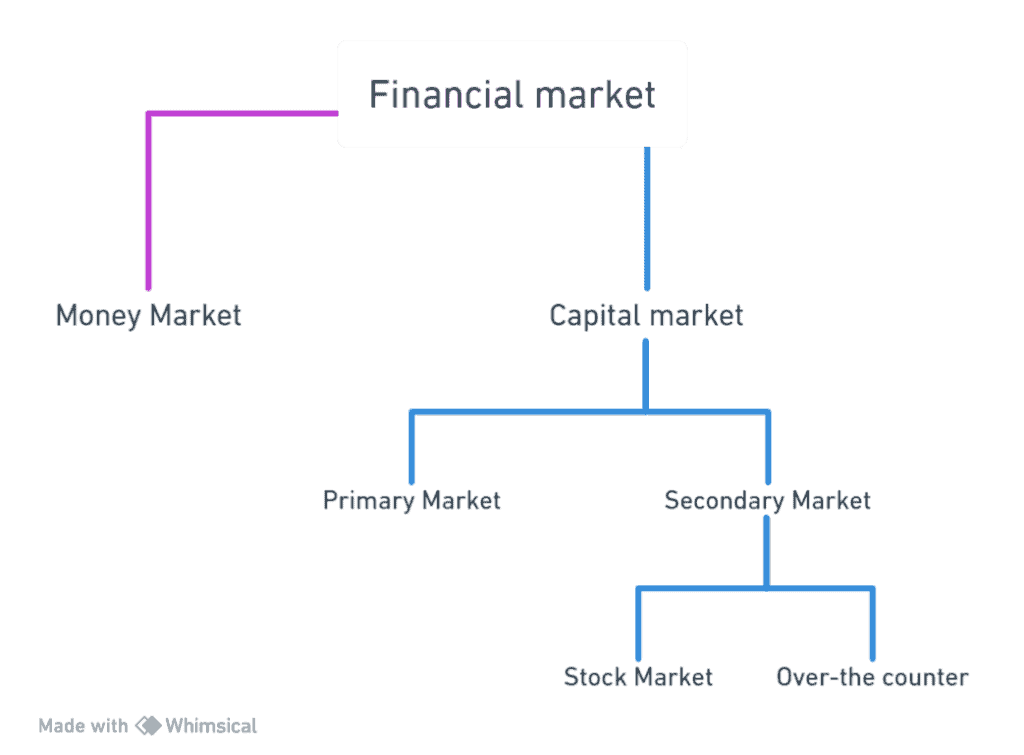

While traditional stock exchanges grab the headlines, OTC markets quietly facilitate the trading of various financial instruments, including stocks, bonds, and derivatives. We’ll get into the interesting world of OTC markets in this article, learning about its meaning, categories of traded securities, benefits, and drawbacks.

You will understand this often overlooked area of finance better through this article.

What is OTC market?

Here, the OTC full form stands for over the counter markets. Individuals can use OTC markets to buy and sell financial products such as stocks, ETFs, bonds, commodities, and derivatives without going through traditional stock exchanges. OTC markets provide flexibility and confidentiality.

Unlike traditional exchanges, OTC trading happens electronically, without a central location, directly between two parties.

You may also like: The world of ETFs – explained in simple terms

How does the OTC market work?

In the OTC market, companies that can’t meet the conditions for listing on bigger exchanges still get to sell their stocks to the public. This trading occurs on simpler, organized networks rather than formal exchanges.

Broker-dealers in these networks quote prices for buying and selling, similar to how traditional exchanges work. Investors can buy and sell these stocks easily. Despite its informal setup, the OTC market serves as a default avenue for trading certain securities like corporate bonds.

It becomes a good alternative for companies unable to uphold the major exchange listing requirements, either due to costs or reporting necessities.

Types of OTC securities and markets

OTC securities

- Equities: OTC-traded stocks often belong to smaller companies that cannot afford the listing fees of major exchanges.

- Bonds: Bonds do not have a formal exchange but are marketed by banks through broker-dealer networks, falling into the category of OTC securities.

- Derivatives: Derivatives, including exotic options, forwards, futures, or similar contracts, derive their value from underlying assets like stocks. These are privately arranged through brokers.

- ADRs: American Depositary Receipts (ADRs), sometimes known as ADSs or bank certificates, stand for a specific quantity of shares in a foreign company, often traded off the major exchanges.

- Foreign currency: Over-the-counter currency exchange, Forex, handles foreign currency trading.

- Cryptocurrency: Cryptocurrencies such as Bitcoin and Ethereum are traded in the OTC market.

OTC markets

- OTCQX market: It is where you will find high-quality companies committed to providing information and transparency to their investors. These companies want to be easily accessible to investors, both big and small.

- OTCQB market: Companies here are usually in the early stages of growth. They might not have as much financial history or information available, but they are working on it. OTCQB is a bit more relaxed, making it a good place for newer companies to start their journey in the OTC markets.

- Pink market: Companies here can vary from solid ones working their way up to some that might raise eyebrows. It is a place for risk-takers. The Pink Market is known for its flexibility, but it is also known for being a bit less regulated. So, when you dive into the Pink Market, you are in for a wilder ride compared to OTCQX and OTCQB.

These three markets cater to a wide range of businesses, from the well-established and transparent to the young and daring. Investors must make wise decisions based on their preferences and risk tolerance because each has unique benefits and risks.

