Investments in the stock market are vulnerable to volatility. To combat this, investors prefer this unique debt instrument with returns of the equity market – market linked debentures (MLD).

Read further to understand the overall nature of market linked debentures in India.

What are market linked debentures?

The non-convertible debentures with stock market returns of underlying instruments are well known as market linked debentures. Investors with a horizon of higher returns and a capacity of medium risk can invest in this instrument.

The market linked debentures mainly invest in diverse underlying market instruments like market indexes, gold ETFs, government securities, etc. The market linked debentures taxation is as per the investor’s income tax slab by categorising it under short-term capital gains.

There are different MLDs in India by DSP Merill Lynch Capital Ltd, Edelweiss Alternative Assets Advisors Ltd, Citicorp (Finance) India Ltd, India Infoline Finance Ltd, Religare Finvest Ltd, etc.

Unique features

- Nature

Market-linked debentures meaning is derived from its nature of non-convertible debt instruments that are privately issued. As per SEBI norms, the minimum investment in MLDs should be ₹100,000.

- Maturity

Regular debt instruments have fixed maturity tenures, while the tenure for MLDs is decided by the issuing company. This tenure is usually very short compared to other instruments.

- Returns

The MLDs provide comparatively better returns than the regular debt instruments as in the positive market the former provides per annum interests with the excess market returns.

MLDs invest in underlying market indexes, which provide a proper diversification of various companies in a single instrument. For example: Purchasing MLD that invests in the Nifty 50 index gives exposure to balanced returns of the top 50 companies in the country.

The listed MLDs have credit ratings from ‘AAA’ to ‘AA’. When the ratings are higher there is a lower risk of default.

Also read: The ‘Debt+Equity’ Jackpot: Partially convertible debentures

How market linked debentures work?

The calculation of returns for market linked debentures is usually considered very complex. However, let us simplify it with an example:

Suppose, “ABC” company issued an MLD of 12% annual return for 30 months. As per the issuing conditions, if the BSE Sensex (at the time of issue) of ₹75000 does not fall below 50% in the tenure of 30 months, then the company will pay 12% interest per annum. The scenarios during maturity could be as follows:

- The BSE Sensex falls below 50%, at ₹37,500 within those 30 months. In such a case, investors would be only paid the principal amount and no interest.

- The BSE Sensex falls between ₹37,500 and ₹75,000 (falling within 50%). In such a case, the investors would be paid 12% interest per annum with the principal amount.

- The BSE Sensex rises above its ₹75,000 mark. In such a scenario, the investors would benefit from the principal amount, 12% interest per annum, and an excess return of over 12%.

Read more on debentures: Understanding convertible debentures

Types of market linked debentures

There are broadly two types of market linked debentures (MLD):

- Principal-protected MLD – These debentures hedge the investors against the falling market by paying the principal amount in adverse conditions. The maximum loss is interest.

- Non-principal protected MLD – These debentures do not protect even the principal amount. As the market falls below the prescribed levels, the investor may get a partial or no principal amount in return.

What are my risks?

The underlying market instruments in which MLD invests are influenced by several factors such as economic, political, social, etc. In the adverse scenario, if the market falls below a certain level, the investor loses almost all the interest and is left with a principal amount.

