Commonly known as SIPs, systematic investment plans have transformed stock market participation. With overall SIP inflows for the January–November period totalling ₹2.4 trillion, SIP inflows in November 2024 peaked at ₹25,320 crore.

SIPs promote controlled saving and investment by letting participants regularly commit a certain amount of money in equities or mutual funds. Over time, this kind of investing helps to grow wealth and reduces the risks connected with market volatility.

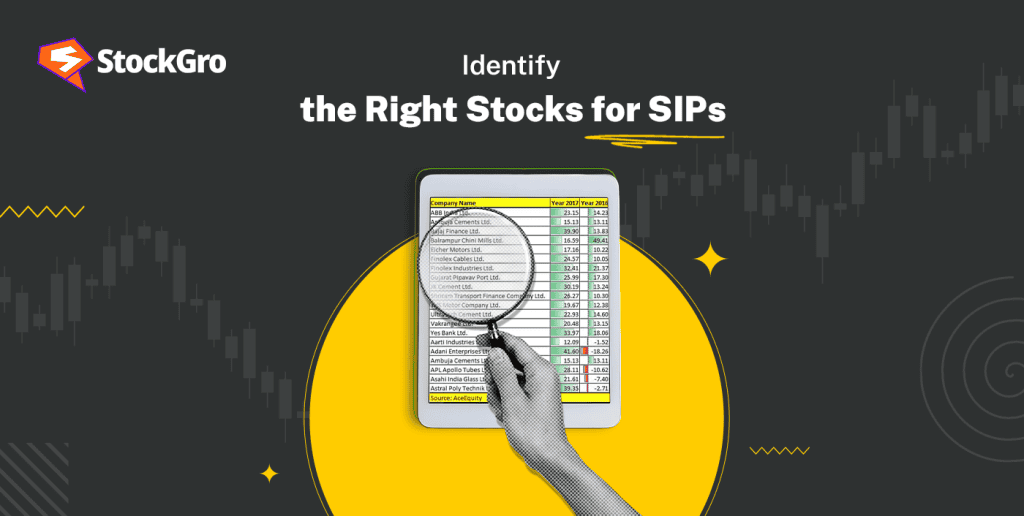

However, choosing the correct equities is essential for success using stock SIPs. Your gains will be much enhanced by selecting stocks with strong foundations, long-term stability, and growth prospects. This article will walk you through the process of choosing the appropriate stocks for your SIP to get a steady, long-term increase.

Must read: SIP investment: Your path to wealth building

What are SIP investment stocks?

Whether weekly, monthly, or quarterly, a stock SIP is a disciplined investment method allowing you to commit a predetermined amount in a few chosen stocks at regular intervals. This approach functions similarly to a mutual fund SIP, however instead of investing in a mutual fund you are instead buying individual company shares.

Regular set amount purchases buy more shares when the stock price is lower and less shares when the price is higher, therefore averaging the cost of your investments over time. This strategy helps balance the consequences of short-term market volatility and reduces the possibility of ill-timed investments.

Unlike making significant lump sum investments, SIPs stock seek to create long-term financial appreciation by progressively growing wealth. Investors spreading the risk over time might profit from the growth potential of premium equities by patiently and consistently.

Also read: Top SIP Plans to Invest in 2024 for Strong Financial Future

Key factors to consider when identifying the right stocks for SIPs

Choosing stocks for SIPs requires careful consideration of numerous critical criteria to guarantee a steady increase and reduce risk over time.

- Company fundamentals: Consider financially sound companies with consistent income growth, profitability, and good balance sheets. Important ratios exposing information on financial stability and returns include debt-to-equity, return on equity, and price-to-earnings (PE).

- Industry potential: Among other sectors with long-term development promise, invest in consumer goods, healthcare, and technology. These sectors gain from changing trends, rising demand, and creative output.

- Track record: Search for businesses with a steady growth path, dividend payment history, and economic downturn resiliency. Long-standing profitable companies are generally safer bets.

- Market conditions: Consider broader market trends and economic conditions. Economic cycles, interest rates, and inflation impact stock performance, so adjust your selection accordingly for better alignment and potential gains.

Evaluating risk and diversification

Diversification within your SIP

Diversification is among the best strategies available to lower risk in your SIP portfolio. Diverse sector or company distribution of your investments helps to reduce the effect of any one stock’s poor performance. Combining equities from the consumer goods, healthcare, and technology sectors, for example, might help balance the total risk as these sectors may behave differently under different market circumstances.

