Every trader shows up looking to make a profit. As a trader, you have to back up your choices with exhaustive research and analysis. Consider several elements regarding the scripts you are funding, like company performance, management, forthcoming announcements, etc. Analyzing different tools, charts, patterns, and technical indicators will help you also base your investments. Here is a useful starting reference on the Ichimoku cloud indicator.

Also read: Fundraising debate: IPO vs FPO

What is Ichimoku cloud?

Developed by writer Goichi Hosoda, the popular technical indicator known as Ichimoku Cloud – is sometimes called Ichimoku Kinko Hyo. Although it was not made public until late 1960s, dealers all around today still highly value it. As Japan’s most often traded instrument, the indicator is still rather popular there. There is a hypothesis that it performs better when used on the Japanese Yen currency pairs and the Nikkei.

Translated into English, the indicator’s name is “one glance equilibrium chart” since it provides traders with a range of information.

What does the Ichimoku cloud chart look like?

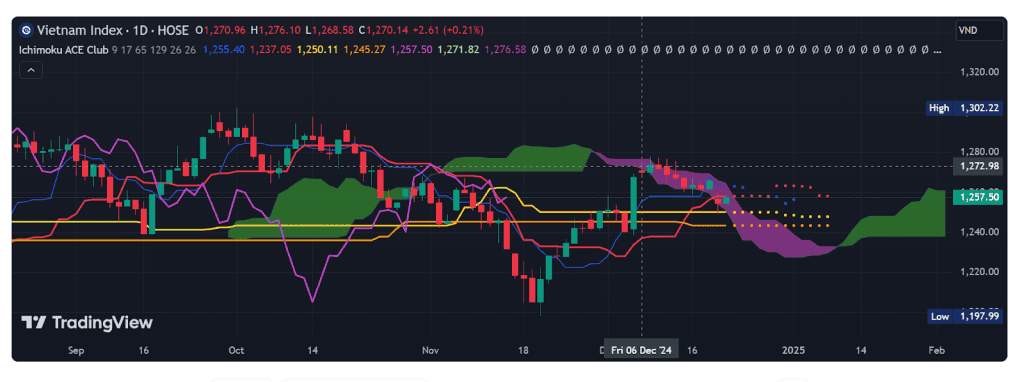

Source: TradingView

Working with this indicator will cause the price chart to show five lines. Between two of these lines—that of the Senkou Spans—the “cloud” will develop. Let us explore the several lines comprising the indicator:

- Tenkan Sen: Tenkan Sen, sometimes called the conversion line, signals little changes and opposition. It’s the nine-period low’s average combined with the nine-period high.

- Kijun Sen: The confirmation line used to examine market price momentum is Kijun Sen, sometimes known as the baseline. It comes out as the average of the 26th-period low and high. The basis line starts halfway between the 26-day high-low range.

- Senkou Spans: Two “leading” line variants are Senkou Span A and Senkou Span B.

- Forming the top of the two cloud boundaries, the first represents the midway between the baseline and the conversion line.

- Senkou Span B represents the middle of the 52-week range and sets the bottom cloud limit.

- Chikou Span: Plotting the closing values of the past 26 days allows Chikou Span to show the lagging span reflecting the market mood. It will present a view of the present market price concerning past patterns. It can also assist in noting any possible reversals.

Traders who want their charts “clean” to avoid information overload may have questions about the indication since it initially seems complicated. However, the Ichimoku indication informs us quite a lot, so there is no need to use too many more indicators.

Also Read: The Importance of a Key Information Memorandum (KIM) in Mutual Funds

Steps to calculate the Ichimoku cloud

The lows are the lowest prices seen over a trading period while computing Ichimoku; the highs are the reverse. Considering the Conversion Line, it may be the lowest pricing during the past nine days and the highest. To obtain the findings, automatically include the Ichimoku cloud indication in your calculating chart. If you want to do your calculations by hand, you should use these seven simple guidelines.