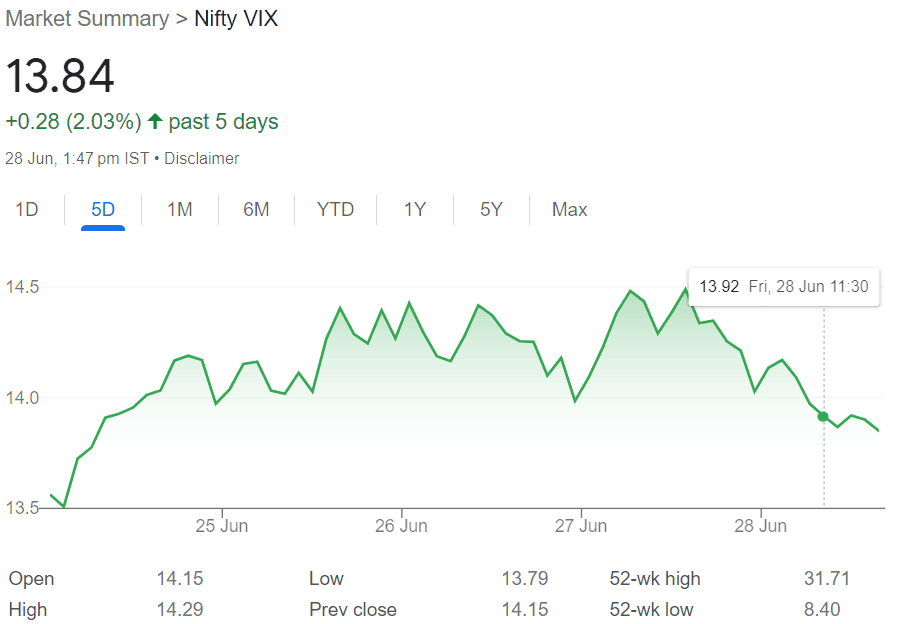

Moreover, with good returns of nearly 27% in a year, the market is vulnerable to experiencing high volatility that is visible in this chart of Nifty VIX:

The MLD is a debt instrument, so the company issuing it is responsible for its repayment. The default or insolvency of the issuing company is one of the risks affecting MLD.

Moreover, an investor should have an appropriate understanding of credit ratings for the MLDs because the low-rated investment could potentially waste the investment.

The payoffs of MLDs are gained at the time of maturity. So, exit before maturity from listed MLDs may pose a risk of not finding buyers. Uncertain market conditions play a crucial role in deciding the returns. This also causes investors to face a dilemma regarding holding the MLDs.

- Taxation uncertainty

The MLD gains are considered under the category of short-term capital gains. The interest from MLD is taxed as per investors’ income slab rates.

Must read: Understanding risk appetite: A prime consideration for decision-makers

Bottomline

Growth in the equity market accompanied by a security of fixed interest instruments is a rare combination available in market linked debentures (MLD). Moreover, it is one of the best instruments for investors with a higher risk appetite and market knowledge.

The minimum investment limits were reduced by SEBI to ₹100,000, which provides an opportunity for secure investments even in the era of market volatility.

Want to test your trading skills without risk? Use StockGro’s virtual trading platform and refine your strategies. Start with virtual trading app now!FAQ

Q1. What is market linked debenture?

The market linked debentures are debt instruments that invest in underlying market indexes, government securities, and gold. The market returns accompanied by fixed annual interest rates are the key features of MLDs. These instruments are an excellent investment option for investors with good market knowledge.

Q2. What is the difference between MLD and NCD?

The MLDs are a type of non-convertible debentures(NCD). The main difference between MLD and NCD is in terms of return. In MLD, the returns are as per the market conditions. While in NCD, the returns are fixed as per the coupon rate of the instrument.

Q3. What is the minimum investment in MLD?

The minimum investment in market linked debentures (MLD) since December 2023 is ₹100,000. Till 2023, the minimum investment was ₹10 lakhs, due to which only HNI invested in this instrument. Lower minimum investment motivates retail investors to participate more.

Investment opportunities like MLD provide a diverse range of sectors and investments in a single instrument. The dual benefit of equity market returns and debt instrument security is an excellent option for retail investors.

Q4. How does a MLD work?

The MLDs offer an interest rate at the time of issue and a prescribed maturity period along with some ‘%’ of variations in the underlying asset. If there are variations more than the limit decided at the time of issue, the investor is returned a principal amount at the end of the period.

But if the variations happen within the limit, the investor is rewarded with interest income. Moreover, if there is no variation as prescribed at the time of issue, the investor gets an added benefit of market return.

Q5. Can MLD be listed?

Market linked debentures are both listed and non-listed. The listed MLDs have better credit ratings and liquidity compared to non-listed MLDs. The taxation norms for both remain the same. When the MLDs are listed on the market, there is an option of exit before maturity if the buyers are available. However, in the over-the-counter (OTC) market, there are rarely any buyers for such instruments, and it poses a liquidity risk.