Insider trading, quite simply, is the act of trading on inside information. ‘Insider’ in this context can be defined as someone with non-public, material information about the company being traded.

However, insider transactions are not always illegal – there are some nuances.

Since traders are always on the lookout for new information to trade stocks with, acquiring inside information can seem natural. However, when traders acquire information from those who are privy to such knowledge illegally and use it for personal gain, they’re taking advantage of the general public who don’t have such connections.

This contributes to making trading in the market more unfair to retail investors.

If regulatory authorities like the SEBI catch hint of insider trading, those accused could face hefty fines and even jail time (in some cases). In this article, we’re going to explore what exactly constitutes insider trading, what’s legal and what isn’t, and what the penalties are.

You may also like: How safe is it to trade in the dabba market? All about dabba trading

How insider trading works

Here’s an example to help you understand how insider trading works.

Suppose Person A works as a high level executive in Company ABC. Person A has sensitive information about an upcoming quarterly earnings report that could potentially affect stock prices in the next week. Since the company has made significant profits, prices are bound to increase.

Here’s what the insider trading process looks like, step-by-step:

- Gaining access to non-public information – Person A, as an insider, has access to confidential company information. In this case, he knows that ABC is about to announce positive earnings that will likely drive up the stock price.

- The decision to make a corresponding trade – Person A decides to use this non-public information to his advantage by buying ABC stock before the earnings report is made public.

- Actually making the trade – Person A purchases a significant number of ABC shares using his own personal brokerage account. He keeps this transaction discreet to avoid raising suspicion.

- Waiting for the event – Person A patiently waits for the company to officially announce its earnings results. During this time, he closely monitors the stock market to gauge the impact of the impending news.

- Sell the Stock – When the news hits, Person A sells his shares at a profit.

This is what insider trading looks like. Now, if Person A is found guilty of insider trading, he could face criminal charges, civil penalties, as well as lawsuits from the company.

Who is an ‘insider’?

An ‘insider’, in this context, is the person who has access to this price-sensitive information that can be used to trade in the markets illegally. This information could be about the general market trend or about a company’s shares or securities.

The law says that an insider can be anyone who has been associated with the company in any way for 6 months preceding the insider trade.

Now that’s a wide list. These could be employees, a director, a relative, an accountant, a banker, or even legal counsel. For bigger companies (or publicly listed ones), insiders could even be stock exchange officials, trustees, or employees of another company they worked closely with.

The NSE also defines ‘insiders’ as political intelligence consultants who can make suggestions or act on material information obtained from government employees.

Also Read: What is BTST trading?

How is insider trading regulated in India?

In India, the Prohibition of Insider Trading (PTI) Regulations are responsible for providing a structure of protocols for the prosecution of insider trading. They’re directly enforced and investigated by the Securities and Exchange Board of India (SEBI) under the Insider Trading Regulations, 2015.

The market regulator has also been given the power to impose fines, negotiate settlements, or even prohibit certain companies or individuals from trading in the open capital market when found guilty.

