We often hear names like Warren Buffett, Benjamin Graham tied to value investing and many others linked to growth investing. What makes these two methods distinct? Why do their principles appeal to different kinds of investors? Let’s uncover growth investing vs value investing and find what fits you.

Growth investing: The basics

This strategy centres on identifying businesses poised for exceptional expansion. These are enterprises that prioritise scaling operations or entering new markets, often at the expense of short-term profitability. The focus lies not on what they currently earn, but on what they are likely to achieve as they grow.

- Performance traits: Such organisations exhibit revenue surges far above industry norms, reflecting their ability to capture emerging opportunities. While their earnings might fluctuate, their consistent upward momentum signals strong potential.

- Valuation outlook: These stocks often trade at elevated multiples compared to peers, driven by expectations of future dominance in their respective sectors.

For example, consider a company that reinvests heavily in its product innovation and captures a growing market share year after year. Investors are drawn to such prospects, believing in their ability to redefine markets.

However, the allure of rapid growth does not come without challenges. Over-optimism can lead to inflated pricing, and unmet expectations often result in sharp corrections. This approach demands an analytical mindset and resilience to short-term volatility, appealing most to those with a forward-looking perspective.

Value investing: What is it?

The strategy is about identifying shares priced lower than their true worth.It revolves around finding shares that are undervalued by the market, often due to short-term disruptions. This often occurs when market sentiment clouds judgment, causing prices to dip below their actual financial merit.

- Core belief: Markets frequently misjudge. Businesses with solid fundamentals can become unfairly discounted due to external factors or transient challenges.

- How it works: By focusing on measurable indicators—like low price-to-earnings ratios, consistent dividends, or low debt—investors can spot such misalignments.

According to Benjamin Graham, widely regarded as the ‘father of value investing’, suggests a P/E below 9 and a P/B under 1.2

For instance a robust company with stable cash flows and a long history of profitability. Its price drops sharply after an earnings miss or unfavourable news, even though its long-term potential remains intact. A value investor sees not the short-term noise, but the long-term opportunity.

This method is grounded in logic, not speculation. It requires discipline to wait for price corrections and confidence to invest in assets others undervalue. Returns may not be immediate, but the objective is steady wealth growth rooted in solid business fundamentals.

To know more: Value investing in India

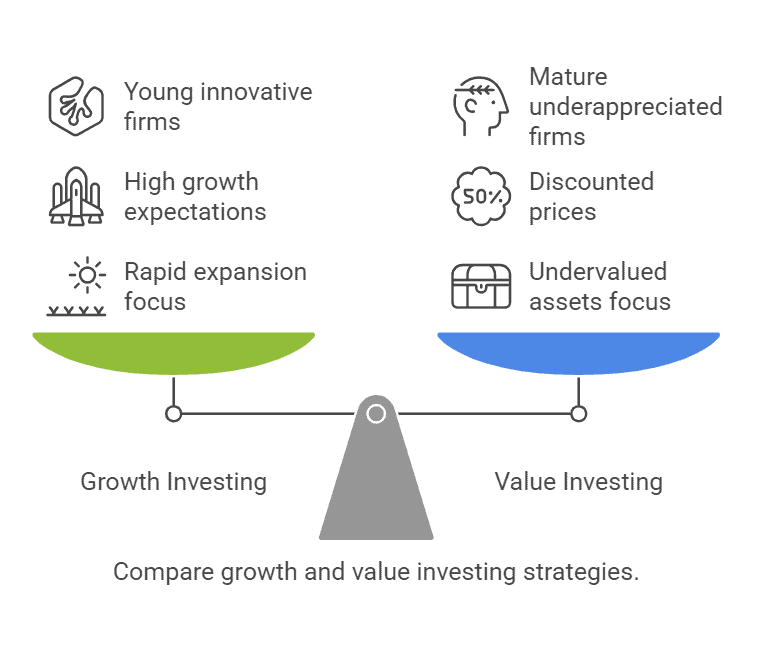

Growth investing vs Value investing

| Aspect | Growth investing | Value investing |

| Core philosophy | Focuses on businesses with the potential to expand rapidly, often exceeding the average industry pace. | Prioritises assets trading below their true worth, typically overlooked by the broader market. |

| Market valuation | Stocks are often correctly priced or overvalued due to high growth expectations. | Trades at discounted prices, reflecting undervaluation compared to the company’s fundamental worth. |

| Performance metrics | High ratios, such as P/E and P/B, highlight investor confidence in future profits and market leadership. | Low valuation metrics underscore the belief in a company’s ability to recover and generate long-term value. |

| Volatility and risks | Fluctuations are common, especially if projected growth fails to materialise as expected. | Risks include prolonged undervaluation, but these stocks tend to experience more stability over time. |

| Type of businesses | Usually younger firms operating in innovative industries, aiming to dominate their sectors. | Typically mature organisations with established operations but temporarily underappreciated by the market. |

| Time horizon | Requires patience for compounding gains over years as firms develop and expand their market share. | Demands discipline, as undervalued assets may take significant time to reach fair valuation. |

You may also like: Crack the code to steady gains with value funds

Which strategy is right for you?

Deciding between growth and value investing requires clarity about your financial priorities and tolerance for uncertainty. For those seeking significant future gains, growth-focused investments target companies with the potential for rapid business expansion. This approach often involves higher volatility but appeals to individuals with long-term ambitions.

Value investing, on the other hand, caters to cautious investors who prefer assets trading below their fair price. These investments often include well-established firms with stable operations and consistent dividend payouts. While their appreciation may take longer, this method offers a safety cushion against market fluctuations.

Alternatively, combining both methods can help balance risks and rewards. By allocating to high-growth opportunities while also including undervalued options, you can diversify your portfolio.

You may also like: Mutual funds or stocks: Which is a better investment?

Bottomline

Growth investing targets companies on the path to rapid expansion. Value investing, in contrast, identifies businesses temporarily undervalued by the market. Ultimately, the right path depends on how much risk you’re willing to take and how quickly you aim to achieve your financial goals.

FAQs

- Is growth investing better than value investing?

No single strategy works for everyone. Growth targets potential future gains and suits those willing to take risks. Value identifies underpriced stocks, appealing to those who prioritise steadiness. Both have unique benefits. Your decision should align with your goals, timeline, and how comfortable you are with uncertainty.

- Is value riskier than growth?

Each approach comes with its own type of uncertainty. Value relies on a company’s recovery from being undervalued, which can be slow. Growth hinges on future expansion, which may not happen as expected. Both have challenges, but their risks are different. Consider your comfort level and financial goals when deciding.

- What are the disadvantages of growth investing?

Putting money into rapidly expanding businesses comes with risks. Their high valuations make them sensitive to market corrections. If growth slows, their appeal can fade quickly. During economic slumps, they tend to underperform. Profits might not align with expectations for a long time. This approach demands resilience and a strong risk appetite.

- What is a growth investing style?

This method targets firms with the ability to expand at a rapid pace. It emphasises future prospects over present achievements. Investors seek organisations increasing their influence through innovation or market disruption. While it offers potential for high rewards, this style carries significant risk and requires confidence in long-term outcomes.

- What is a value investor?

This type of investor seeks opportunities in shares trading below their fair assessment. They rely on analysing strong fundamentals to identify overlooked opportunities. Temporary market trends or misjudgements often create such scenarios. The goal is to purchase at a discount and wait for the market to recognise the asset’s real potential.