to November 2020, the Sensex and Nifty both had a growth of 8.23% and 7.57%, respectively. Considering the extraordinary emergence of obstacles such as the COVID-19 pandemic, this increase has been outstanding.

Usually, market prices are anticipated to fall sharply during periods of economic stagnation. But defying all reason, the market had managed to expand rapidly during that period.

This raises the question if stock market trends are based on sound market fundamentals, or are investors’ intrinsic FOMO, the fear of missing out.

What are market fundamentals?

In essence, all the quantitative information about a particular stock is referred to as its fundamentals. Investors would examine this information to determine how the shares’ apparent value and true worth vary.

Together with financial statements like cash flow and balance sheets, investors usually consider the market and industry as a whole while researching a certain firm. Finding the equities that are overpriced or underpriced and those that are appropriately priced is the fundamental objective. Having such in-depth knowledge about a stock makes choosing wisely nearly effortless.

Also read: Key factors influencing stock market trends.

What is FOMO?

The acronym represents “Fear of Missing Out.” It’s a psychological phenomenon where people feel pressured to follow a trend or activity out of dread of falling behind. FOMO can cause investors to make rash stock purchases due to stock market trends. The urge to avoid losing out on possible gains is what motivates this.

For example, investors may purchase a specific stock because of a fear of losing out on a profitable investment prospect. Many investors have made unwise investments as a result of the FOMO idea.

FOMO is also evident in the financial sector when an investor feels disappointed or guilty after losing out on a significant market surge. Many investors make snap judgments without giving them much thought because of this irrational desire to seize every chance.

Momentum investing: The secret sauce of the FOMO stock market?

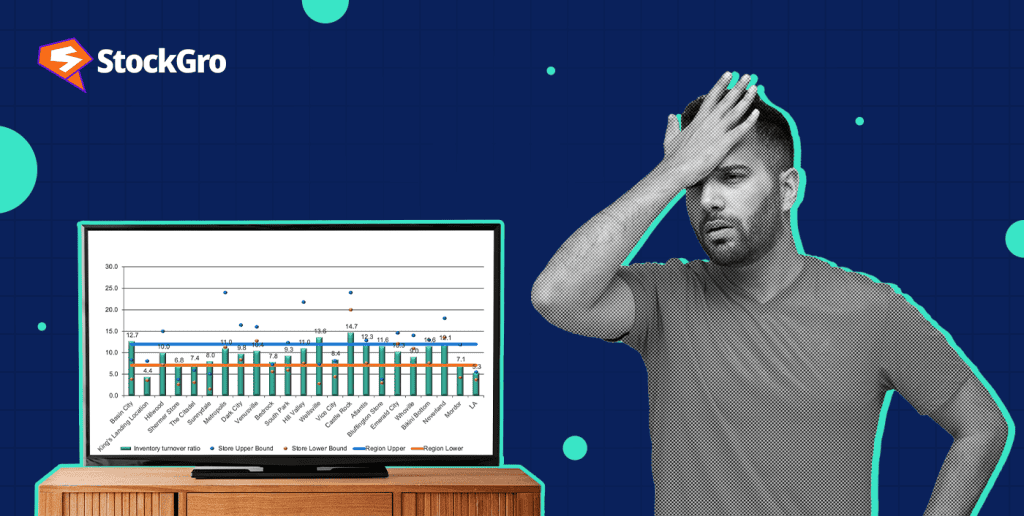

A mechanism known as price momentum states that assets with rising prices are prone to continue growing in the near future, whereas securities with falling prices are more inclined to continue declining.

Fear of missing out drives market momentum far more than market fundamentals. It is found that the FOMO reaction is strongest when things are at their riskiest, such as when stock market trends are at their height.

Because of the continuous media attention that serves as free promotion for these marketplace leaders, investors who own the most successful stocks are content to hang on, whereas those who don’t soon experience the stress of “missing out.”

The influence of FOMO is increased when passive investors unintentionally contribute large amounts of their money to already inflated stocks. Investors are tempted to follow the trend when they compare themselves to a benchmark index.

Also read: Long-term investing: A smart strategy for lasting wealth.

Market fundamentals and FOMO- Smart investors probably choose both

It’s critical to realise that FOMO has serious hazards in addition to the potential for rapid financial gain. It is important to maintain a balance between market fundamentals and an investor’s inherent FOMO to make sustainable gains. Before investing, investors should be aware of the market circumstances, growth potential, and financial standing of a company.

It is crucial to educate oneself on the fundamentals of market movements and stock pricing. With this information, an investor can make wise choices and steer clear of FOMO’s traps. In order to identify its significance on investing behaviour and take action to lessen it, it is essential to comprehend FOMO in its entirety.

An investor needs to keep an eye on their financial objectives and consider the big picture. Knowing how much risk one can tolerate is also important. Investors should avoid overestimating their risk tolerance and getting caught up in the rise. It is necessary to effectively navigate through volatility and accomplish their objectives by sticking with stocks that have strong fundamentals.

Also read: Mastering Real-Time Stock Data Analysis.

Conclusion

As is clear, a mix of strong market fundamentals and the potent pull of FOMO drive a market rally. Even after strong corporate development, fear of losing out has often contributed to significant market volatility.

It is crucial for investors to be comfortable with market fundamentals, exercise caution, and prioritise long-term objectives above market volatility. By doing this, the investor might be able to maximise their investments and manage the market’s fluctuations.

FAQs

- What are market fundamentals?

Essentially, the term “fundamentals” refers to all of the facts regarding a certain stock. Investors would look at this data to see how the current and actual/true values of the shares differ. By acquiring and analysing such data, investors may decide which investments to make.

A company with strong financial health will be considered to have strong market fundamentals. Such a company could enjoy a strong stock market position.

- What is market FOMO?

The abbreviation stands for “Fear of Missing Out.” It’s a psychological phenomenon where people fear falling behind and feel compelled to join a trend or activity. Because of stock market tendencies, FOMO might lead investors to make hasty stock purchases. This is driven by the desire to prevent missing out on potential rewards.

- What is FOMO and FOLO?

Both of these terms refer to an individual fearing to miss out or lose out on any experience. FOMO stands for fear of missing out. FOLO stands for fear of losing out. When it comes to investing, FOLO is the fear of losing out on future profits, even if it means delaying withdrawals. This is especially typical during a bull market when optimism is high.

- How to stop FOMO in trading?

The word in its true essence refers to an intrinsic human quality. While FOMO can help an investor not lose out on market opportunities, strong adherence to it may cause trouble and hasty risks. Finding a balance between the fundamental analysis and the rigour of excitement of potential rewards is the key to successful investment. Investors should understand a company’s financial situation and market conditions before investing.

- What is Ghost month in trading?

This is a concept mostly rooted in superstitions of cultural significance. August is often referred to as Ghost Month in Eastern traditions when investors observe additional caution. Many individuals follow certain rituals to ward against misfortune, particularly in the realm of money. The tradition often suggests financially prudent practices like- only borrowing from trusted sources and not overspending.