A persistent reality influenced by several factors is market volatility. With the COVID-19 epidemic, for instance, BSE Sensex index dropped more than 40% from over 42,000 points in January 2020 to just over 25,000 points in March 2020. These episodes highlight the risks and doubts in trading and investing.

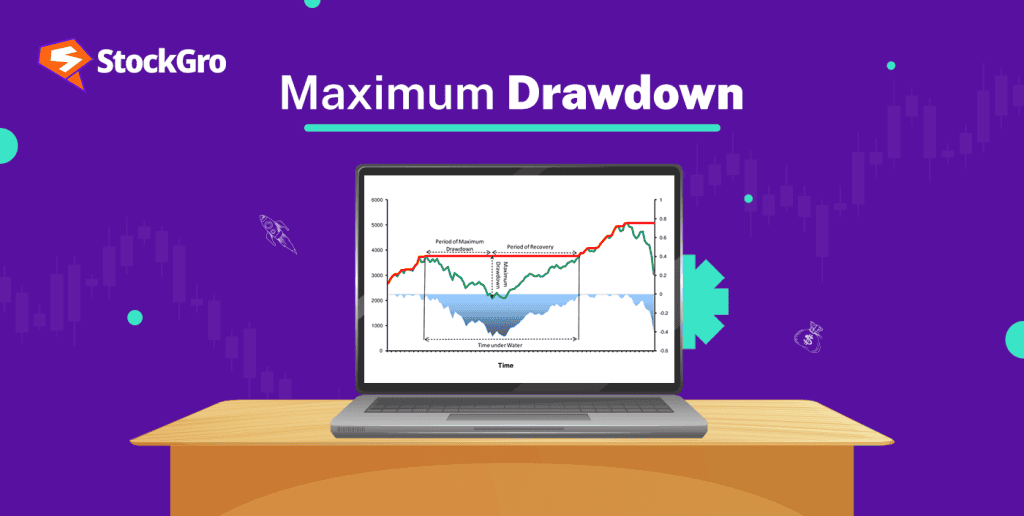

Knowing the maximum drawdown (MDD) is essential since it enables one to evaluate the possible risks connected to investment and the extent of capital in danger during market crises. Over a given period, MDD gauges the biggest percentage decline from a peak to a trough, thus providing investors with information on the worst-case situation they might encounter.

This article will define MDD, discuss how it is computed, and explain why it is a crucial statistic for investors trying to properly control risk and make decisions in their investment path.

You may also like: Decoding the significance of drawdown in investments

What is the maximum drawdown?

The maximum percentage loss in value of an investment portfolio in respect to its peak over a given period is known as maximum drawdown.

It gauges the largest loss an investor could incur in a market drop before portfolio recovery. Through MDD, an investor’s focus or concentration can shift as they are made aware of potential risks while an essential investment decision is being made.

For example, if an investor were to invest 1,00,000 and the percentage earned boosted the amount to 1,20,000 but due to unforeseen circumstances it came crashing down to 70,000, only recovering back 1,00,000 mark after a long period. The loss experienced in such investments is 41.67%, which would make MDD.

Thus, half of the value of the portfolio was the biggest loss throughout this period. In the worst-case scenario, MDD is vital in determining the potential loss an investor could incur and guides their decision on whether they are ready with the related risk.

Importance of MDD for investors

- Risk assessment: MDD clarifies for investors the possible maximum loss they could suffer in unfavourable market conditions.

- Informed decision making: Provides an open evaluation of risk, therefore leading investors towards better decisions with their money.

- Portfolio resilience: Helps evaluate the robustness of investments against market volatility.

- Comparison tool: Enables the comparison of several investment possibilities according to maximum drawdown.

- Risk management: Help create plans to lower risk and safeguard capital.

- Strategy development: Crucially important for creating strong investment plans resistant to market declines.

Must read: Risk management in stock market

How is MDD calculated?

Finding the utmost point (peak) and lowest point (trough) of an investment’s value over a certain period then allows one to determine maximum drawdown by then computing the percentage loss between them. One can make exact computations of this as follows step by step:

- Identify the peak: Find the maximum point that the investment made over the given period reaches.

- Identify the trough: Find the lowest point the investment declines to follow the peak before it starts to climb back.

- Measure the decline: Get the drop’s degree by subtracting the trough value from the peak value.

- Calculate the percentage: The percentage drawdown is then obtained by dividing the fall by the peak value then multiplying by 100.