- Calculating the baseline and the conversion line comes first.

- You should then review your previous calculations and base your computation of the Leading Span A on them. Once you finish this, the data point showing 26 periods into the future will show itself.

- You have to figure out Leading Span B. Plot the Span B data 26 times in the future, as with Span 1.

- Second last is the lagging span. On your technical analysis chart, plotting the closing price at 26 periods in the past calls for this.

- The coloring will create the Ichimoku cloud in Span A and B, which differs currently.

- The green cloud can be painted when Leading Span A is visible above Leading Span B. On the other hand, you may paint the cloud red if the Leading Span A shows below the Leading B.

- The six actions discussed above will produce a single data item today. You must follow the procedures above to draw the lines every time every period ends. This will enable the creation of fresh data points for every period. Finally, you can link every data point to produce an impression of the clouds and lines.

How can the Ichimoku cloud indicator help you?

Combining the Ichimoku cloud approach with a few technical indicators can help you, as a trader, think about maximizing your rewards and adjusting them for risk. For example, you can combine the cloud method with the Relative Strength Index to validate the price momentum of a script in a specific direction.

For crossings as well, the Ichimoku indicator performs. Prices above the cloud should be watched on the conversion line to see whether they move above the baseline; this is a strong buying signal. You can use any other line as an exit point to hang the trade until the conversion line dips below the baseline.

Also Read: Direct vs. Indirect Tax: Understanding the Key Differences

Conclusion

The Ichimoku framework is a strong, all-in-one indicator that offers a lot of data at once. As we have seen, using and interpreting the Ichimoku signal and its various components are closely linked to trading based on moving averages, so there is no secret about them. Still, the Ichimoku indicator has its place, and traders who use this kind of trading approach can build a strong base.

FAQs

- Is the Ichimoku Cloud a good indicator?

Though it has certain restrictions, the Ichimoku Cloud provides a different approach than other instruments, including moving averages. It shows data aesthetically differently rather than being better or worse. Combining numerous elements into one chart lets traders examine trends, momentum, and possible reversals in one glance. When utilized properly, it is a great instrument for spotting market circumstances, yet combining it with other approaches is only necessary for the best outcomes.

- How accurate is the Ichimoku indicator?

Many people consider the Ichimoku indicator a consistent instrument for price movement analysis. Its several presented data points enable traders to evaluate momentum, reversals, and trends more clearly. It has been tested extensively by combining three separate components, making it fit for the state of the market. Although no indication guarantees success, its methodical approach and unambiguous signals offer traders great value when applied properly, guiding their wise investment decisions in different trading conditions.

- What is 9 26 52 in Ichimoku?

The 9-26-52 parameters help traders comprehend Ichimoku Cloud signals to evaluate market developments. For instance, when the price continues above the cloud or when the Tenkan-sen crosses above the Kijun-sen, a bullish signal is confirmed. Likewise, line positions and price connections help distinguish between bearish and neutral signals. These particular criteria are the pillar of the Ichimoku system since they enable effective trend identification, offering important insights.

- How do you read the Ichimoku indicator?

Combining graphic components, the Ichimoku indicator evaluates market momentum and trends. The cloud, or Kumo, first shows general direction: red for down trends and green for uptrends. Analyzing shorter-term price movement and momentum changes requires the Tenkan-sen and Kijun-sen lines. Seeing these links can help one understand possible trade setups and verify if the market supports neutral, bullish, or bearish situations. Although initially difficult, understanding Ichimoku helps hone trading techniques and enhance market decision-making.

- What is the success rate of Ichimoku?

Though the Ichimoku chart seems intimidating at first glance, it offers a clear structure for effective trading plans. Many experienced traders claim that using its signals results in a higher success rate. Its capacity to monitor market trends, momentum, and reversals, in one view, helps one to appreciate these. Learning this instrument will help beginners and professionals transform the labyrinth of lines and clouds into a strong system that increases accuracy and improves trading performance over time.