In stock markets, different investors invest their money in various securities and assets. Naturally, it includes multiple people on both ends of the spectrum. Institutional investors are one of the categories that control vast sums of money in the financial markets. Despite their enormous behind-the-scenes influence, most retail investors know little about them.

In this article, we will discover who they are, their types, and their role in various sectors, among other aspects. Let’s begin.

You may also like: What exactly do angel investors do?

Who are institutional investors?

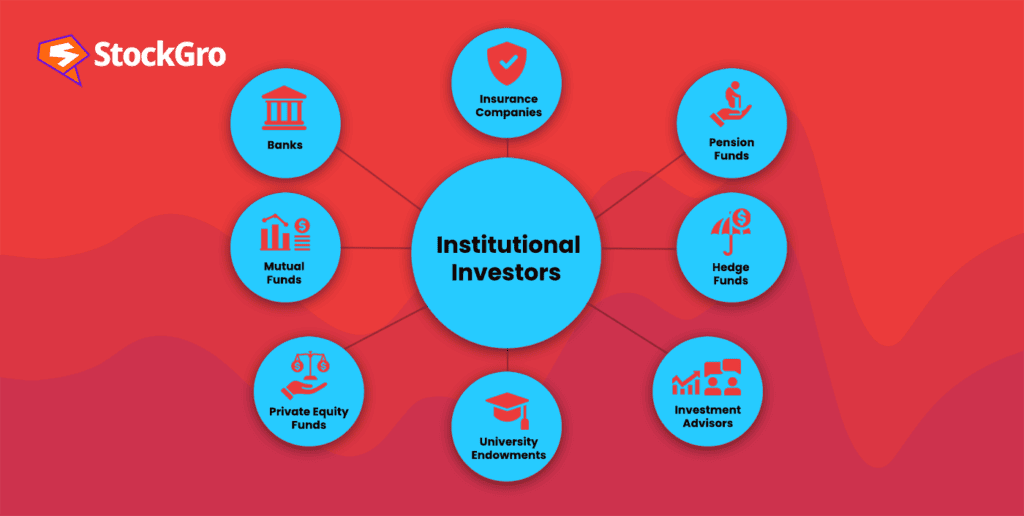

A business or entity that manages investments on behalf of others is known as an institutional investor. Any group or business that invests money on behalf of many parties, including individual investors and other entities, in various market securities qualifies as an institutional investor. In another way, institutional investors are those participants in the market who pool the funds of other people to purchase and sell assets such as bonds, equities, foreign exchange, international contracts, etc.

Institutional investors have access to discounted fees and special treatment. Additionally, since they are more capable merchants than individuals and can defend themselves better, they are not subject to as many protective restrictions. Institutional investors, sometimes referred to as market makers, significantly impact the fluctuations in the price of various financial products.

Large financial organisations’ presence in the market has a favourable impact on the state of the economy across all sectors. The active participation of institutional investors as stakeholders is believed to enhance corporate governance, as the oversight of financial markets is advantageous to all shareholders.

Institutional investors can also access and know about a wide range of investment products that are not accessible to individual investors. Mutual funds are one of the common examples of institutional investors.

Also read: Mutual funds or stocks: Which is a better investment?

Types of institutional investors

Institutional investors can be classified into two groups based on the geographical location of an investment: foreign institutional investors (FII) and domestic institutional investors (DII). Both FIIs and DIIs play a significant role in the financial markets, as they have large amounts of capital and expertise to invest in various securities. Both of these types of investors may fall under qualified institutional investors.

In the SEBI Regulations, 2000, the term “QIB” was first defined. Investors who comply with SEBI standards areconsidered Qualified Institutional Buyers (QIBs) according to the definition of QIB. QIBs are institutional investors who possess the skills and resources required to evaluate and engage in capital markets.

Foreign institutional investors

An investment fund or investor who makes investments in a nation other than its home or place of registration is known as a foreign institutional investor. It is most likely in India that the phrase “foreign institutional investor” is used to describe foreign companies making investments in the country’s financial markets.

FIIs may be eligible for tax breaks or other incentives, and they may have an impact on capital flows and market movements in the host nation. Hedge funds, sovereign wealth funds, and pension funds are a few types of FIIs.

Domestic institutional investors

Investors in a country’s financial assets on behalf of companies such as mutual funds, banks, insurance companies, and others are known as domestic institutional investors or DIIs. In other words, domestic investors will utilise the combined funds solely for the purpose of trading national resources and assets.

Political and macroeconomic factors have an influence on DIIs’ investing decisions. Like their international counterparts, DIIs have the ability to influence the overall investment flows in the country’s economy.

It is important to take note that particularly when FIIs are the nation’s net sellers, domestic institutional investors in India have a significant influence on the direction of the Indian stock market.

Also read: Foreign portfolio investments – Overview, types and benefits

Who are non-institutional investors?

A noninstitutional investor is an individual, whereas an institutional investor is a major institution such as financial organisations, insurance agencies, mutual funds, pension funds, or other establishments.

Non-institutional investors use a broker, bank, or mutual fund to purchase and sell debt, stock, and various other securities. Non-institutional investors or retail investors sometimes pay greater commissions along with additional costs on their trades due to their lower purchasing power.

Role of institutional investors in corporate governance

Voting rights are one of the main ways that institutional investors impact company governance. Institutions are able to own a sizable amount of a company’s shares thanks to their financial strength.

Advisory roles of the board enable the use of shareholding rights in meetings to shape the course of the company. Institutional investors have the ability to uphold strict corporate governance standards and keep the board and management accountable by endorsing specific initiatives or candidates.

Institutional investors also have a part in regulating the societal and ecological aspects. The ability to withdraw funds from businesses that use immoral or unsustainable business practices belongs to investors. They have the ability to make it evident that they will not put up with poor governance practices by taking their money out.

Role of institutional investors in real estate

In contrast to owner-occupied properties, institutional real estate is not purchased as an individual amenity or consumer item, but rather as a financial asset. Only properties with institutional grade and third-party ownership make up the institutional real estate sector. Between January and September 2023, institutional investments in Indian real estate reached $4.6 billion, a 27% YoY increase.

This encouraging trend has been facilitated by the solid underlying fundamentals of real estate asset classes, including commercial and residential buildings, as well as a favourable outlook for the domestic economy. The office sector has attracted the attention of institutional investors in particular because of the growing opportunities, steady demand, and promising development forecasts over the next two to three years.

Conclusion

Institutional investors are hugely influential market makers controlling financial markets. While retail investors react to daily price swings, institutions take a long-term, research-based approach to generate returns over many years. By making the effort to understand these investors and what motivates them, small traders can attempt to align their own positions with institutional flows.