Liquidation is a term that carries significant weight in the business world. Simply put, liquidation is the formal process of shutting down a company by selling off its assets and settling the debts.

But why does a company reach this point? The causes of the liquidation of a company can vary, but most often, it’s down to insolvency. That means the company can’t carry on its business profitably. During this period, regular operations cease as the focus shifts towards settling liabilities and distributing any remaining assets.

Now, let’s dig deeper into the concept of liquidation, how it works, and what it involves.

You may also like: Mastering revenue expenditure – Categories, impacts and management

What is liquidation of a company?

When a company is in financial turmoil, the first line of action is often to prepare and implement a resolution plan. This aims to revive the business and set it back on course. However, if the plan doesn’t yield the desired results or fails to gain approval, the company faces the unavoidable reality of liquidation.

This process includes the sale of the company’s assets—ranging from inventory to operations—to pay off its liabilities. Any remaining funds are then allocated to the shareholders.

Importantly, liquidation is a regulated, legal procedure. It’s not a decision that a company can make spontaneously. It necessitates formal approval from an Adjudicating Authority (AA) in the following scenarios

- When the company fails to submit a business-saving resolution plan in time.

- If the AA finds issues with the plan and decides to reject it.

- When the Committee of Creditors (CoC) collectively approves the decision for liquidation.

- If the company itself goes against an already approved plan.

Effects of company liquidation

When a company is under liquidation, a wave of legal and procedural shifts occurs.

- First off, the protective moratorium under Section 14 of the Insolvency & Bankruptcy Code (IBC) is lifted the day the liquidation order passes through the National Company Law Tribunal (NCLT).

- According to Section 52 of the IBC, it is not possible to file any new lawsuits against the company. However, a liquidator can take legal action on behalf of the corporate debtor, but only with the prior approval of the AA.

- Finally, the liquidation order acts as a formal notice of discharge for the company’s officers, employees, and workers. This is unless the business continues to operate during the liquidation process under the liquidator’s supervision, as stated in the IBC.

Liquidation process

The process of liquidation of a company is a structured, well-defined exercise regulated by legislation and requiring professional oversight. Let’s break down the key steps involved:

1. Secure shareholder approval

Initiating the liquidation process requires explicit consent from the company’s shareholders, typically approved through a special resolution in a general meeting.

2. Notify the Registrar of Companies

Following shareholder consent, a formal notice outlining the intention to liquidate must be filed with the Registrar of Companies (ROC). This notification should also detail the particulars of the resolution meeting.

3. Appointment of a liquidator

The subsequent stage involves designating a qualified individual, like a Chartered Accountant or Company Secretary in active practice, to execute the liquidation proceedings. Their job is to ensure assets are sold off in a structured manner. And this isn’t a fast process. Sales are done incrementally, and cash or bank balances are usually excluded. This professional can be replaced by the AA as per guidelines laid down in the IBC.

4. File a statement of financial position

Upon appointment, the liquidator is responsible for filing a Statement of Affairs with the ROC. This document comprehensively details the company’s assets and liabilities.

5. Prepare the liquidation financial account

The liquidator is tasked with creating a liquidation account, which defines how residual assets will be apportioned among shareholders in accordance with the Companies Act of 2013.

You may also like: Mergers vs. Acquisitions – How are they different from one another?

