The world is a highly connected place today. Almost all nations are intertwined due to commodities/services supply and demand activities. It has fuelled better opportunities, optimum usage of resources and establishment of a robust global economic cycle. However, this was not the scenario a century back.

The aftermath of the World Wars and the catastrophic conditions of the Great Depression called for better management of world finance. Countries involved in the war needed assistance in terms of finance and restructuring. In the historical venue of Bretton Woods, New Hampshire, the idea of one regulating international body to facilitate the above purpose was born.

The birth of the International Monetary Fund (IMF) changed the course of global economic history. Let’s explore in detail about IMF, its functions and its role in the world economy.

Also, read: How Global Economic Events Affect Personal Finances.

What is IMF?

IMF is one of the apex institutions for the efficient management of world finance and overall management of economic aspects. It works towards the upliftment of its member countries. Moreover, it keeps a keen watch on capital transactions, trade, and policy decisions of its member countries.

About IMF Origin

The main concern of Allied nations after World War 2 was the destructive aftermath of it. Countries suffered heavy downfall, colonies were falling apart, and the economic capacity of almost all the nations was heavily affected. To combat this, a conference was organised with 44 countries, and the Bretton Woods system or the International Monetary Fund (IMF) was established in July 1944.

At its inception, the system started with a fixed exchange rate system. However, the oil crisis changed the course. It was changed to a floating exchange rate system in 1971, after the oil price shocks. Moreover, previously the exchange rates were in terms of gold, which changed to the US Dollar in the same year.

Present scenario of IMF

Over the years, the organisation has played a crucial role during many global crises like oil price shocks, the Asian tiger crisis, Eastern Europe changes, the 2008 financial market crisis, etc. It was started by just 44 countries and has spanned 190 member countries as of September 2024.

Mission

The organisation works mainly to ensure financial assistance to the countries and bridge the gap in the balance of payment (BOP) crisis. The three main missions of the IMF are:

- Induce and fuel the monetary cooperation at the international levels.

- Encourage trade, employment and economic growth.

- Discourage any harmful policies and acts concerned with prosperity.

How does IMF work?

While working with different countries and experiencing varied economic conditions, the organisation has developed over the years. However, some of its core functions are based on the same:

- Policy advice

The act of surveillance is a key function for the organisations. It monitors the financial policies of the member countries. Moreover, its country-level monitoring is accompanied by bilateral or multilateral policy surveillance. It also helps in policy construction for specific purposes.

- Financial assistance

Countries may face different types of crises in the process of development. The issues regarding BOP management, external debt, crises due to insolvent financial institutions, excessive deficits, etc.

- Capacity creation and development

The technical assistance and training regarding optimum creation and use of opportunities is known as capacity development. IMF actively offers the service for its members for capacity development in legal, economic, strategic, etc., areas of the economy.

In addition to these core functions, the institution actively works towards reducing poverty, employment generation, sustainable development, exchange rate stability, international payment system, etc.

An interesting read: Global events impacting stock markets

IMF pay quota and SDR

These are crucial aspects of the IMF in terms of financial assistance. The Special Drawing Rights (SDR) of the IMF is a facility provided to member countries as an extension to country reserves. Liquidity requirement is facilitated by this instrument. It is a basket of five currencies, including the US dollar, Yen, Euro, Yuan and Pound Sterling.

Since the inception of the IMF, the process of general allocation has been facilitated four times. In this, member countries are allocated shares as per their quota. The last allocation, as of September 2024, was processed in 2021.

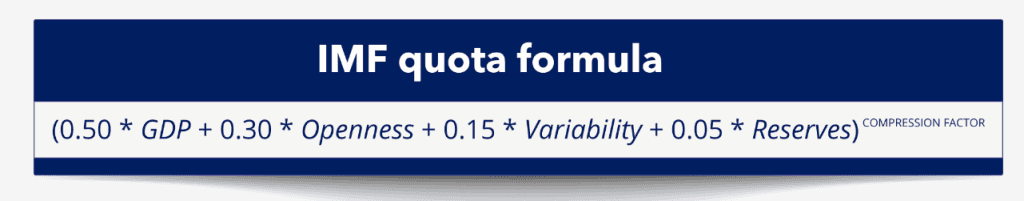

The IMF pays quotas in different strata to categorise countries based on the factors such as GDP. It is a relative position compared to other member countries. Moreover, the share in this quota affects the SDR capacity. These quotas are reviewed every five years. The Latest review was in 2020 (as of September 2024).

Source: IMF

Summary

The increasing connectedness of the world economies creates a need for financial and policy-based restructuring assistance in some conditions. The International Monetary Fund (IMF) has played a crucial role in providing this assistance since its inception. Its functions regarding capacity building, sustainable financial goals, BOP help, exchange rate stability, etc., are the peculiar features of the IMF.

Check this out: SEBI’s quasi-powers: Keeping India’s securities market ethical

FAQs

Q1. What is the Bretton Woods system?

The International Monetary Fund was originally termed the Bretton Woods System. The world was hard-hit by the constant saga of world wars and the Great Depression. In July 1944, 44 countries came together to create this system to explore the opportunities for world cooperation, postwar reconstruction and the gradual opening up of economies.

Q2. Is India a member of the IMF?

Yes, India was one of the earliest countries to join the IMF as a member in December 1945. India last took financial assistance from the IMF in 1993. Today, the country is one of the fastest emerging economies in the world. Thus, it has a strong say in the organisation. As of September 2024, India has a quota of 13,114.5 million SDR.

Q3. What are the missions of the IMF?

The organisation is working towards empowering the low-developing or crisis-hit countries with its financial assistance. The three main missions of the IMF are:

- Advancing global cooperation among countries to foster economies.

- Encouraging economic growth and trade expansion.

- Keeping a strict eye and discouraging policies that can harm prosperity in the world.

Q4. What are Special Drawing Rights (SDR)?

It represents the pool of world currencies. Currently, it constitutes the top five currencies. The SDR value, determined by the IMF, is calculated daily per spot exchange rate. It is expressed in US Dollars. In the general allocations, the IMF distributes SDR among the member countries and determines their share in the total quota. Currently, the US dollar has the highest weight.

Q5. Who is the first deputy manager of the IMF?

An Indian origin, Gita Gopinath is the first deputy manager of the IMF. She is regarded as a distinguished economist. Moreover, she has previously served the United States of America in various positions. Her studies till post-graduation are done in India, and she received her doctorate from Princeton University.