In the modern age of growing inflation, geo-political instability and evolving investment horizons, financial security has become crucial. Therefore, investors seek long-term investments with potential market stability. It helps them combat inflation and earn alpha returns.

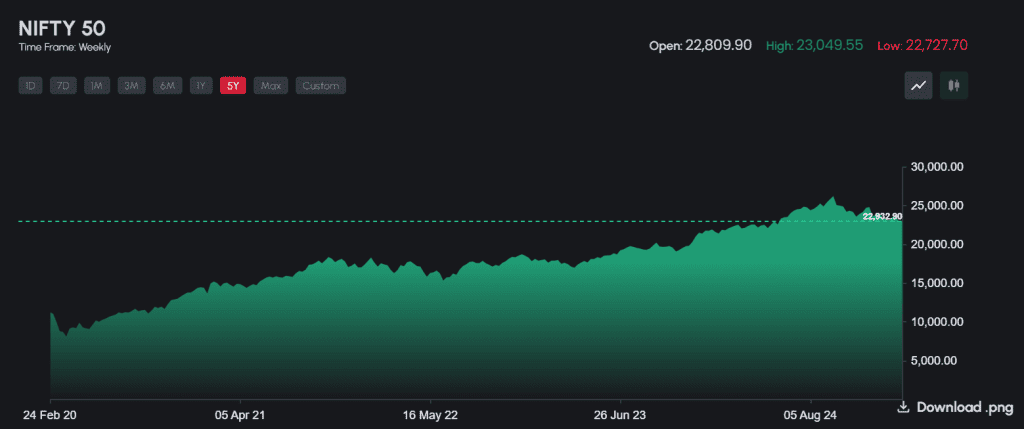

A key index of the Indian stock market, NIFTY 50, has grown by 13.6% CAGR in the past 5 years. It constitutes the top 50 stocks with the largest market capitalisation in the country. These can be some of the best-performing stocks in India due to their market cap and may provide potential long-term returns. Read further to know more!

Dive deeper: Long-term investing: A smart strategy for lasting wealth

Long-term capital gain in India: NIFTY 50

The Indian stock market has experienced different phases in the past 5 years. Despite falls, the market has benefited investors with a long-term investment approach. Such long-term investments can benefit investors in the following ways:

- Compound the returns.

- Financial stability and hedge against inflation.

- Risk minimisation and diversification.

- Lower tax burden due to long-term capital gain in India.

A key index for the Indian stock market is NIFTY 50. It constitutes the top 50 stocks in India based on the market cap. As of February 20, 2025, the index price has shot up by almost 104% in the span of 5 years. Moreover, the price-to-earnings per-share ratio has been in a downward trend in this period, which indicates potential efforts to improve market valuations.

The data and charts indicate that investing in NIFTY 50 stocks has been significantly profitable for investors willing to earn long-term gain in India. Moreover, investing in all 50 stocks can be cumbersome. Therefore, investors can explore the top stocks generating significant long-term returns from the index.

Must read: Get to Know Nifty 50: Calculation and Top 10 Stocks

Best performing stocks in India from the NIFTY 50 index

Here are some of the best-performing stocks in India, curated based on their NIFTY 50 inclusion and ranked based on their 5-year return as of February 20, 2025.

This public-sector unit is mainly associated with the manufacturing of electronic equipment and systems. It was established in 1954 by the Defence Ministry and mainly specialises in defence equipment. Recently, it received an order of ₹1220.12 crores from the Indian Coast Guard for the software-defined radios procurement.

Its financials indicate that it is the best-performing stock in India in terms of returns with a potential market cap.

| Particulars | FY 2024 | FY 2023 | Change (%) |

| Revenue (in ₹ crores) | 20,268.2 | 17,734.4 | 14.2% |

| Net Profit (in ₹ crores) | 3,985.2 | 2,986.2 | 33.4% |

| Earnings per share (in ₹) | 5.4 | 4.0 | 35.0% |

| Debt to Equity ratio (in times) | 0.0 | 0.0 | 0% |

It has mainly 4 business segments, namely consumer goods, energy and utility, primary industry and transportation. It is the holding company for 10 significant entities under the Adani group. Its financials reflect its strength.

| Particulars | FY 2024 | FY 2023 | Change (%) |

| Revenue (in ₹ crores) | 96,420.9 | 1,27,539.5 | (24.4%) |

| Net Profit (in ₹ crores) | 3,335.2 | 2,421.6 | 37.7% |

| Earnings per share (in ₹) | 27.2 | 21.7 | 25.3% |

| Debt to Equity ratio (in times) | 1.1 | 1.0 | 11.8% |

The company operates under the Tata group of companies and holds some of the big brands in the country, such as Westside and Zudio. It was originally started as Lakme in 1952. In the past 3 years, the company’s net profit has grown nearly 5 times.