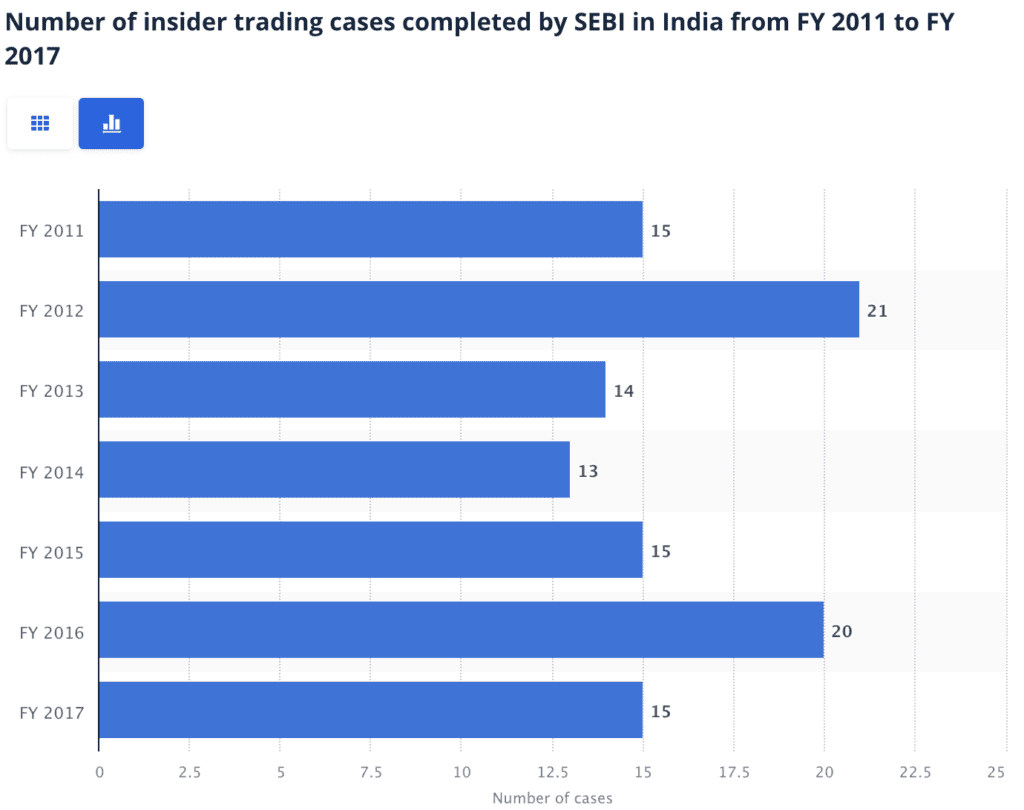

India’s record on prosecutions based on insider trading isn’t particularly impressive. In the last three decades of SEBI’s existence, there have been very few insider trading convictions in India. However, this doesn’t mean that these agencies are being complacent.

Source: Statista

Over the same period, insider trading laws have evolved and have only gotten more strict. Today, the onus is on companies to protect price sensitive information from getting to people who might misuse it to trade stock.

However, although laws are getting narrower, enforcement is a different ball game altogether. A lack of efficient surveillance, challenges in establishing realistic links, and gathering evidence are some hurdles.

How do the authorities detect insider trading?

After an insider trade has been made, the first step is to identify the insider from within the company. This could be any one of the people listed above. Even close relatives or friends related to the trader qualify as insiders.

The second step is detecting what the price-sensitive information could have been. This has to be understood very clearly. This information could be details about upcoming reports, managerial reviews, details about a potential structural change, etc.

There are several nuances to what exactly constitutes insider information, most of which only experts can tell apart.

Also Read: How does arbitrage trading work?

What is the UPSI?

Unpublished Price Sensitive Information (UPSI) refers to a piece of exclusive and privileged information about a publicly-listed company’s stock prices, quarterly results, mergers, upcoming deals, or any other potential price influence.

When insiders are able to get access to UPSI, they can illegally conduct trade dealings for personal gain.

The bigger picture

Insider trading is truly a detrimental practice – both to traders who exploit their access to privileged knowledge, and to the market at large. When traders use insider knowledge to trade stocks, they compromise the integrity of the market and its fairness.

Investor confidence is often lost and overall, widespread insider trading might reduce liquidity and efficiency. A prime example of this phenomena is infamous trader Harshad Mehta – who used insider trading to manipulate the market to amass wealth for himself and his associates but caused largely irreversible damage to an entire generation of investors.

To mitigate these risks and effects, stock market regulators around the world have implemented strict rules and regulations against insider trading. They conduct surveillance and investigations to identify and punish insider trading activities, thereby striving to maintain market integrity and investor confidence.

Additionally, companies often have internal policies and procedures to prevent and detect insider trading among their employees, executives, and board members.