What is your opinion about low-cost investment? The normal tendency is that most investors grab such opportunities with both hands. But are such investments really safe?

Today, we will discuss one such instrument in the stock market, available at reasonable costs. However, the risks associated with this instrument are high. Read further to know how penny stocks work and the impact of investing in such costs.

What are penny stocks?

Penny stocks belong to listed companies whose market capitalisations are low. There is no exact range to determine a penny stock, however, the penny share price in the Indian stock market is usually below ₹10.

In the Western markets, stocks whose share prices are below $5 come under this category.

You may also like: Exploring small-caps: Rising stars with significant profit potential

Understanding penny stocks

In India, penny stocks work like all other stocks in the market. They are available for trading on the National Stock Exchange (NSE), Bombay Stock Exchange (BSE) and on Over-the-Counter (OTC) markets, as well.

In the Western markets, penny stocks usually trade on the OTC markets. Their listing is rare on stock exchanges.

It is essential here to note that all penny stocks are small-cap stocks, too. But, all small-cap stocks are not penny stocks.

Small-cap stocks relate to companies with a market capitalisation of ₹5,000 crores or lower. Market capitalisation represents the value of a company’s stocks in the market. It is the market share price of the stock multiplied by the number of shares outstanding.

Since the share prices of penny stocks are low, they will impact the market capitalisation of companies.

The low prices of stocks may be due to various reasons. Sometimes, it can be for genuine reasons where companies are new to public exposure. Other times, it can be for severe reasons where companies are not performing well.

When the goodwill of companies is affected, the demand for their stocks reduces, thereby decreasing their share prices. Stocks falling under the penny stock category due to such reasons are generally risky.

How to find penny shares?

Investors often mistake small-cap stocks for penny stocks. Hence, it is essential to understand the features of penny stocks that will help investors identify penny stocks:

- Penny stocks are highly volatile. Since penny stocks belong to companies with weak balance sheets, they react aggressively to market conditions. Such companies are not stable like large-cap companies.

- Penny stocks lack liquidity. Given the risks, the number of investors willing to invest in penny stocks is low. So, finding buyers and sellers for penny stocks is difficult.

- The possibility of return on penny stocks is uncertain. Either they fail and go so low to the extent of being delisted, or they grow in manifolds and offer huge returns to investors. Stability in returns is rare.

The pros and cons of investing in penny stocks

Advantages of investing in penny stocks:

- Penny stocks are an ideal investment avenue for new investors who do not have sufficient experience in investing and trading. Since penny stocks require low investments, this is a risk worth taking.

- Some penny stocks have the ability to turn into multi-bagger stocks. Multibagger stocks are those which provide returns in manifolds to investors. Since the investment needed is low, an increase in share prices of penny stocks can reap high benefits for investors.

Disadvantages of investing in penny stocks:

- Speculative risk is an in-built feature of penny stocks. The probability of profit and loss are equal owing to the uncertainty in their prices. So, such stocks are ideal for investors who are willing to high-risk exposure.

- Penny stocks are often subjected to financial scams like the pump-and-dump. Pump and dump is where scammers buy large quantities of stocks through fake accounts and investors to increase the demand and price of such stocks. They then sell it to benefit from the increased price.

Also read: The world of multibagger stocks, and should you invest in them?

Examples of penny stocks in India

- Regent Enterprises Ltd

The shares are listed on the Bombay Stock Exchange (BSE) under Spine Traders Ord Shs.

Share price as of 09 Nov 2023: ₹3.10

Market capitalisation: ₹10.40 crores

- GTL Ltd

The shares are listed on the National Stock Exchange (NSE).

Share price as of 09 Nov 2023: ₹9.10

Market capitalisation: ₹143 crores

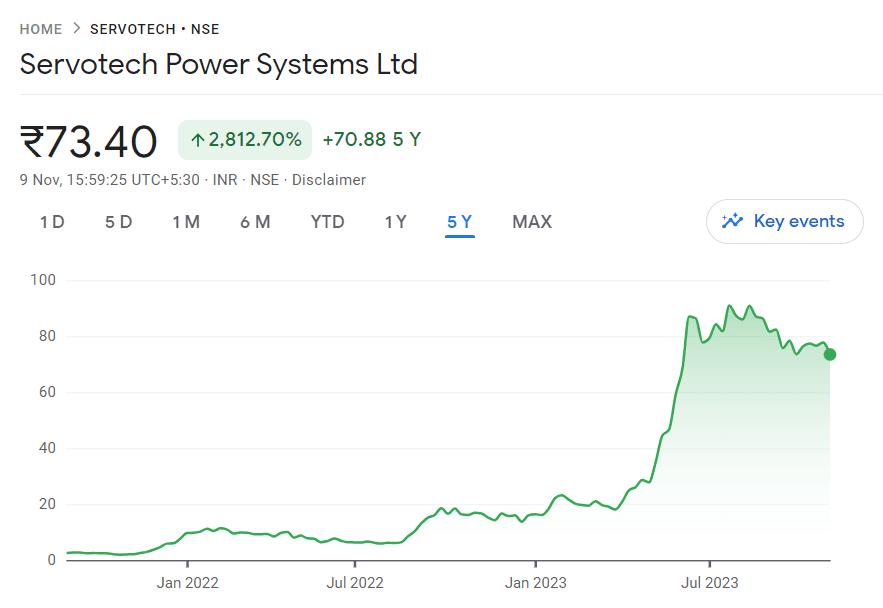

Here is an example of a penny stock that turned into a multi-bagger recently.

The share price of Servotech Power was ₹2.50 in 2021. It raised to ₹86 in August 2023, offering a 3,300% return to investors.

So, if you had invested ₹1 lakh in Servotech’s shares in 2021, the value of your investment would be ₹34 lakhs in August 2023.

Also Read: Exploring the art of speculation

How to buy penny shares?

Buying penny stocks is similar to regular stocks.

Investors must open a demat account with a brokerage firm and select the penny stocks they wish to invest in.

Though the process of buying such stocks is simple, it requires a thorough analysis of different factors before investing in the penny stock market.

- Investors must essentially analyse their risk appetites before anything else.

- Going through the financial statements of penny stock companies and analysing them through various ratios can be significant in making investment decisions.

Bottomline

Penny stocks trading are low-cost investment options available on the exchange. They can be called budget investments, given their reasonable market prices. However, the performance of such stocks is uncertain to the highest level. While some perform well and yield high returns, others can lead to heavy losses.

Hence, investors must use their discretion to see if such stocks are essential in meeting their investment objectives.