The term ‘grey market’ usually invokes a sense of intrigue and ambiguity when used in the context of the stock market. It’s a part of the investing world where the line between what’s legal and what’s not starts to blur. The grey market can be understood almost as a parallel economy working alongside the NSEs and the BSEs of the world.

In this article, we’re going to dive into what the grey market is, how it operates, and what significance it holds to you, the legitimate investor.

You may also like: NSE considers extending trading hours

What is the grey market?

The grey market is a market for securities that aren’t available on official markets. That’s the USP and the need of grey markets – provide investors access to securities and derivatives that they can’t have officially. Grey markets usually operate in these sectors:

- Delisted stocks – Trading of securities that have been suspended or removed from the market;

- Pre-IPO stocks – Trading of securities that have not yet IPOed (but are going to, soon);

- Regulatory differences – Trading of securities that are scarce or unavailable for investment in some regions;

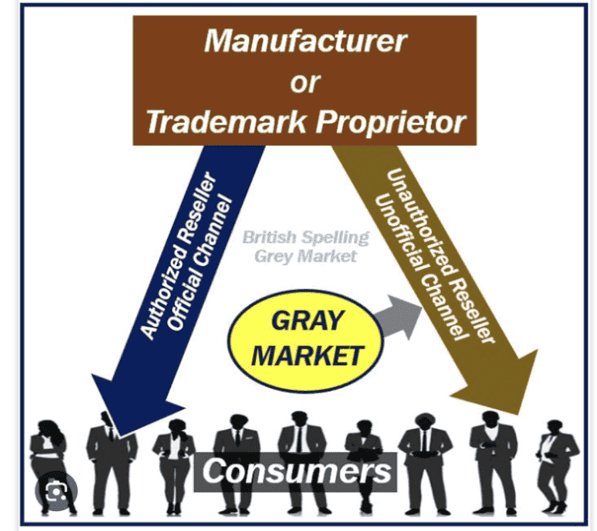

The grey market is not ‘illegal’ but unregulated. This means that when you buy or sell on the grey market, you do so with unauthorised dealers and importers who have little to no accountability compared to their regulated counterparts.

Also Read: What is IPO? Understand the Initial Public Offer Process

Understanding trading in the grey market

Even though we’re exploring the term from the stock market perspective, grey markets aren’t limited to just investing. In many nations, there exist several grey markets for everything from consumer electronics to luxury cars. The scarcity or lack of supply of these items incentivise buyers to pay a premium for them, helping suppliers make a healthy cut on the markup, but still remain sufficiently competitive with local prices.

While grey markets have securities and trading occurs openly, this investing and trading can’t be made official until the markets officially open. This oftentimes causes fraudsters and scammers to renege on deals made alreadypreviously right before the market opens, often causing losses. This is the reason why reputable investors, funds, and mutual funds mostly stay away from grey market trading.

Lack of oversight, regulation, and accountability

Grey markets usually lack the transparency of official markets when it comes to legal compliance and regulation. The lack of oversight from independent or government bodies might make grey markets more dangerous for investors, especially for amateurs. Since these markets are not subject to the same level of scrutiny as the official ones, counterparty damages is also an omnipresent risk.

Price discovery

This is another con of having little to no oversight and regulation. Since there’s no scrutiny, prices in grey markets often run haywire with volatility. They are often way off from the true value of security. Price fluctuations are also mostly influenced by market sentiment, and not the intrinsic value of the business itself. Such price discrepancies might give opportunistic traders arbitrage opportunities which might take advantage of the retail player.

What makes matters worse is that most companies that trade on the grey market are little-known, leading to the spread of false information and fake news too.

Sometimes, you might come across the term ‘grey market premium’ right before a popular company IPOs. The term refers to the prices at which shares of the company are being sold before the IPO hits the market. The higher the demand and enthusiasm for the company, the higher the premium is.

Impact on companies

Companies IPO generally to raise more capital. Since grey markets are most active before a popular company’s listing date, they might also affect a company’s ability to raise capital during the actual IPO. High demand or disinterest might affect company reputation right before a huge day, which in turn might affect how many investors subscribe to their share lots.

Also Read: A guide to FPO and its various types

Should you trade in the grey market?

It depends. There are a lot of variables in deciding whether you should get your hands dirty in the grey market. Here are some things to consider:

- Assessing your risk tolerance and investment goals – Consider how comfortable you are with volatility and paying a high premium for your investment. If that’s something you want to do and you’re certain it’ll pay off in the long term, the grey market could be a winning bet for you.

- The legal and tax considerations – We’re no experts on Indian tax law, but what we do know is that taxation for grey market stock investments are different. We encourage you to speak to a tax professional to find out what your individual case is.

- Expertise and knowledge – Ask yourself: do you know enough about the stock and the market to walk the fine line between regulated and unregulated trading?

Start small – If you’re into it and the above apply to you, here’s another tip: don’t invest your life savings in the grey market. You never know what’s going to happen.

Conclusion

While a grey market trade could definitely be your biggest winner ever, it could also be the biggest scam. We advise you to indulge in unregulated trading only if you’re willing to take on a very high risk and invest the time and effort it takes to research and understand this sector of the market. In any case, we encourage you to do your own research before investing actual money.