The count of Indian investors has been increasing in recent years. With this growing base, the needs for diversification and unique investment options also increase. Investors are always in search of minimising the risk and increasing the returns.

The Exchange Traded Fund (ETF) is a product of such innovation. It is an amalgamation of mutual funds and stocks. It invests in underlying assets, and investors can trade it on stock exchanges. The benefit of collective potential returns and the spread of risk makes it a unique option for investors.

One such famous ETF is Nifty BeES. Let’s explore them in detail and understand their benefits and functioning.

What is Nifty BeES?

The NIFTY 50 index is a benchmark weighted average of the top 50 companies on the National Stock Exchange (NSE). Investors cannot directly invest in NIFTY 50 like a stock on the cash market, so to smoothen the process, Nifty BeES was introduced.

The BeES refers to the ‘Benchmark Exchange Traded Scheme’. These were first introduced by an Asset Management Company (AMC) – BENCHMARK. The AMC was first released in January 2002. Being an ETF, it is traded in capital markets and as per the demand-supply.

The BENCHMARK Mutual Fund calculated the NAV of the Nifty BeES ETF. Its returns are similar to the S&P CNX Nifty Index. Also, each unit of Nifty BeES is equivalent to 1/10th of this index value and has a face value of ₹10. Moreover, S&P CNX Nifty is also known as NIFTY50.

The Nifty BeEs ETF on the stock market can be tracked as Nippon India ETF Nifty 50 BeEs.

After December 2001, the face value of Nifty BeES was reduced to ₹1, and each unit became equivalent to 1/100th of the Nifty 50 index.

There are also other ETFs in the stock market which have NIFTY 50 as their underlying asset.

Also, read: Exchange traded fund (ETF)

How is it unique?

One can easily invest in the Nifty 50 index by mutual funds and derivatives. However, both these instruments have some limitations.

- Mutual fund investment is driven by the fund manager’s bias. The scheme may fully or partially consist of Nifty 50 stocks. The responsibility for such decisions is on fund managers. The Nifty BeES replicates pure returns of the NIfty 50 index and does not have the risk of such bias..

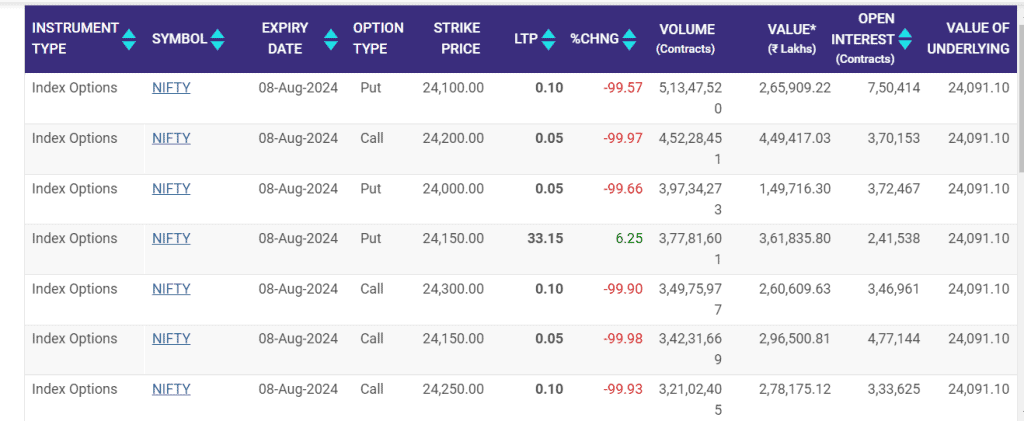

- The derivatives market consists of instruments like futures & options. These are contracts based on underlying assets. One such asset is the Nifty 50 index. They have very high risk due to the feature of heavy volume and speculation. Nifty 50 BeES are less exposed to such risks and are traded like regular equity instruments.

Source: Most Active contracts – NSE

Features

- Feasible option

It is considered a feasible option for investors willing to invest in the market benchmark, which is S&P CNX Nifty or NIFTY50. It offers returns that replicate the top 50 stocks collectively.

- Net Asset Value (NAV) calculation

Nifty BeES are an ETF, so their market value is denoted by NAV. A single unit of Nifty BeES share is 1/100th of the value of Nifty 50 index.

- Marketability

The Nifty BeES is traded on stock exchanges. Nifty BeES share price closed at ₹271.10 as of August 7, 2024. Investors with De-materialised (DEMAT) accounts can only invest in the Nifty BeES.

- Taxation

The tax levied on Nifty BeES ETF investment is similar to that of other equity investments. If it is in holding for less than 12 months, the short-term capital gain tax will be charged at 20%. and if held for more than that, the long-term capital gain tax will be charged at 12.5%.

Check this out! NIFTY 50: The ultimate guide to India’s leading stock index

Benefits of NIFTY BeES

- Less complexity

It is traded as simply as regular equities in the market. Moreover, the structure of the Nifty 50 index makes it easy to understand.

- Economical

Investors willing to invest in the top 50 stocks, and seeking to earn their returns have an opportunity to invest in Nifty 50 BeES, which replicates this return. It is a no-load scheme. Moreover, Nifty 50 BeES share price is also affordable.

- Transparent functioning

Investors are well aware of market happenings due to the existence of Nifty BeES on stock markets. It also eliminates the risk of biassed decisions of fund managers and creates transparency.

- Liquidity

Investors can easily buy or sell ETFs on the stock markets. Also, buyers or sellers are available due to large volumes on exchanges like NSE.

- Diversification

The Nifty 50 index consists of companies from 13 different market sectors. Moreover, these are selected top stocks.

Summary

Indian investors have unique investment opportunities in the market. The Nifty BeES share is an opportunity to indirectly invest in all top 50 companies on the exchange and seek their potential return. Moreover, this diversification allows a better spread of risk in the Nifty 50 portfolio.

The simple instrument helps investors better understand the overall market and evaluate their investments frequently. Nifty BeEs is a classic evidence of this. Easy liquidity and market listing help investors make an informed investment decision. However, investors should consult a financial advisor before investing.

Must read: Using options and derivatives in investment.

FAQs

Q1. What are BeES in Nifty?

The first ETFs in the stock market, with an underlying asset as the Nifty 50 index, are known as Nifty BeES. It was introduced in 2002 and has returns similar to the regular Nifty 50 index. They have a value of 1/100th times of the index. It helps to minimise the risks of fund manager’s bias, and high derivatives volumes.

Q2. Is it safe to invest in Nifty BeES?

The Nifty BeES are similar to regular equity instruments. They do not have the risk of fund manager’s decision bias like mutual funds. However, they are exposed to market fluctuations like any other stocks. Moreover, they invest in the top 50 stocks so risk is diversified, but investors should only invest in it after analysing the personal risk appetite.

Q3. Who owns Niftybees?

At the time of introduction in 2002, Nifty BeES was owned by BENCHMARK Mutual funds. This is also the reason for its name – ‘BENCHMARK Exchange Traded Scheme’. However, currently, it is owned by the Nippon India Mutual funds. It is listed as Nippon India ETF Nifty 50 BeES.

Q5. Is an ETF better than a mutual fund?

Exchange Traded Funds or ETFs are listed on the stock market as an equity instrument, and they have features of mutual funds to invest in specific underlying assets. Mutual funds have fund managers, to effectively manage the investor’s money. However, it has a risk of fund manager’s bias. So, investors should analyse their priorities, and then invest in suitable options from ETF and mutual funds.