Price bands play an important role in the world of finance, serving as invisible barriers that guide stock prices within predefined limits. Understanding their significance is crucial for investors and traders navigating the volatile landscape of financial markets.

In this article, we will dive into the realm of price bands, exploring their various types, implications, and real-world applications, shedding light on their influence in shaping market dynamics and investor behaviour.

What is a price band?

A price band is a predetermined range within which the band set price of a financial instrument, such as a stock or an initial public offering (IPO), is allowed to fluctuate during trading. It serves as a mechanism to control and stabilise price movements in the market.

In the context of IPOs, a price band specifies the minimum and maximum prices at which shares can be offered to the public.

Also read: A beginner’s guide to understanding share price calculations

Investors can place bids for shares within the price band, and the final offer price is determined based on the demand generated within this range. Price bands are a crucial element in the pricing and allocation of new securities to the investing public.

Components of a price band:

- Cap limit – The highest price at which buyers can place bids for shares during IPO

- Floor limit – The lowest price at which buyers can place bids for shares during IPO

Features of the price band

Price range limitation: A price band sets the upper and lower limits within which the trading price of a financial instrument, such as stocks or IPO shares, can fluctuate during a specified period.

Market stability: Price band markets are designed to prevent excessive price volatility, ensuring that prices remain within a reasonable range reducing the risk of sharp and unpredictable price movements.

Fair pricing: In the context of IPOs, price bands help in determining a fair and transparent offer price based on market demand. Investors can place bids within this range, and the final price is often set at the equilibrium point where supply meets demand.

Regulatory control: Regulatory authorities set and monitor price bands to maintain market integrity and protect investors from extreme price manipulation.

Investor participation: Price bands allow investors to place bids at prices they find reasonable, ensuring a wider investor base and participation in the trading process, promoting market efficiency.

Also read: Fractional shares: Unlocking stock market access for every investor

Who decides the price band?

The price band for financial instruments, such as stocks or IPO shares, is typically decided by the issuer of those instruments in consultation with investment bankers and regulatory authorities.

For an Initial Public Offering (IPO), the issuer, often a company seeking to go public, works closely with underwriters and financial advisors to determine an appropriate price range. This range is based on various factors, including the company’s financial health, market conditions, and investor sentiment.

Regulatory authorities, such as stock exchanges and securities commissions, review and approve the price band to ensure it aligns with market regulations and fairness standards.

Once approved, the price band becomes an essential part of the IPO process, guiding investor expectations and bid submissions.

Price band in IPO

In the context of an Initial Public Offering (IPO), a price band is a critical element that defines the range within which the IPO shares will be offered to the public. It comprises a lower limit, known as the floor price, and an upper limit, called the cap price.

This range is determined by the issuing company and its financial advisors, taking into account factors like the company’s financial health, market conditions, and investor demand.

The price band serves as a reference point, giving potential investors an idea of the IPO’s valuation. During the IPO process, investors place bids within this price band, and the final offer price is often set at or near the higher end of the range based on investor demand.

Also read: Understanding the difference between equity and debt IPO for the right investment

Price band example

An example given below to show the price band for JSW Infrastructure Ltd.-

| JSW Infra IPO Details | |

| Aspect | Details |

| IPO Opens | September 25 2023 |

| IPO Closes | September 27 2023 |

| Price band | ₹119 to ₹125 |

| Issue size | ₹2800 crore |

| Lot size | 126 shares and multiples |

Source: CNBC

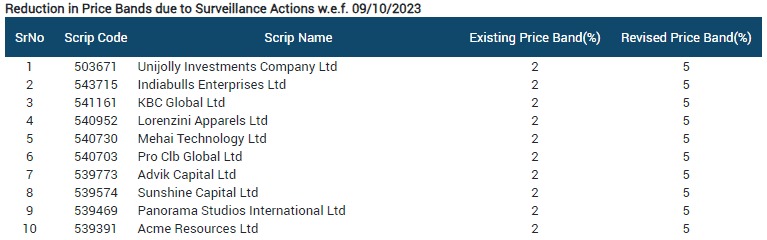

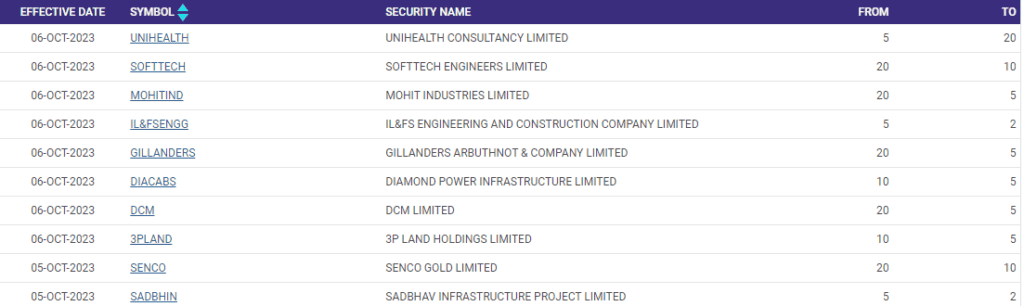

Below is the list of altered price bands for a few scrips-

Source: BSE

The stock exchange sets a price range for each stock or contract, which is a certain percentage above and below the current price.

The existing price band of 2% in the above table suggests 2% above the current price as the upper limit and 2% below the current price as the lower limit for the price band.

Below is a list of recent NSE price band changes on few securities:

Source: NSE

Recent changes and developments

Flexibility in price bands: Regulatory authorities in various countries have introduced measures to make price bands more flexible. For example, companies revise the price band during the IPO process based on market conditions.

Dynamic pricing mechanism: Some stock exchanges have adopted pricing mechanisms for price bands. Instead of fixed, these mechanisms adjust the price range based on demand and supply factors. This approach can lead to more efficient price discovery during IPOs.

SEBI’s revisions: In India, the Securities and Exchange Board of India (SEBI) has periodically revised regulations related to price bands. To mitigate unwanted market volatility, all exchanges had to establish a consistent daily price range of 10% and a weekly aggregate limit of 25%.

Nevertheless, for securities valued at up to ₹ 20, stock exchanges could determine their own price limits. These limits would be computed based on the previous day’s closing price of the security, which is the weighted average price during the last half-hour of trading on that specific exchange.

Retail investor participation: To encourage retail investor participation, regulators have sometimes set lower price bands, making IPO shares more affordable, which broadens the investor base and creates more equitable access to IPOs.

These developments underscore the dynamic nature of price bands in IPOs. Regulators, companies, and investors continue to adapt to changing market conditions and evolving regulatory frameworks to ensure fair and efficient capital markets.

Also read: The fair value method of asset valuation

Bottomline

Price bands strike a balance between fair pricing and market dynamics, ensuring that IPOs are conducted transparently and efficiently.

Recent developments have brought greater flexibility and adaptability to price bands, reflecting the evolving nature of financial markets and regulatory efforts.

For companies, these bands represent a tool to navigate the complexities of the IPO process in a rapidly changing economic landscape.

Ultimately, price bands contribute to the overall integrity and functionality of capital markets, fostering trust and confidence among all stakeholders.