Maximum drawdown formula:

MDD = Trough Value − Peak ValuePeak Value

Example:

Consider the investment of ₹1,00,000 in the beginning; the value of the investment then goes up to ₹1,20,000 only to collapse to ₹80,000. The investment then appreciates and returns to ₹1,00,000.

- Peak Value = ₹1,20,000

- Trough Value = ₹80,000

- Decline = ₹1,20,000 – ₹80,000 = ₹40,000

MDD = ₹40,000₹1,20,000 100 = 33.33%

The maximum drawdown is thus 33.33%. This implies that the investment dropped from its highest position to its lowest point throughout that period at 33.33%.

Factors that affect MDD

- Market volatility: Larger drawdowns as asset prices vary greatly from market events, including crashes, corrections, or bear markets, will result in major losses in a short period.

- Asset type: Variations in assets mean different risk profiles. Because of their price volatility, equities, especially growth stocks, tend to have greater drawdowns; safer assets like bonds or blue-chip stocks may see lesser drawdowns.

- Investment strategy: Different investing strategies affect drawdowns. Larger drawdowns might result from high-risk approaches such as leverage or focused growth investing. Conversely, as risks are distributed, diversified portfolios or value investing techniques usually show fewer drops.

- Time period: The result depends on the specified time span for computing MDD. While longer periods, such as several years, may catch more market volatility, therefore generating higher MDD values, shorter periods may indicate fewer drawdowns.

Must read: Stock Market Volatility: The Roller-Coaster Ride

Common misunderstandings about MDD in investment risk management

- Confusing MDD with volatility: Many investors confuse MDD with volatility. While MDD measures the biggest peak-to-trough drop in an investment, volatility describes the general price variations throughout time independent of the direction of change.

- Overlooking recovery time: Many times, investors concentrate on MDD without thinking through the recovery time for the investment. While a lengthy recovery can greatly affect long-term returns, a big downturn may not be as alarming if the asset recovers fast.

- Focusing solely on MDD: Depending on MDD to evaluate risk could be deceptive. To have a whole picture of risk and performance, one should take into account other criteria such as the Sharpe ratio or standard deviation. MDD by itself misses the whole picture of the possible hazards and benefits of an investment.

Bottomline

The first step towards better investment and efficient risk management is an awareness of maximum drawdowns. MDD gives you tools to assess investment performance, project possible losses, and modify your plans to save your wealth. Including this statistic into your financial strategy will help you to boldly negotiate market volatility.

Remember that drawdowns are a normal part of investing. Even experienced investors go through them. Effective investors are those who can evaluate, control, and change with these demands. Make MDD the pillar of your risk management plan and take control of your financial future by means of resilient and wise decisions.

FAQs

What is the maximum drawdown in portfolio management?

In portfolio management, maximum drawdown is the biggest recorded loss from the peak value of a portfolio to its lowest point prior to a fresh peak being attained.

It shows the worst-case scenario for an investment, therefore suggesting the highest possible loss an investor might suffer. Assessing risk and allowing investors to grasp the negative risk of their investments depend on MDD.

How to reduce maximum drawdown?

Spread risk across several asset classes to lower maximum drawdown from your portfolio. Put stop-loss rules into effect to restrict possible losses. Rebalance your portfolio often to keep intended risk levels. To guard against market declines, employ hedging techniques including futures or options. Last apply a structured approach toward investing and refrain from letting your emotions influence your decisions in order to counteract the effects of fluctuations in the market.

What is the difference between FDD and MDD?

First drawdown, or FDD, is the first notable loss, that initial drop in value of an investment from its high. From the peak value of a portfolio to its lowest position before a new peak is attained, maximum drawdown is the most noted loss. FDD shows the first decline; MDD gauges the worst-case scenario for possible investment losses.

How to determine MDD?

Finding the highest peak and lowest trough in the value of the investment over a given period would help one ascertain maximum drawdown. Subtract the peak from the trough value; then, divide this difference by the peak value. To find the percentage decline, multiply the value by 100. Before a new peak is attained, this percentage shows the biggest noted drop from the peak to the bottom.

What is the difference between drawdown and maximum drawdown?

Drawdown is the decrease in value of an investment from its peak to a following trough. The worst-case scenario for possible losses, maximum drawdown is the greatest drawdown noted for a certain period. Drawdown quantifies any decrease; MDD emphasises the most important loss, therefore offering a better view of the risk associated with an investment in a market downturn.