Including a mix of large-cap, mid-cap, and small-cap equities is also absolutely vital. While mid-cap and small-cap companies give growth prospects, although with more risk, large-cap stocks usually offer stability and dependability. This well-rounded strategy guarantees that your SIP portfolio gains stability as well as expansion possibilities.

Interesting to read: Best Mid Cap IT Stocks to Invest in India for 2024

Risk tolerance

Choosing stocks for SIPs calls for an awareness of your own risk tolerance. Higher-growth, high-risk companies could be of interest to you if you want significant gains and are at ease with more volatility. Although these equities usually show good returns, they can also see dramatic drops.

Conversely, if you want stability and reduced risk, choose reputable businesses with continuous dividend history and consistent growth. Matching your stock selections to your risk tolerance guarantees that your SIP plan will be followed through market changes.

You may also like: Risk tolerance: Defining your personal investment strategy and portfolio

Common mistakes to avoid in stock SIPs

- Chasing hot stocks: Investing in equities depending on market trends or short-term excitement is a common error. Popular stocks could create buzz, but long-term stability and expansion should always take the stage. Pursues of hot stocks could cause volatility and unanticipated losses.

- Ignoring risk management: Another mistake is not diversifying your investments. Emphasising one stock too much raises risk, particularly in cases of a declining stock. Diverse market sizes and industries assist in distributing risk. Making sure your portfolio remains in line with your objectives also depends on a consistent review.

- Lack of patience: SIPs are meant to grow over time; hence, success depends on constant investing. A lack of patience could lead you to withdraw from investments too soon, therefore losing the possible compounding power over time. Follow your SIP plan and stay away from acting impulsively depending on transient changes in the market.

Further reading: Choosing the Best Date for Your SIP Investments

Bottomline

Maximising long-term wealth creation in your SIP depends on choosing appropriate stocks. You may create a healthy portfolio that increases consistently over time by concentrating on businesses with good foundations, diversifying your investments, and knowing your risk tolerance. Steering clear of typical errors like chasing hot stocks or ignoring diversity guarantees that your SIP plan stays successful.

Remember that the power of stock SIPs comes from consistency and patience. Your long-term financial goals will be reached and major profits unlocked with the correct strategy and smart stock selection.

FAQs

How to select stock for SIP?

Look for companies with solid foundations, steady income growth, and profitability when choosing stocks for SIPs. Spread over areas including consumer products, healthcare, and technology. Review the company’s performance, dividend history, and ability to weather economic crises. Think of more general market trends and economic situations. Match your risk tolerance to your stock choices to balance stability with potential for growth. Steer clear of chasing hot stocks and guarantee consistent portfolio assessments to complement your goals.

What is the 7-5-3-1 rule in SIP?

Maximising SIP benefits in mutual funds is accomplished in SIP using the 7-5-3-1 rule. Investing for at least seven years, diversifying among five different funds, keeping a three-year minimum holding time for every fund, and yearly SIP increase by one per cent highlights here. This method lowers risk, promotes long-term development, and takes advantage of compounding.

What is the 15-15-15 rule in SIP?

The 15-15-15 rule in SIP advises that you can build ₹1 crore by investing ₹15,000 monthly for 15 years in a stock or mutual fund with a 15% yearly return. This approach uses compounding power to produce notable long-term increases. Using disciplined, regular investing, this basic yet powerful strategy helps one create significant wealth.

Is SIP better than FD?

Different financial objectives are served by SIPs (systematic investment plans) and FDs (fixed deposits). Through equity investments, SIPs are possible for better returns, so benefiting from market growth and compounding. Though they carry market risks, they fit long-term wealth creation. For risk-averse investors looking for consistent income, FDs offer fixed interest rates, capital safety, and guaranteed returns. Based on your financial goals, investment horizon, and risk tolerance, pick.

Can SIP go in loss?

Yes, because of market volatility, SIPs may experience losses, particularly in the short term. Market conditions, economic considerations, and firm success all affect the value of investments. SIPs are meant for long-term investing, nevertheless, thus regular payments over time can help offset short-term losses and maximise compounding’s ability for possible increases. Furthermore, lowering risks includes diversification and consistent portfolio evaluations.