| Particulars | FY 2024 | FY 2023 | Change (%) |

| Revenue (in ₹ crores) | 12,375.1 | 8,242.0 | 50.1% |

| Net Profit (in ₹ crores) | 1,477.4 | 393.6 | 275.3% |

| Earnings per share (in ₹) | 41.8 | 12.5 | 234.4% |

| Debt to Equity ratio (in times) | 0.1 | 0.0 | 200% |

It is one of the biggest brands in the automobile manufacturing sector of India. Due to strong leadership and the company’s experience of nearly 80 years, it has spanned over more than 100 countries globally. Its core strength is in its SUV products.

| Particulars | FY 2024 | FY 2023 | Change |

| Revenue (in ₹ crores) | 1,38,279.3 | 1,21,268.5 | 14.0% |

| Net Profit (in ₹ crores) | 12,269.8 | 11,374.4 | 7.8% |

| Earnings per share (in ₹) | 100.7 | 91.9 | 9.5% |

| Debt to Equity ratio (in times) | 1.3 | 1.3 | – |

Established in 1945, the company is one of the leading automobile manufacturers in the country. The company has an international presence with the help of its joint ventures like Marcopolo and Fiat. The brand’s financial strength is reflected in its consistent revenue and profits.

| Particulars | FY 2024 | FY 2023 | Change |

| Revenue (in ₹ crores) | 72,745.9 | 65,298.9 | 11.4% |

| Net Profit (in ₹ crores) | 7,902.1 | 2,728.1 | 189.6% |

| Earnings per share (in ₹) | 20.7 | 7.2 | 187.5% |

| Debt to Equity ratio (in times) | 0.45 | 0.83 | (45.7%) |

Comparative analysis of 5 best-performing stocks in India

Here is the comparative analysis of stocks with high 5-year returns from the NIFTY 50 cohort.

| Particulars | Market cap (in ₹ crores) | 5-year returns | Net Profit Margin | P/E ratio (in times) |

| Bharat Electronics Ltd. | 1,90,237.0 | 55.2% | 19.5% | 38.1 |

| Adani Enterprise Ltd. | 2,52,061.1 | 53.1 | 3.7% | 66.0 |

| Trent Ltd. | 1,81,070.7 | 45.7% | 7.3% | 121.8 |

| Mahindra & Mahindra Ltd. | 3,53,212.3 | 40.1% | 8.8% | 28.5 |

| Tata Motors Ltd. | 2,54,021.2 | 34.2% | 7.4% | 7.9 |

Summary

Investors seeking long-term capital gain in India can explore the NIFTY 50 index constituents. It has generated significant returns in recent years. Moreover, being blue-chip companies, investors can be assured of a potential hedge against inflation.

Also, explore Comparing Nifty Total Market Index and Nifty 50

FAQs

- What are blue-chip stocks?

Usually, stocks with high market capitalisation and reliable financials are known as blue-chip stocks. Investors can select these types of stocks with a long-term investment horizon. These are also known as large-cap stocks, which are categorised as the first 100 stocks based on market capitalisation.

- Which factors are analysed to determine the long-term potential of equity shares?

One of the key characteristics of a potential long-term investment is its fundamental strength in the business. Therefore, stocks with sound financial statements, growth, operations and cash flows can be considered for long-term investments. Moreover, investors can also analyse valuation metrics for selecting such stocks.

- How is the NIFTY 50 index made?

NIFTY 50 is the key index of the Indian stock market. It accounts for the top 50 companies based on the market capitalisation listed on the National Stock Exchange. It is reviewed semi-annually in March and September. The 6-month average free-float capitalisation is considered as of January 31 and June 31.

- Can I directly invest in NIFTY 50?

No, NIFTY 50 is an index and not a script for trading. Investors can invest in this index with the help of derivatives like futures and options. Also, index funds or exchange-traded funds can be used for investing in NIFTY 50. Investors can select suitable instruments based on their risk appetite.

- What is the reason for NIFTY 50 downfall at the start of 2025?

Several different reasons have contributed to the weakness in the NIFTY 50 at the start of 2025. Moreover, the market has been under pressure since October 2024, when mass FII selling instilled volatility. Apart from this, the fall is part of the market cycle of correction and is stimulated by aspects like the Budget 2025 announcement, weak GDP growth, geo-political pressure, etc.