A bridge that connects two vital aspects of your financial identity in India. On one side, you have your Permanent Account Number (PAN), the key to your tax transactions and financial history. On the other, there’s your Aadhaar, the biometric-backed identity that’s uniquely yours.

The Pan-Aadhaar link is that bridge, and the Income Tax Department is the architect urging everyone to cross it before time runs out.

It’s not just about adhering to regulations; it’s about ensuring a smooth financial experience, avoiding the pitfalls of increased Tax Deducted at Source (TDS), and effortlessly navigating tax compliance.

This article seeks to simplify the process of linking your PAN with your Aadhaar, a crucial step required by the Income Tax Department.

The urgency of compliance

The Aadhaar-Pan card link is a critical requirement enforced by the Income Tax Department to ensure that every taxpayer’s identity is authenticated and financial transactions are transparent. The urgency to comply with this mandate stems from the consequences of not linking, which can significantly impact one’s financial dealings.

Neglecting to establish the Aadhaar-PAN connection by the Aadhaar-PAN link last date of May 31st, 2024, will lead to the deactivation of your PAN. This implies that you won’t have the ability to carry out financial transactions that require providing your PAN, such as opening a bank account, buying foreign currency, and most importantly, filing your income tax returns.

Higher Tax Deducted at Source (TDS) rates may be imposed under Sections 206AA and 206CC of the Income Tax Act if your PAN is not operating correctly. A larger portion of your income and transactions may be subject to tax deductions as a result of this.

In addition, you could face a fine of up to ₹1,000 and all the repercussions outlined in the Act if your PAN stops working. To avoid these consequences, make sure your PAN is active and that you link your Aadhaar with it before the deadline. This will keep you in compliance with tax regulations.

You may also like: The UIDAI has released new rules for Aadhaar updates. Check them out here!

TDS and its significance

The basic premise of TDS is to avoid middlemen and collect taxes straight from earners.

Under this principle, a person (the deductor) tasked with disbursing a certain type of payment to someone else (the deductee) is obligated to withhold tax at the point of payment and remit it directly to the government’s account. Anyone who has had income tax withheld at the source can get a refund for that money by submitting Form 26AS or a TDS certificate that the deductor sent them.

Significance of TDS:

- TDS is significant as it is a way to collect tax based on the “pay as you earn” principle.

- It ensures that the government has a functional system to prevent tax evasion.

- The obligation to withhold tax at source rests with the individual issuing the payment, known as the deductor.

Must read: What is TDS? A complete overview of TDS in income tax

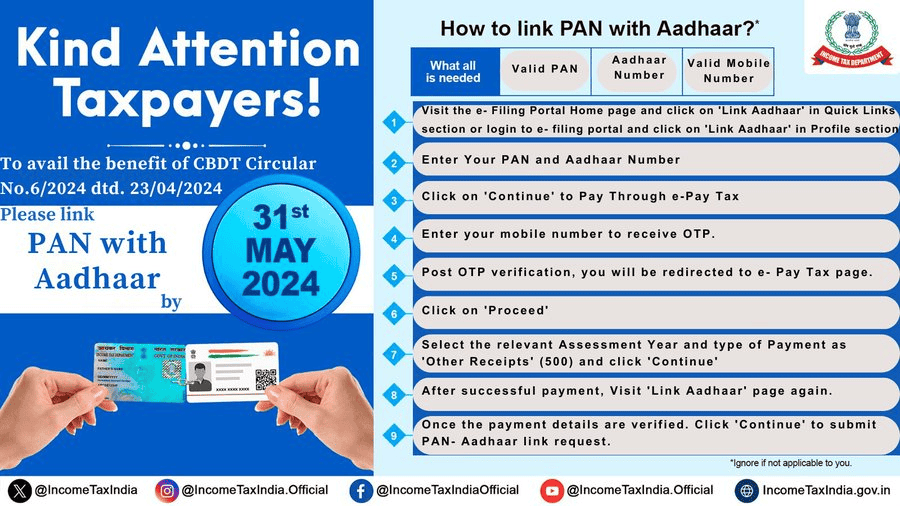

Step-by-step guide to linking Aadhaar with PAN

Here’s a detailed step-by-step guide on how to link Aadhaar to PAN card:

- Visit the income tax e-filing website: Access the official website and locate the “link Aadhaar” option under the “quick links” menu.

- Input PAN and Aadhaar details: In the appropriate spaces on the page, enter your PAN and Aadhaar numbers.

- Validate information: Go ahead and click “validate” to make sure all the information you’ve entered is accurate.

- Proceed to ‘e-pay tax’: To proceed, click the “e-pay tax” option once confirmation is complete.

- Re-enter PAN and provide mobile number: To complete the verification process, please input your PAN again and then enter your mobile number to get an OTP.

- Authenticate with OTP: To verify your identity, enter the one-time password (OTP) that was sent to your mobile device.

- Select assessment year and payment type: Select the appropriate assessment year and “other receipts (500)” as the payment type on the e-pay tax page.

- Generate challan for payment: After you see the amount that is owed, click “continue” to create a challan.

- Choose payment method: You can complete the transaction on your bank’s website after choosing your payment mode.

- Finalise linking: After you’ve paid, you’ll be able to finish integrating your Aadhaar and PAN on the e-filing platform.

This guide offers a detailed walkthrough for associating your Pan-Aadhaar link via e-filing portal, ensuring a smooth and secure process.

Source: X – Income Tax India

Verifying your Aadhaar-PAN link

Here’s a list of steps detailing how to check the Aadhaar-Pan link:

- Access the e-filing portal: To begin, go to the official website for e-filing income taxes.

- Find ‘link Aadhaar status’: Look for ‘link Aadhaar status’ under the ‘quick links’ section and click on it.

- Provide your details: Your PAN and Aadhaar numbers will be requested of you. It is imperative that you input these details accurately.

- Check status: After entering your details, click on ‘view link Aadhaar status’. The portal will then show the current status of your Aadhaar-PAN link.

- Understand the response: Should your Aadhaar already be connected to your PAN, a message affirming this will be displayed. Otherwise, you will receive instructions on how to create the link, or you’ll be notified that the linking process is currently underway.

Further reading: Blue Aadhaar Card: Features and how to apply

Bottomline

Taking the time to link your Aadhaar with your PAN before the deadline is a small but significant action that can safeguard your financial future, ensure compliance, and enhance your overall financial management. Don’t wait until the last minute; act now to secure your financial identity and avoid the pitfalls of non-compliance.