Trading in futures contracts is nothing like stock trading. It’s more complicated, more risky, and has more upside. That being said, most people who do trade futures will tell you there’s nothing like it – and they’d be right.

Among the multitudes of derivative options that traders around the world have, futures have emerged on the top. Futures allow you to buy certain securities (or bet on them) based on what you think their price will be in the future. What makes these contracts particularly enticing is that they have leverage – which we’ll get into in the article.

Let’s dive right in.

The basics of NIFTY futures

NIFTY is an index that tracks India’s top 50 companies across all sectors. When you invest in the NIFTY, you invest on the cumulative growth of all these companies over time. Now, NIFTY Futures are a way for people to make a bet on NIFTY today, but for a price that hasn’t come yet.

So if you think NIFTY could go down in the future, you sell a contract and if you think it’ll go up, you buy one. Most of these contracts use ‘leverage’ to make things more exciting.

Using leverage, you could use a relatively small amount of money to place big bets and multiply your gains (or losses) several times. So while you can make a lot of money if you’re right, you can also lose a lot if you’re wrong.

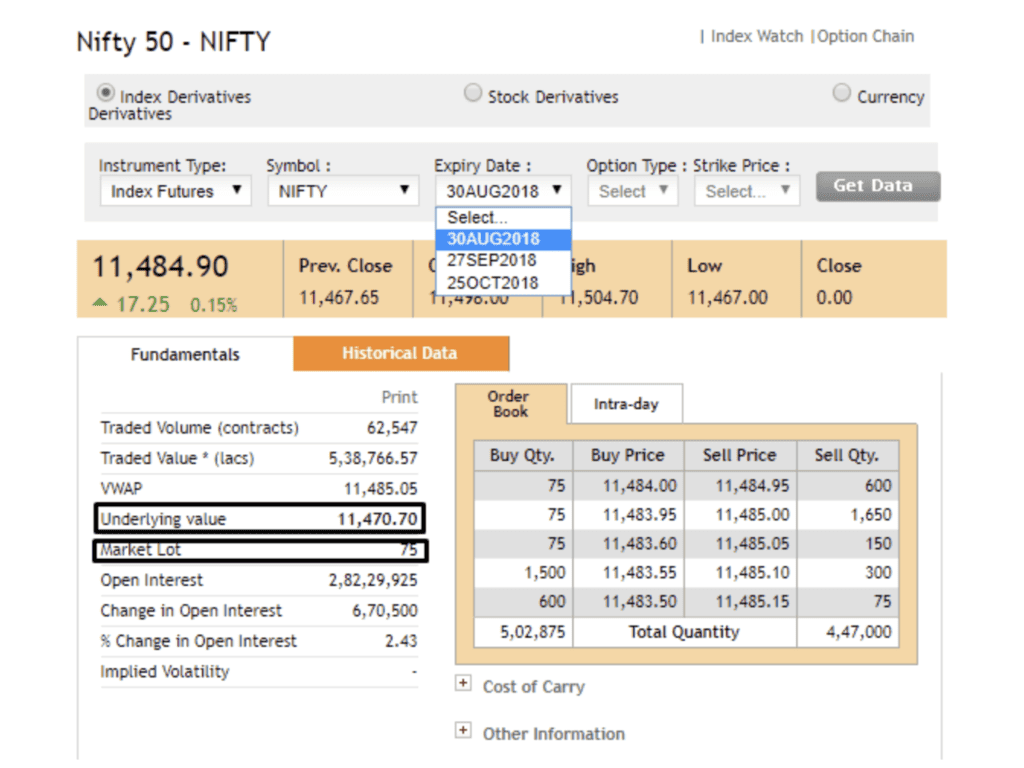

Here’s what a NIFTY futures contract looks like

You may also like: Nifty 2023: What have you in store?

Leverage in futures contracts

Leverage in futures contracts allows you to control a much larger investment with a small amount of your own money. For example, if you have ₹1,000, you could use leverage to control an investment worth ₹10,000 in a futures contract.

This means that the gains or losses you realise will be to the tune of ₹10,000, not your ₹1,000. Here, the leverage used is 10x, which is to say ten times your original investment.

However, using leverage in futures contracts is like trying to tame a wild horse. If you’re right and your investments are accurate, you could make a ton of money. But if the market goes against you, you can lose money just as quickly.

Here are some tips to use leverage correctly:

- Diversify well – Don’t put all your funds into a single contract.

- Practice without money first – Write down your trades on a piece of paper and pretend like you’ve taken them. At the end of the day, calculate where you went wrong (or right) and remember those insights when money gets involved.

- Risk management – Stop-losses are your friend. Make sure you know how much money you can afford to lose on every trade and place stop losses accordingly. Proper risk management is the key to long-term and sustainable trading in NIFTY futures.

Also Read: Futures vs. Options: Differences every investor must know!

Why invest in NIFTY futures?

Like we said earlier, NIFTY futures is basically a basket of the 50 biggest stocks in the National Stock Exchange (NSE). Since they’re selected from a wide range of sectors and industries, they are often seen to represent the broader economic scene in the country. In that spirit, we believe that NIFTY futures is a great investment option.

Here are some other reasons:

- Hard to manipulate – Since NIFTY represents a very high market cap (considering it has the 50 biggest stocks in the country), it would take an ungodly amount of money to manipulate the NIFTY in any significant manner. This, however, cannot be said for individual securities.

- High liquidity – Since futures contracts incur an ‘impact fee’ every time you place an order that doesn’t get filled, it can quickly get expensive to trade futures on an illiquid security. Experts say that NIFTY has exceptionally high liquidity, which means that individual traders like you and me could transact literally any quantity of NIFTY without worrying about them filling.

- Less volatility – This is an extension of the first point. Since a lot of money is required to move NIFTY, there’s comparatively less volatility here than other stocks. The data says that while NIFTY has an annualised volatility around 16-17%, other well-known stocks like Infosys have volatility numbers that are more than double that range.

Also Read: Take a tour of the economic concept of the ‘liquidity trap’.

Key points to remember when investing in NIFTY futures

Here are some things you need to know before you start investing:

- Trading symbol – NIFTY

- Type of instrument – Index Futures

- Lot size – 75 units

- Underlying asset – NIFTY 50 Index

Tips:

- Using leverage – In NIFTY futures trading, you’re generally given a 10% margin for normal trades and 5% for intraday trades.

- Tracking overhead – There are several additional costs (apart from trading fees) you need to be careful about. They can make a difference in your bottom line and increase or decrease your tax liability at the end of the financial year.

Depending on your broker, these could be market costs, custodian fees, advisory fees, commissions, brokerage, etc.

Conclusion

In conclusion, while trading index futures like NIFTY might seem like a good idea on the surface, there’s a lot that goes into making actually profitable futures trades.

We recommend you do your own research and practice on paper before investing your own money. Until then, good luck!