Introduction

Investing and trading are exciting and rewarding activities but require precision and strategy. Before starting your investment journey, you must know that there are different types of orders that you can use to execute your trades in the market, and each one has its advantages and disadvantages.

Knowing the different types of orders can help you decide which is best for you and help you make the most of your strategies. In this comprehensive guide, we’ll unravel one of the most common and basic types of orders, market order.

You may also like: What Is a Limit Order in Trading, and How Does It Work?

What is a market order?

In a market order, you instruct your broker to buy or sell a security immediately at the current or prevailing market price. It means that a market order guarantees execution, but it will not guarantee any specific price to investors.

When choosing a market order, you opt for quick execution of the trade without quoting the price. Thus, the transaction is carried out at the security’s current market price.

Investors who want to ensure fast execution of their transactions without any specific price in their minds can opt for market orders. Remember, the price at which the order gets executed can vary due to liquidity and market conditions.

How does a market order work?

When you opt for a market order during a trade, you are basically instructing the broker to trade the security or asset at the prevailing or current market price immediately. Here, the trader prioritises speed over price.

Usually, a market order is the default setting for most trading platforms and brokerages. So, when you place an order, the order type is market. So, by opting for a market order, you are willing to buy/sell the security at the current market price.

For instance, let’s assume you are willing to buy shares of ITC Limited. The current market price of ITC is ₹449.85, and you place a market order to buy 50 shares. The order will be executed immediately at ₹449.85 as long as there are sell orders for the same number of shares.

Now, let us assume that the market price rises to ₹450 by the time the order is sent to the exchange and executed. Now, the order will be executed at ₹450 instead of ₹449.85.

Also Read: What is a GTT order? How is this tool beneficial for investors?

What are the steps to execute a market order?

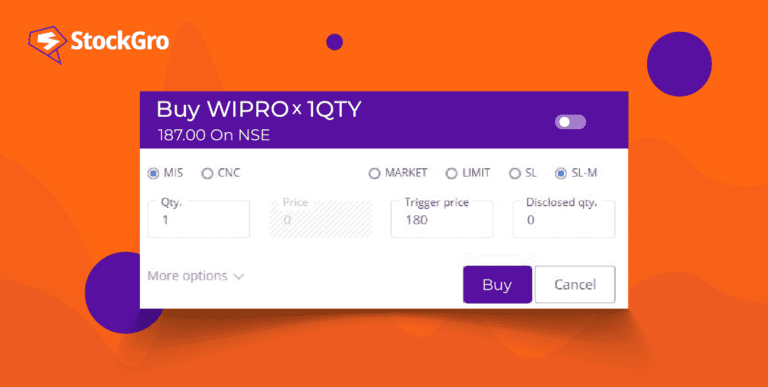

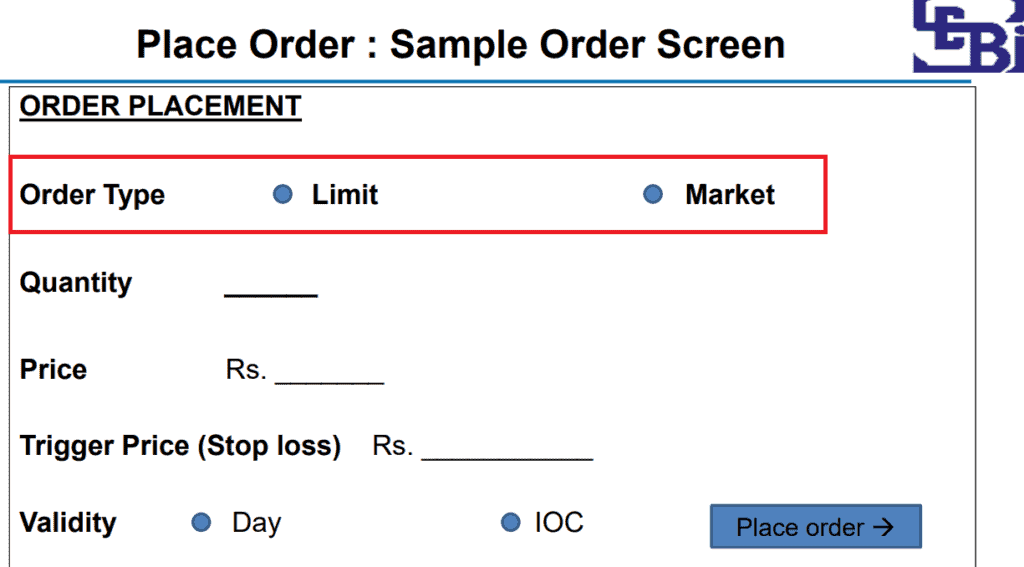

Follow the below steps to execute a market order:

- First, log in to your trading account or brokerage account.

- Select the financial security you want to trade.

- Select order type – Market.

- Enter the number of shares you are willing to buy or sell.

- Submit the order.

Once you submit your order, it will be executed quickly at the best available price in the market.

Source: SEBI

Pros and cons of market order

A market order is a smart choice for many investors, but not all. Hence, here are some pros and cons of market order.

Pros

- Market orders are executed immediately and efficiently.

- A market order also guarantees execution, which helps you buy a security or sell a security you want without holding it for a long time.

- Since a market order is placed at once, you must pay trading fees only once, reducing your cost.

Cons

- Since market orders are executed immediately, there is no guarantee about the price. This means that you might end up buying at a higher price or selling at a lower price than expected.

- In the case of less liquid stocks, like small-cap or penny stocks, a large price swing is possible. Thus, you might not get the price you expected.

Also Read: Immediate or Cancel (IOC) orders: A trader’s guide from concept to execution

Market order vs limit order

Before understanding the difference between a market order and a limit order, let us quickly glance at what a limit order is.

In a limit order, you instruct the broker to trade the security, i.e., buy or sell a security at your desired price. With a limit order, you specify the minimum price to sell the stock or the maximum price to buy the stock. The broker will only execute the trade when you get that desired price or better.

For instance, you want to buy 50 shares of ITC Limited at ₹442. Currently, the market price of the share is ₹449.85. In this scenario, the order will be executed when the price reaches ₹442 or below that.

| Market order | Limit order |

| Market orders are executed at the current or best price available. | Limit orders are executed by the broker only when the price reaches our desired price or better. |

| Market orders are guaranteed and are executed immediately. | Not executed immediately and the trade is also not guaranteed. |

| No limit on the price | Option to select the price at which you want to execute the trade. |

| During volatile markets, investors may end up paying more or receiving less. | The order will be executed only at the price mentioned, even during volatile markets. |

Bottomline

In a nutshell, choosing between a market order and a limit order depends on your preferences and the state of the market. If you want to execute your orders immediately without waiting for the price, a market order is your go-to, but be prepared to compromise on the price.

Conversely, a limit order gives flexibility over price and also offers price control, but bear in mind it could take a while to go through or might not even happen.

So, take a moment, weigh up what matters to you most, and take a good look at the market before you make your move.