Are you worried that the money in your savings account is sitting idle & losing value? If yes, you’re not alone. The silent monster called inflation eats away the purchasing power of your money. So, how can you protect your hard-earned wealth? One intriguing answer lies in “inflation-indexed bonds.” Don’t worry; by the end of this blog, this term will be as familiar to you as your favourite coffee order.

What are inflation-indexed bonds?

Inflation-indexed bonds are a type of investment that is designed to protect your money from inflation. Unlike traditional bonds, which pay a fixed interest, these bonds adjust their interest payouts based on inflation rates. Imagine them like a ship that rises with the tide, ensuring your investment doesn’t drown in a sea of rising prices.

How do they work

So, how exactly do inflation-indexed bonds work? These bonds are usually issued by governments. When you invest in them, you receive periodic payments or “interest.” But unlike ordinary bonds, the interest amount changes with inflation.

For instance, if you invest ₹1000 in an inflation-indexed bond with an interest rate of 2%, and inflation is at 3%, your interest rate will adjust to effectively become 5%. Essentially, these bonds add the inflation rate to the fixed interest rate, ensuring your investment keeps up with rising prices.

Inflation-indexed bonds in India

In countries like India, inflation can fluctuate significantly, making these bonds quite appealing. In fact, inflation-indexed bonds in India are widely considered a safe bet, especially when compared to other investment options like stocks. They offer a secure way to preserve the value of your money while providing a decent return.

Capital-indexed bonds vs. inflation-indexed bonds

You might have heard of “capital-indexed bonds” and wondered how they differ from inflation-indexed bonds. Capital-indexed bonds also offer protection against inflation, but they do so in a slightly different way. Instead of adjusting the interest payments, they adjust the principal amount (the initial amount you invested). Therefore, you get returns based on an increased principal, somewhat neutralizing the effects of inflation.

You may also like: Bullish engulfing candlestick pattern: Learn how to spot trend reversals

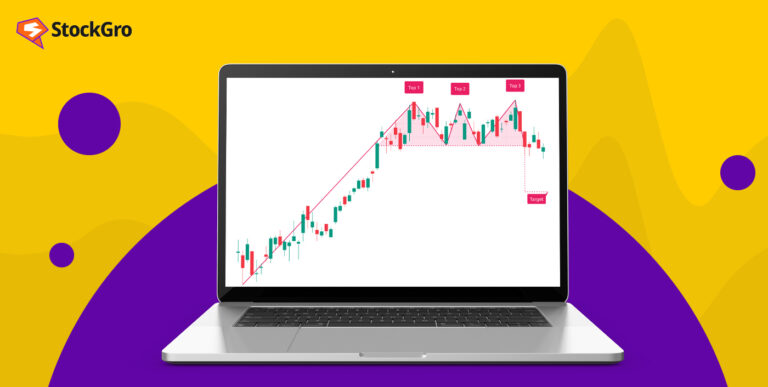

How is falling wedge pattern relevant

Now, let’s introduce a fascinating concept from the world of finance – the “falling wedge pattern.” It’s a term often used in technical analysis to predict the future movement of a security, like stocks. But what does it have to do with inflation-indexed bonds?

Well, the falling wedge pattern often indicates a bullish market, meaning asset prices are likely to go up. If you can identify this pattern in the bond market, it might be a good time to invest in bonds, including inflation-indexed ones. When bond prices are low but likely to rise, you can maximize your returns, inflation protection included!

Comparing inflation-indexed bonds with other investments

| Investment Type | Risk Level | Returns | Inflation Protection |

| Stocks | High | High | No |

| Traditional Bonds | Low | Low | No |

| Real Estate | Medium | Medium | Partial |

| Inflation Indexed Bonds | Low | Medium | Yes |

As you can see from the table, inflation-indexed bonds offer a unique combination of low-risk and medium returns with the added benefit of inflation protection.

Also read: Government bonds in India – Meaning, types and features

Advantages and drawbacks of inflation-indexed bonds

The Pros

- Shield against inflation

One of the most compelling reasons to invest in inflation-indexed bonds is their ability to protect your purchasing power against inflation. Unlike conventional bonds, where inflation can erode your returns, these bonds adjust with rising prices, ensuring that your investment doesn’t lose its real-world value.

- Consistent earnings

Inflation-indexed bonds offer a consistent and predictable stream of income, providing you a level of financial security. This makes them a reliable investment vehicle for those who require a steady cash inflow.

- Relative safety of investment

Typically issued by governments, these bonds come with an added layer of security. Your capital is relatively safe since it’s backed by the full faith and credit of the issuer, which is usually a stable entity like the federal government.

The cons

- Lower potential returns

Because of their lower risk, inflation-indexed bonds often yield less compared to other higher-risk investment avenues like equities or corporate bonds.

- Complexity of interest rate adjustments

The interest rate adjustments based on inflation indices can be complex to understand. If you’re not financially savvy, you might find it challenging to grasp how your returns will be calculated.

Who are the ideal investors for inflation-indexed bonds?

If you prioritize financial stability and are looking for a low-risk, long-term investment, inflation-indexed bonds are an excellent choice. They are particularly beneficial for retirees or those nearing retirement, as they offer a safeguard against the fluctuating value of money, ensuring a more stable income.

How to get started with inflation-indexed bonds

Now that you understand the importance of inflation-indexed bonds, you might be wondering how to get started. Fortunately, investing in these bonds is fairly simple. Let’s get started.

Step 1: Finding the right issuer

Firstly, you’ll need to identify who is issuing the bonds. Most often, these are government-issued, but some corporations also offer them. If you’re in India, you can opt for bonds issued by the Indian government. Make sure to do your homework and opt for a reliable issuer.

Step 2: Evaluating terms and conditions

Before diving in, take a moment to evaluate the terms of the bond. Check the duration of the bond, the initial interest rate, and how the inflation adjustment will be calculated. Make sure you’re comfortable with all these factors before investing.

Step 3: Making the investment

Once you’re satisfied, the next step is to make the investment. Usually, you can do this through your bank or a financial advisor. You’ll need to fill out some forms and provide identification. Once the paperwork is sorted, you’ll receive a certificate or a digital acknowledgment confirming your investment.

Step 4: Tracking and interest payments

Post-investment, make sure to track the interest payments. These will typically be deposited into your bank account or reinvested, depending on the options you’ve chosen. Keep an eye out for any notices or updates regarding changes in the interest rate due to inflation adjustments.

Also read: Bond voyage: Unraveling the intrigue of Bonds

Conclusion: Take the step to secure your future

To sum it up, inflation-indexed bonds are a smart, secure way to ensure that your money grows, regardless of inflation. They may not make you rich overnight, but they will keep you from getting poorer due to inflation. Whether you’re in India or anywhere else in the world, these bonds can be a vital part of your investment portfolio.

Don’t let the monster of inflation eat into your hard-earned savings. After all, financial security is not just about growing your wealth; it’s also about preserving what you already have.