Liquidity is a significant factor in investments. It determines how conveniently an asset can convert itself into cash.

Liquidity is usually seen as a positive trait of an investment. But do you know that too much liquidity can cause more harm than benefits?

Assessing the degree of liquidity is essential. Read further to understand how high liquidity can negatively impact the economy and create a liquidity trap.

What is a liquidity trap?

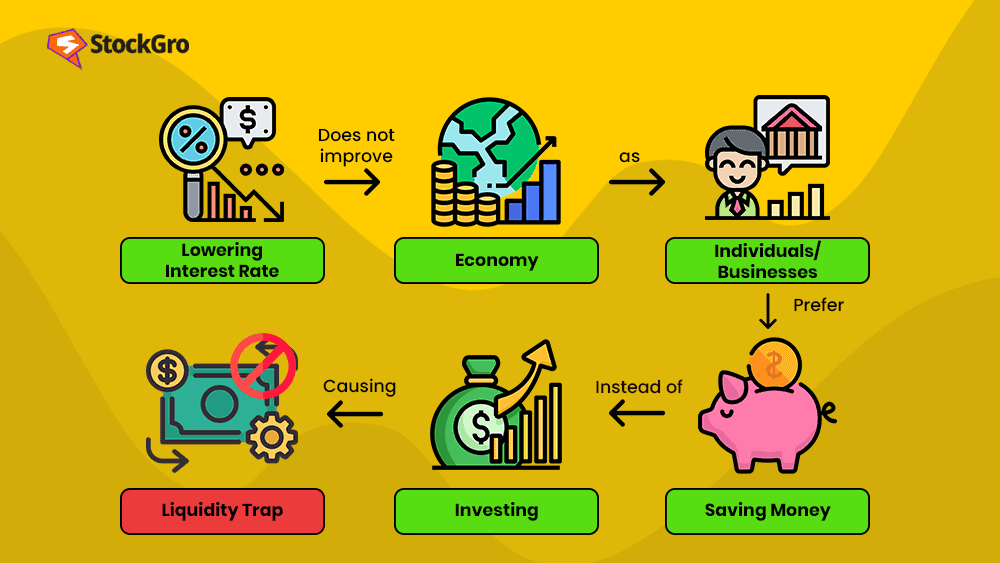

A liquidity trap is an economic situation where interest rates in the market are very low, due to which investors prefer holding liquid cash rather than making investments.

It usually occurs after a recession or depression, when the expansionary monetary policies fail.

Expansionary monetary policies are measures that the government takes to increase the money flow in the economy to recover after a recession. One of the ways for the government to do this is by reducing interest rates to promote borrowing. When the reduced interest rates become unattractive, it leads to a liquidity trap.

You may also like: NPA: The tipping point in banking and economy

Investors prefer holding cash to attend to economic uncertainties rather than making investments that may not seem lucrative.

Source: Educba

Identifying the trap

- Low-interest rates in the market can be the first sign of a liquidity trap. The continuous reduction of interest rates for a long time suggests the beginning of the liquidity trap.

- It is also a common scenario that most economies witness after a recession. Since the recovery post-recession takes time and involves uncertainties, consumers stick to frugality.

- The exact opposite of inflation is the situation of deflation, where the prices of goods and services reduce in the market. Such price reductions across different classes of goods indicate a liquidity trap.

- Unemployment is another cause leading to a liquidity trap. When the rate of unemployment increases, people prefer saving money for urgent needs, thereby cutting down all other expenses.

Economic impact

The equity and bond markets take the hit of this economic condition.

Since consumers have a restraint on their investing behaviour, companies looking to raise capital through the issue of equities suffer. The lack of capital restricts companies from performing to their full potential, leading to a loss in revenue and finally impacting the country’s GDP (Gross Domestic Product).

Similarly, the bond market experiences a downfall too. The bond prices share an inverse relationship with interest rates. Since the government keeps altering the interest rates in this situation, the bond prices keep fluctuating, too. This leads to instability and stops investors from investing in bonds.

Also Read: Working capital – the what, how, and why of business lifelines

Strategies to handle the liquidity trap

- The primary reason for a liquidity-trapped economy is falling interest rates. If the government improves the interest rates on deposits and investments, consumers will automatically start diverting their savings into these avenues.

- A significant reduction in the prices of goods and services across various sectors helps in promoting the flow of money. Consumers will try to make the best use of the low prices and spend money on these goods rather than saving them.

- The government can try to alter its fiscal policies and regulations by offering subsidies and lowering tax rates. This promotes the idea of spending among individuals.

- Another way of handling this issue is to reach out to other countries with excess cash.

Benefits and limitations

While the liquidity trap is a situation of crisis, it offers few benefits, too.

- Due to the low interest rates, borrowing loans from the bank becomes easy and affordable for people in urgent need of money.

- The government must closely monitor how its policies impact the economy. Events like the liquidity trap act as eye-openers for the government to update their rules.

- It encourages the habit of saving and sensible spending among consumers.

The liquidity trap is an event that affects the entire economy of the country. Some of the major disadvantages are:

- Low interest rates cause demotivation among banks, non-banking companies and other financial institutions. So, they reduce their activities and avoid approving loans to people in need.

- The central bank (Reserve Bank of India), which is the authority of financial rates in the country, loses its control over how the economy should react during the crisis.

- Companies fail to raise sufficient capital, which affects their operations. Employees suffer from irregular salaries, and sometimes it can also result in heavy layoffs, leading to an increased unemployment rate in the economy.

- The liquidity trap is usually a result of recovering from a recession. Contradictory to its purpose, the liquidity trap puts the economy under more pressure.

- Coming out of this trap essentially means increasing the money value and flow in the economy, which leads to inflation. Inflation impacts the consumers severely, again.

Liquidity trap in the real world

The deadly coronavirus resulted in the global economy falling into a liquidity trap in 2020.

It is said that more than 60% of the economy reduced their interest rates to less than 1%. Since unpredictability prevailed globally, consumers were apprehensive about borrowing and investing despite attractive rates.

Also Read: Debt instruments in India: Understanding your investment options

Bottomline

The term and meaning of liquidity trap was first used by J.M Keynes in 1937.

The liquidity trap is a failure of the central bank’s regular approach to recover from economic lows by reducing interest rates.

This is an issue of global concern and can affect all kinds of economies, ranging from developed to underdeveloped countries. If governments & banks fail to make the right decisions, the economy will continue to fall, and the recovery becomes difficult.

Hence, it is essential for the government to give these events their due importance and take corrective measures as early as possible.