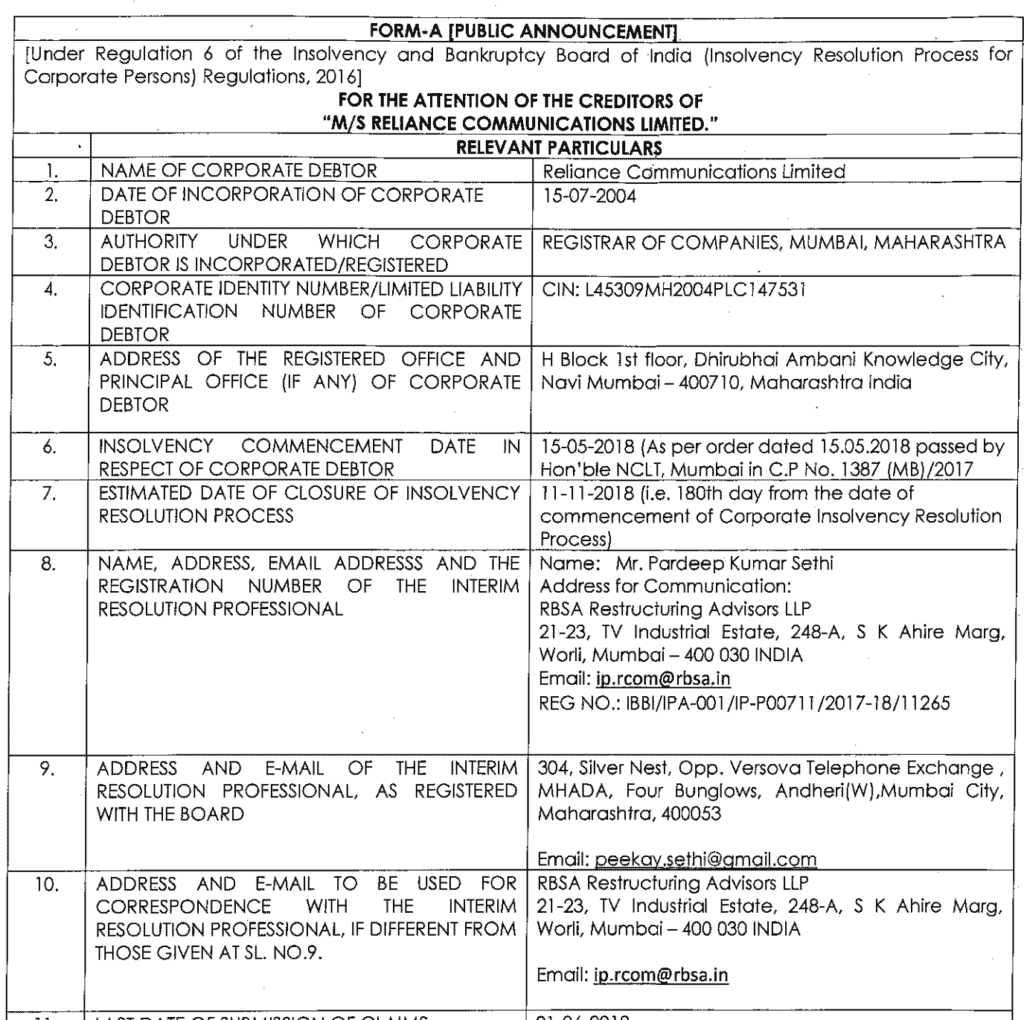

6. Public announcement

Officially announce the liquidation to invite claims from creditors and other stakeholders.

Source: Insolvency and Bankruptcy Board of India

( Reliance Communications Public Announcement)

7. Verify claims

Assess and validate all creditor claims.

8. Asset memorandum

Prepare an in-depth asset evaluation.

9. Initiate sales

Assets get sold, keeping in line with existing laws and rules.

10. Execute asset distribution

Asset dissemination must adhere to legislative frameworks, specifically the Companies Act, 2013. This ensures equitable distribution among all vested parties.

11. Submit the final liquidation report

Completion of the process necessitates the submission of a final liquidation report to the ROC. This report encapsulates the various activities undertaken during the liquidation process.

12. Acquire a No Objection Certificate

The final procedural requirement is the procurement of a No Objection Certificate (NOC) from the ROC, thereby signalling the formal conclusion of the liquidation process.

Types of liquidation

Here are the main types:

1. Voluntary liquidation

In voluntary liquidation, the company chooses to close. It’s a planned move, usually because the owners think it’s best for the business. They sell off the company’s assets and are able to pay all debts.

2. Creditor’s voluntary liquidation

Here, the company’s directors or stakeholders initiate the closure. They do this because they are concerned they won’t be able to pay the debts in the future. Assets are sold, and creditors are paid to avoid legal issues.

3. Compulsory liquidation

This is court-ordered. If a company can’t pay its debts and there is no way out, a legal authority steps in. The company is required to sell everything to pay off debts, and then it closes down.

Also read: EBITDA explained: Definition, calculation, significance, and more

Liquidation of dormant company

In India, dormant companies are legal entities created and left ‘on the shelf’ to be sold later. Liquidating a dormant or “shelf” company in India is streamlined under the Companies Act 2013. The Indian government offers a Fast Track Exit Scheme, making the process straightforward. The key step is filing Form STK-2 with the ROC, signed by the company’s director. To be eligible, the company must have no assets, liabilities, or business activity for at least a year prior to the application.

Final Words

Liquidation of a company is a regulated, often intricate process that effectively winds up a company’s operations. The end result is that the company ceases to exist by law, having sold off its assets and settled its liabilities. Although time-consuming, the process provides a structured way to handle losses, offering a sort of financial and emotional closure for the stakeholders involved.