Investment analysis is an essential practice that should form the foundation of your investment strategy. The goal is to assess the investment opportunity’s feasibility and possible profitability.

Contrary to the number of investment advice readily available on social media platforms, a rigorous approach ensures a more comprehensive understanding of the associated risks and returns.

With the prevalence of various investment schemes, the risk of scams and poor investment choices is also escalating. Investment Analysis mitigates these risks by providing a structured framework to evaluate profitability, risk factors, and investment tenure.

Investment analysis is not merely advisable—it’s indispensable for anyone serious about safeguarding and growing their financial assets. Stay tuned as we delve deeper into the different facets and the scope of investment analysis.

What is investment analysis?

Investment Analysis is a systematic approach for evaluating investment opportunities to determine their potential viability and fit within an individual’s or institution’s financial portfolio. This encompasses a range of methods, such as scrutinising past returns, projecting future performance, and assessing associated risks.

The main aim of investment analysis and portfolio management is to facilitate informed decision-making. This involves determining the suitability of an investment based on key metrics such as entry price, anticipated time horizon, and the investment’s role within a diversified portfolio.

For instance, when evaluating a mutual fund, metrics like past performance, expense ratios, and management stability become crucial variables. This careful process ensures that your investment aligns with your own financial goals and risk appetite.

You may also like: Your comprehensive guide to successful share market investing

Factors to consider while conducting investment analysis

The process of investment analysis involves multiple factors that help you make decisions in tune with your risk tolerance and financial goals.

1. Cash flow analysis

Understanding the cash flows generated by an investment is indispensable. Examine both present and future cash flows to ascertain if the investment will offer adequate returns relative to the risk involved.

2. Resale value

Consider the potential resale value of the asset in question. An asset with a high expected rate of growth in market value is generally a favourable investment opportunity.

3. Economic conditions

The macroeconomic landscape, including interest rates and inflation, can significantly influence an investment’s yield. Therefore, a thorough understanding of the current economic conditions is essential.

4. Company financials

A thorough review of a business’s financial statements yields important information. Studying key performance metrics including debt-to-equity ratios, revenue, and profitability is important.

5. Business strategy

Evaluate the company’s competitive advantage, growth plans, and target market. A strong business strategy can often lead to sustained profitability and should not be overlooked.

6 Management

The knowledge and skill of a company’s management team has a big impact on its development. Their collective experience, historical performance, strategic planning, and risk-taking capabilities are pivotal in steering the organisation towards success.

7. Sector trends

An awareness of the prevailing trends in the relevant sector can offer investment advantages. Recognise growth drivers, technological advancements, and potential disruptors within the industry.

8. Market size and competition

Two key factors are the size of the market and the intensity of competition. A growing market with minimal competition often presents a compelling investment opportunity.

9. Regulatory framework

The performance of an organisation can be significantly impacted by compliance to laws and government regulations. It’s crucial to be cognizant of the regulatory environment when assessing an investment.

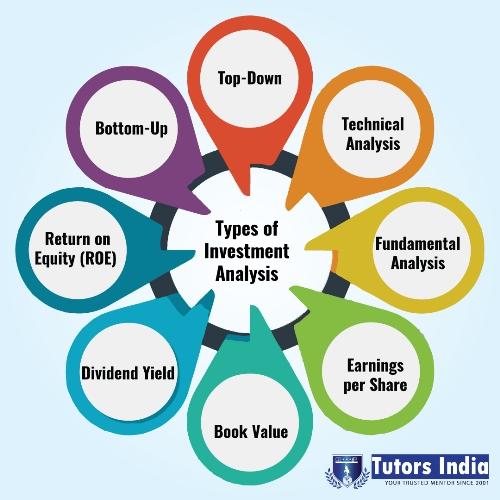

Types of investment analysis

Here is the overview of the primary types of investment analysis

Bottom-up approach

The fundamentals of an individual company are the focus point of bottom-up approach. Parameters such as company valuation, management competence, and stock pricing power are critically examined. This analytical style is ideal for investors who seek to understand a company’s core strengths and weaknesses.

Top-down approach

Conversely, the top-down approach commences with analysing macroeconomic variables, including GDP, employment rates, and industry trends. It narrows down to specific sectors and companies that are well-positioned to benefit from identified macroeconomic trends. This approach is particularly useful for investors capable of nuanced macroeconomic interpretations.

Also read: Beat the market: Your ultimate guide for fundamental analysis tools.

Fundamental analysis

Fundamental analysis remains the technique of choice for long-term investors. By analysing a variety of financial data, the goal is to determine a stock’s intrinsic worth. This includes annual reports, profit and loss statements, and balance sheets, among other key financial metrics like P/E ratios and ROE. The goal is to identify whether a stock is undervalued or overvalued based on intrinsic value calculations

Technical analysis

Technical analysis, on the other hand, is designed for investors looking at short-term gains. To forecast future price behaviour, it uses data on trading volume and past price movement. Various charting tools and trading signals are often used to arrive at buy or sell decisions.

Hybrid approach

Given the complexities of modern financial markets, a hybrid approach that combines elements from multiple methods is increasingly recommended. For example, one might utilise a top-down strategy to identify an industry with high growth potential and then employ fundamental analysis to select specific investment opportunities within that sector.

Also Read: Do all technical analysis tools work equally well?

Importance of Investment Analysis

So, why should you do an investment analysis? Investment analysis is a critical process for anyone looking to make informed financial decisions and safeguard their assets.

It will allow you to assess potential opportunities through a systematic evaluation of risks, returns, and other key factors. Investment analysis plays a major role in guiding both new and experienced investors to make more profitable and secure investments while staying away from any costly mistakes.

Manages Risks

Firstly, investment analysis helps in identifying and managing risks. Every investment, whether in stocks, real estate, or bonds, comes with a certain level of risk. By carefully examining market trends, company financials, and economic conditions, investors can get an idea of the potential cons of making a particular investment. This risk assessment is important, especially in volatile markets, as it allows you to adjust your portfolios in a way that balances risk with reward.

Helps in Decision-making

Investment analysis also enhances decision-making. By using different methods, such as fundamental analysis for long-term investments or technical analysis for short-term trades, investors gain insight into the most beneficial time to buy or sell assets. It is a data-driven approach that minimises reliance on speculation or emotion-based decisions, which are common mistakes that can lead to lower returns.

Porivdes Diversification

Another reason why investment analysis is important is because it allows you to diversify your portfolio. By analysing different sectors and asset classes, you can build a diverse portfolio that reduces risk across various investments. A well-diversified portfolio ensures that losses in one sector can be balanced by gains in another. This leads to more stable long-term returns.

Helps Understand Different Market Cycles

Investment analysis also provides clarity on market timing and economic conditions. Investors can align their strategies with market conditions by understanding macroeconomic indicators like inflation, interest rates, and employment trends. Doing so ensures that investments not only perform well but are also sustainable through different phases of economic cycles.

Investment analysis gives you the right knowledge, helps reduce risk, supports diversification, and allows you to create strategies for building wealth, making it an important practice for investors.

Final thoughts

The most effective tool for making wise choices in the financial market is investment analysis. With methods like Bottom-up and Top-down approaches or fundamental and technical analysis, you get a 360-degree view of investment prospects.

Each offers unique insights and helps you sidestep risks associated with making choices on hearsay or trends. The richer the data you incorporate, the more precise your decision-making.