Also read: Why is everyone talking about equity shares: Essential features & benefits!

What are OTC Market Risk?

Reduced regulation: OTC markets face looser rules than big exchanges, which can increase the chances of scams and market tricks.

Less clarity: OTC securities might not have as much information available, making it harder for investors to find their real value and potential risks.

Low liquidity: OTC securities have lesser trading volumes which lead to bigger bid-ask spreads. These securities also face difficulties in purchase and sale at desired prices.

Counterparty risk: OTC trades often involve direct transactions between parties, increasing counterparty risk if one party defaults on its obligations.

Volatility and speculation: OTC markets can be more susceptible to speculative trading and extreme price fluctuations, making investments riskier for inexperienced investors.

Advantages and disadvantages of the OTC market

Infographic: Advantages and disadvantages of pros and cons of the OTC market

| Advantages and Disadvantages | Description |

| Pros | |

| Access to Various Securities | OTC provides access to securities like bonds, ADRs, and derivatives. |

| Easier Entry for Companies | Fewer regulations allow many companies to enter who can’t list elsewhere. |

| Earning Opportunities | Trade of low-cost, penny stocks can yield significant returns. |

| Cons | |

| Low Trade Liquidity | Low volume leads to delays in trades and wide bid-ask spreads. |

| Less Regulation | Results in less public information, outdated data, and possible fraud. |

| Volatile Price Movements | OTC stocks can have volatile price changes due to market or economic news. |

Also read: Key risks in investing in the stock market

How to purchase over the counter stocks

- Look for a brokerage firm that lets you trade for OTC stocks.

- Follow your chosen broker’s account opening process and provide the necessary information and documents.

- Next you should deposit the amount of capital in your trading account to buy stocks.

- Identify the OTC stocks you want to buy and understand the fundamentals required to invest in them.

- Place buy orders for the chosen OTC stocks using the brokerage site. Specify the stock symbol, quantity, and OTC share price.

- Review and confirm your order details before finalizing the purchase.

- Keep an eye on your OTC stock investments and make decisions carefully by understanding the market developments.

- When you decide to sell your OTC stocks, use the same broker to place sell orders following a similar process.

OTC Market Vs Stock Exchange

| Factors | OTC market | Stock exchanges |

| Trading | Online platform where people buy and sell stocks, bonds, and more directly with help from brokers. | Places with trading floors where people can buy and sell stocks, but most do it online. |

| Things traded | Lots of things like stocks, bonds and digital currencies. | Mostly big company stocks and special investment funds and ETFs. |

| Rules | There are rules. But, they do not have strict penalties as compared to stock exchanges. | They have strict rules, and the government watches closely. |

| Who can trade | Smaller and newer companies can join with fewer rules, which can be cheaper. | Larger and well-established companies are here, following strict rules. |

Is the OTC market safe?

The OTC market is risky due to lower transparency and easier reporting requirements. Though shares here are cheaper, they are more prone to speculation.

Some OTC stocks may rise and shift to major exchanges, offering long-term gain possibilities. Yet, others may continue to decline. Understanding the different OTC markets helps in assessing the risks involved before investing.

Over-the-counter exchange of India (OTCEI)

The Over-The-Counter Exchange of India (OTCEI) is a unique digital platform allowing smaller companies in India to raise capital. Here are the features and requirements of OTCEI explained simply:

Features of OTCEI:

- Stock Restrictions: Stocks on OTCEI are exclusive; they won’t be listed on other exchanges and vice versa.

- Minimum Capital Requirement: Companies need to have a minimum issued equity capital of 30 lakh rupees to be listed.

- Large Company Restrictions: Big companies with issued equity capital over 25 crore rupees cannot be listed here.

- Member Base Capital Requirement: Members should maintain a base capital of 4 lakh rupees to continue on the exchange.

OTCEI listing requirements:

To be listed on OTCEI, companies should:

- Get sponsorship from OTCEI members.

- Have two market makers for their stock.

- Once listed, remain on the exchange for at least three years, with 20% of issued equity capital held by promoters during this period.

OTCEI transactions:

Transactions in OTCEI revolve around dealers who act in two main roles:

- Broker: Helping buyers and sellers to trade shares.

- Market Maker: Ensuring shares are available for trading and prices remain reasonable through controlling supply and demand.

Besides dealers, OTCEI has:

- Custodians: Individuals handling various administrative tasks like validating and storing documents and facilitating daily clearing transactions.

- Registrars and Transfer Agents: They ensure the correct transfer and allotment of shares, helping in keeping the transactions smooth and error-free.

OTCEI, stationed in Mumbai, operates digitally, providing a vital platform for small to medium-sized Indian firms struggling to gather funds from the mainstream exchanges due to rigid rules.

It’s a stepping stone for them, so as they grow and meet the national exchange standards, they transition from OTCEI. The simple rules and digital nature of OTCEI make it a vital part of India’s financial market, aiding the growth of smaller companies and consequently, the economy.

Bottomline

The over-the-counter (OTC) market offers investors an alternative to traditional stock exchanges. While OTC networks lack the formality of centralised exchanges, they operate within SEBI-regulated guidelines.

Within the OTC marketplace, investors have the option to trade various financial instruments such as stocks, bonds, derivatives, and foreign exchange currencies. This marketplace offers flexibility and opportunities, especially for companies that may not fulfill the strict criteria set by major stock exchanges.